Among the effects on Louisiana of Hurricane Katrina 10 years ago was the state dropping its laid-back approach to attracting outside business. Now it's aggressively seeking investments, especially from China reports May Zhou in New Orleans.

W hile New Orleans' nickname of "The Big Easy" implies its easygoing lifestyle, it could be used to describe Louisiana's past policy toward attracting outside investments.

"Up to 10 years ago we just assumed that international companies will come; that's not the case," said Louisiana State Senator Conrad Appel to a small group of international media invited by Louisiana Economic Development (LED) to get a firsthand look at the state's economic development environment and results.

Louisiana was heavily dependent on oil and natural gas. "When the oil crisis struck worldwide in early 1980s, most [energy] companies relocated to Houston or Dallas. We always had a strong presence in international commerce. But because of the mechanization and different changes in international trade, we kind of lost our place," said Appel.

But the severe economic impact brought by Hurricane Katrina in 2005 forced the state to reconsider such a laid-back approach. "We made policy change to attract domestic and international business," said Appel.

After nearly a decade's effort, Louisiana began to see results.

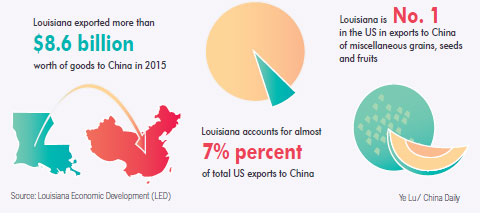

"About $62 billion investment has come to Louisiana since 2008, resulting in 91,000 new jobs. We have a nice and diverse industry, and the fastest growing industry in Louisiana is technology," said Kathe Falls, executive director of international commerce at LED.

And now the state is aggressively seeking investments from China.

"In the past two years, Louisiana officials have traveled on multiple occasions to China and other destinations in Asia to attract foreign direct investment opportunities. One of our main goals is to create greater awareness of Louisiana and interest in our state as a destination for major business investment," said Steve Grissom, the state's Commerce secretary.

The incentives

Land availability, tax incentives and a trained workforce offered by LED's FastStart program, were some of attractions offered by the state to get a large foreign direct investment project from China.

Based in Houston, Texas, Yuhuang Chemical Inc (YCI), the US subsidiary of Shangdong Yuhuang Chemical Company (YCI) in China, announced in July 2014 that it would build a $1.85 billion methanol plant by the Mississippi River at St. James Parish. Groundbreaking for construction began in September 2015.

The two-phase project is estimated to create 400 direct jobs with 200 for each phase at an average annual salary of $85,000. The state projects that it will also create more than 2,300 indirect jobs.

YCI considered building the plant in Texas, but Louisiana lured YCI away with better incentives and, in Appel's words, "red carpet treatment".

The incentive package included two performance-based grants: $9.5 million to be paid over five years beginning in 2017 to offset the project's infrastructure costs; another $1.75 million to be paid over 10 years to partially defray the costs of necessary riverfront access and development.

YCI also will receive the comprehensive workforce solutions of LED FastStart, and the company also is expected to utilize the state's quality jobs and industrial tax exemption programs.

FastStart is a program state leaders love to tout.

"When a company comes to Louisiana, one of the very first questions is where are we going to find qualified workers, and that is where FastStart comes in," said Todd Rossnagel, manager of media service at FastStart. The program has ranked No 1 state workforce program in the nation by the magazine Business Facilities for the last six years.

To attract new companies, FastStart offers to recruit, screen and train workers at no cost to the company. The program partners with the state's higher education institutions, such as Louisiana State University, to help future workers to not only get an education but an education specific to a company, explained Rossnagel.

In some cases, FastStart will send people overseas to a company to develop a customized worker training program, said Rossngale. Since its inception in 2008 to July 2015, FastStart has trained almost 125,000 workers for 158 companies. Its budget for the current fiscal year is about $10 million.

For YCI, FastStart will help train roughly 70 to 80 workers, most of them operators at the future manufacturing plant, according to Charles Yao, CEO of YCI.

