The making of a trade war Trump can't win

Robert Zoellick, a former US Trade Representative and head of the World Bank, once said: "Trade was more about politics than economics." Indeed, international trade among nations is all about business, but once politicians step in, it becomes polarizing with unexpected consequences that could lead to a trade war.

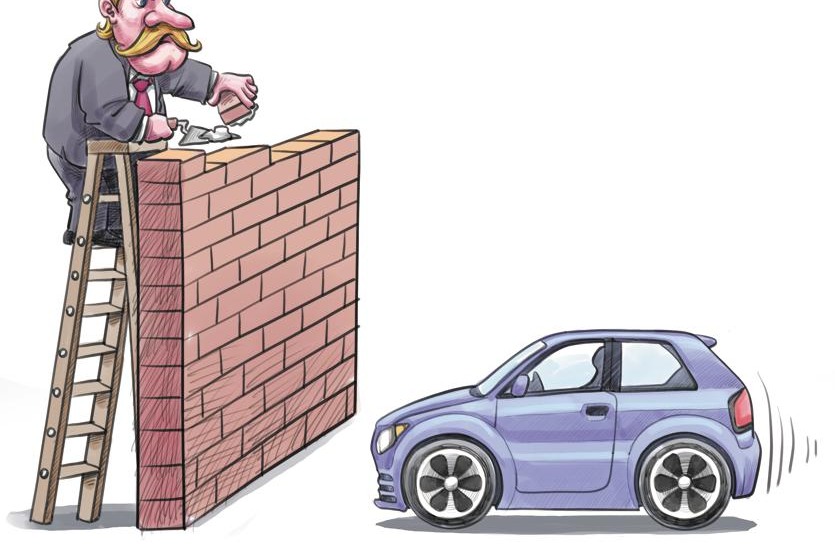

The ever-boastful US President Donald Trump tweeted that "trade wars are good, and easy to win". His newly appointed top economic advisor, Larry Kudlow, should remind him that trade wars are a pyrrhic form of competition in which even the victor is left worse off.

Trump's campaign rhetoric and recent actions are contrary to the United States Constitution and the Republican Party's free trade doctrine, shaped by President Ronald Reagan in the 1970s.

The US Constitution clearly states: "Congress shall regulate interstate and foreign commerce." It grants authority to the executive branch to negotiate trade agreements, but it has the last word on increasing tariffs, whether it's trade agreements or executive actions.

Republicans shocked at protectionist action

But Trump has no patience to follow such procedures. Instead he is issuing executive orders to satisfy his political base. That's why he cited "national security" concerns as justification to impose tariffs of 25 percent on steel imports and 10 percent on aluminum imports.

The Republicans in Congress were shocked that their leader would take such a protectionist action, recognizing it was more about politics than national security. Their swift opposition forced Trump to make Canada and Mexico exceptions (to be part of North American Free Trade Agreement negotiations), and eventually minimize the effects on the US' other allies.

There will not be a trade war with these countries. If it occurs, it will be with China.

The Trump administration has already taken shots that may spark a trade war, including slapping tariffs on solar panels. The next, and most fierce, battlefield in today's complex global economy will be the intellectual property rights and technology sector. As early signs, Trump blocked a Chinese-backed private equity company's planned $1.3 billion acquisition of Lattice Semiconductor, and more recently pressured AT&T to drop its deal with Huawei, a global provider of telecom network equipment, which would originally enable the latter's smartphones to enter the US market.

Around the corner is Section 301 of the Trade Act of 1974 — originally intended to safeguard patent rights — that will give the US president the authority to limit China's technology advances in the US and beyond.

Actually, the US is sending mixed messages to China. Many state governors and mayors in the US are eager to attract Chinese investments and enterprises that will boost local economies. According to the Rhodium Group, a New York-based research firm that closely follows Chinese investment in the US, today there are 3,400 Chinese-owned operations in the US with a cumulative value of $110 billion (since year 2000), creating more than 140,000 jobs across the country. That should be appreciated by the 400 congressmen who represent the districts that benefit from those investments.

However, on Capitol Hill, China is viewed as more of a threat than an economic savior. The anti-China sentiment has been in evidence in both the Senate and House of Representatives, to be sure, but now it is wrapped around the sacred national security concerns — both national and economic security. What's alarming is the rare bipartisanship on future actions directed against China — a combination of Republicans (who are hawkish on national security) and Democrats (mostly protectionist) that will rally support around Trump's punishing hits on China.

China will retaliate if necessary

Beijing will likely retaliate even though it has largely been patient so far. It seems China has already prepared a list of US sectors and goods subject to import restrictions. In the US, the legendary statement that "all politics is local" best describes the ultimate outcome if a trade war with China occurs. Almost all US states and local communities will get hit.

Washington state is one part of the country that will surely feel the brunt should China take retaliatory action. It will affect not only the state's robust agriculture sector, which is ranked second among all states when it comes to trade amount with China, but also Puget Sound, a major port facility in Seattle, for shipments of goods between the two countries. Not to mention Boeing. According to the company, one out of every four airliner it makes goes to China. Boeing also forecasts that over the next 20 years, China will need 7,240 new airplanes worth $1.1 trillion and this demand will make China Boeing's largest commercial airplane customer. It's not hard to predict that Boeing will suffer badly should China decide to retaliate.

Governing by threats is nerve-racking — be it the warning of pre-emptive missile attacks on the Democratic people's republic of Korea or ordering harsh actions to punish China. Hopefully, Trump's and President Xi Jinping's personal relationship is sufficient to get us through these troubled times. But if a trade war occurs, what's certain is there will be no winners.

The author is a former US congressman representing the Washington state. Currently, he is the executive director of APCO Worldwide.