Misperceptions affect US' policies on China: experts

Misconceptions about China's economy and negative feelings between the US and China in many ways have affected economic policies and investment decisions, some experts said on Tuesday.

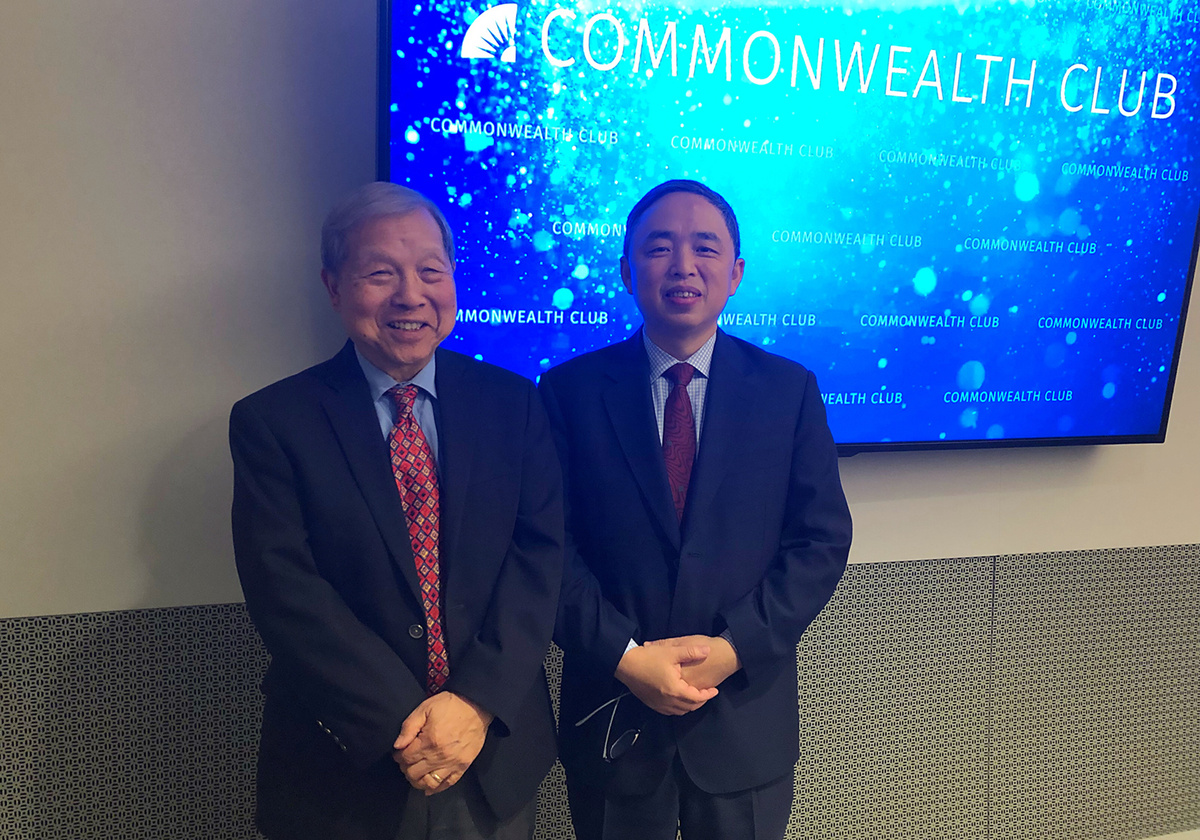

"Unless one can understand these (misconceptions), it's very hard to figure out what the right policies should be," said Yukon Huang, a senior fellow in the Carnegie Asia Program, speaking at the Commonwealth Club.

China's trade surplus with the US hit a record $275.81 billion in 2017, and the US trade deficit with China was a record high in the same year.

Not many people realize that China's trade surplus of 2017 was the lowest - only 1.3 percent of its economy - in the last 20 years, said Huang, who was formerly the World Bank's country director for China.

"Everybody in the US, including the White House, believes that America's huge trade deficits are caused by China," said Huang.

He admitted that it's not easy for the public to understand that there is actually no relationship between the US trade balance and China's.

The US trade deficits became large around the late 1990s, and then they started to get smaller around 2005, while China's trade surpluses were small around the late 1990s and didn't start to get significant until 2005, he explained.

"So it's not possible that China's surpluses are responsible for America's deficits. They aren't in the same time span," he said.

He also pointed out that trade is not a bilateral issue but multilateral across countries.

Only 9 percent of Asia's surpluses came from China, and the other 90 percent came from Japan, South Korea and other Asian countries and regions, said Huang, who used the iPhone as an example.

"The iPhone is made in China but only 5 percent of the value actually goes to China. But people think the $800 phone is a Chinese export," he explained. "So this causes the misperception both in terms of timing and how the production network shows up."

When it comes to investment, it gets more complicated.

There's a general perception that US companies are investing heavily overseas, largely in China, and people believe that leads to the loss of jobs and competitiveness, said Huang.

He said that is a misunderstanding, because only 1.5 percent of US overseas investment goes to China. "It's actually too little," he added. "It needs to be increased."

China's direct investment in the US grew to $46 billion in 2016, more than three times the previous year, according to the Rhodium Group. The rapidly growing investment also raised concerns.

It's usually a rich country investing in a poor one, but now it's the first time that a developing country is investing a lot in a developed one, and the developing country is interested in becoming innovative and technologically sophisticated, which affects the political equation, said Huang.

Another issue is that a third of China's investment comes from state-owned enterprises, which creates a sense of concern.

"Even that, I would argue, doesn't matter, as long as the investment is largely commercially driven," he said.

The Chinese companies need to do a better job to help dispel those misconceptions, said Pin Ni, president of Wanxiang America, a subsidiary of Wanxiang Group, the Chinese automotive components manufacturing company.

"There's a tremendous misunderstanding and disconnect between the US and China. We have way too much positioning instead of compromise, way too much political statement instead of mutual understanding," he said.

liazhu@chinadailyusa.com