Mississippi site

The YCI site by the Mississippi River offers easy access to the waterway, railroad and ocean transportation - another major reason YCI decided on Louisiana, according to Yao.

"We will manufacture methanol right by the river, and the product can be easily loaded to trains nearby, or directly loaded to the ships either traveling upstream toward inland or downstream through the Port of New Orleans to China by the ocean." said Yao.

State leaders often boast about the transportation network as a major business asset. The port complex along the Mississippi between Baton Rouge and New Orleans is said to be one of the largest in the world. The waterway has long since attracted China's shipping giant COSCO (China Ocean Shipping Company) to the area.

According to Captain Wang Zhenlin, president of Sea Mark, a wholly owned subsidiary of COSCO Americas, Inc, Sea Mark has operated in New Orleans since 1998. COSCO eventually moved its headquarters to New Jersey. But the Port of New Orleans and the Mississippi River remain quite important for COSCO and Sea Mark keeps a small office in New Orleans.

"We primarily handle customs paper work for bulk carriers from China at our New Orleans office. Through this port, the US exports food to China and China exports steel and minerals to the US," said Wang.

Each month Seamark handles about 20 carriers from China through the port. Wang said that almost all grains exported from the US to China are through the Mississippi River, which passes over 30 states and into Canada.

Wang said he highly values Louisiana's business environment and the river: "The labor market is friendly, and the government provides some nice incentives. The state is advantageously located because of the Mississippi River. A lot of goods can reach the American heartland by the river or go out of the country through the port. It's convenient and cheap."

But Wang would like to see the river bed improved. Sediment has limited the river's capabilities and bigger ships have to wait for high tide before they can enter the river.

"Two of our ships were stranded this year, which resulted in serious loss for us. If Louisiana's government could somehow come up with a plan to dredge the river bed, it certainly will benefit the state tremendously, especially in light of the soon to be opened new Panama Canal," said Wang.

The state is preparing to do something about it, said Matt Gresham, director of external affairs at the Port of New Orleans. He said the deepest drift control is 47-feet deep.

"The river is authorized to go 55 feet deep but we are doing the feasibility study of going 50 feet deep. We should have the preliminary study done by September 2016, then begin the process of securing a state match to federal funds needed to go forward with the project. We are hoping to have the project move forward in the next two or three years," said Gresham, adding that a lot depends on the federal government.

COSCO investments

Despite the less than ideal river-bed depth and no immediate improvement in sight, COSCO considers the Mississippi River and Port of New Orleans important enough that it is considering further investment in Louisiana, according to Wang, who declined to reveal details.

Even with the recent large investment made by Yuhuang Chemical, the footprints of Chinese investment in Louisiana are relatively small compared with the neighboring state of Texas. On LED's website, the number of companies investing in the state is only six.

This makes the Yuhuang project very significant for the state beyond being the largest Chinese FDI project in the Gulf Coast because it helps to raise the awareness of Louisiana in China.

"Going back to about 2010, we didn't see tremendous Chinese investment coming to the Gulf Coast. Today there is a tremendous shift, especially in the petrochemical and chemical refining industry," said Adam Knapp, president and CEO of the Baton Rouge Area. "Yuhuang has come, and many others have started to express interest. From my own perspective, far more than what we anticipated."

Louisiana's economic connection to China can be seen beyond direct investment. For example, a sizeable order of the Bell 505 Jet Ranger X comes from China at the newly established Bell Helicopter assembly plant in Lafayette, Louisiana.

Chinese customers

According to Texas-based Bell Helicopter, of more than 350 letters of intent for the new 505 model, 79 were from customers in China.

"Bell Helicopter continues to see a lot of potential in the helicopter market in China. The installed fleet of civil helicopters in China has more than doubled in the past five years from 300 to more than 650, and we expect that trend to continue," said Chris Jaran, vice-president for Bell Helicopter in China.

In Baton Rouge, Eugene Ji, a Chinese American originally from southwest China, has been brokering business between the US and China. He operates two golf courses under G2 Golf Club in Shreveport, offering golf camps and sessions to wealthy Chinese. "This provides a networking opportunity for Chinese and American business people," said Ji.

Earlier this year, Ji's film company, 1885 Media, formed a partnership with the Beijing Film Academy and Hunan TV to take advantage of Louisiana's motion picture investor tax credit, which provides up to a 30 percent transferable tax credit on eligible in-state expenditures. This has led to a booming filming industry in Louisiana over the last decade and earned it the reputation of "Hollywood South".

Ji said 1885 Media and the Beijing Film Academy established a film training center in Baton Rouge this year. 1885 Media also will shoot TV programs with Hunan TV, known for producing popular programs in China.

Ji is also involved in an upcoming liquefied natural gas (LNG) project. Baton Rouge-based G2 LNG LLC announced in October 2015 that it plans to construct an $11 billion LNG facility on the ship channel in Cameron Parish. It would be one of the largest capital investments in Louisiana's history, according to the company's announcement.

According to Ji, the executive vice-president of G2 LNG LLC, there is some Chinese investment involved in the project, but he declined to provide details. The company, chaired by former Louisiana governor Charles "Buddy" Roemer, was granted a license to export LNG to FTA (Free Trade Agreement) nations by the US Energy department in July 2015, and is applying for a license to export LNG to non-FTA countries such as China.

Also in Baton Rouge, Louisianan State University (LSU) not only works with the FastStart program to train workers, but also has an emerging markets initiative that evolved from a China initiative started in 2007 by Dr. Ye-Sho Chen at the Ourso College of Business.

According to Chen, director of the emerging markets initiative, the program is a collaboration of LSU, the University of So Paulo (USP) in Brazil, the Central University of Finance and Economics in Beijing and other entities in China.

Tailored curriculum

Chen, along with others including LSU professors Edward Watson and Edgard Cornacchione, had developed a curriculum tailored for Chinese small- and medium-sized enterprises (SMEs) going abroad. Named Flying High, Landing Soft, the curriculum enables US and Brazilian students to help Chinese SMEs explore business opportunities and develop new global ventures.

In addition, LSU's Innovation Park is an incubator for entrepreneurship. Its soft-landing program specifically helps international businesses by offering market research, helping companies to adapt products and services to the US market, and providing other assistance at very low costs, said Chen.

"A solar company in Wuxi, China, was interested in selling their products in the US. The owners sent their kid here to study at LSU," said Chen. "We taught the kid how to access the US market and understand the dynamics of doing business in the US through our courses and incubator. Now the company is doing very well."

The "kid" is Li Yi, founder and CEO of Renogy, a company specializing in renewable and green energy. Li went to LSU in 2008 to eventually sell products from her parents' company, HQ ST, in the US market.

"At first I did not know how to start. The incubator provided me with a lot of marketing resources and helped me to get started. I am very grateful for that," said Li.

Under the soft-landing program at the incubator, Renogy's business had first-year sales of $1.3 million in 2010. Annual revenue grew to $15 million in 2014 and $20 million in 2015. Renogy now markets products not only from Li's parents, but also from other countries and regions. "Currently only 40 percent of our products come from HQ ST," said Li.

However, though it landed softly in Baton Rouge, Renogy eventually moved to California in 2013.

"Louisiana's policy is not that supportive when it comes to renewable energy. The state requires green-energy products to be made in the US to get any tax credit. Also, container shipping from China is more cost-effective to Long Beach, California, than to Baton Rouge. Another factor is, it's hard to recruit talent in Baton Rouge when we wanted to scale up," explained Li.

Contact the writer at mayzhou@chinadailyusa.com

|

Panamax gantry cranes by the bank of the Mississippi River at the Port of New Orleans, which has been essential to Louisiana's economy and attracted Chinese shipping giant COSCO to the area. May Zhou / China Daily |

(China Daily 12/18/2015 page19)