The acid test for China as it comes of age

On March 22, US President Donald Trump announced three measures in response to an "investigation" into China's intellectual property rights violations under Section 301 of the Trade Act of 1974. The US administration claimed that China's actions, policies and practices related to technology transfer, intellectual property and innovation, which had harmed US businesses. The three measures are:

* Tariffs: The US Trade Representative will publish a proposed list of products and any tariff increase within 15 days. After 30 days of notice and comment, the USTR will issue the final list of products under the particular tariff increase.

* WTO complaint: The USTR will pursue dispute settlement in the World Trade Organization to address China's discriminatory technology licensing policies and practices.

* Investment restrictions: The Treasury secretary will determine the limitations on Chinese investment in US high-technology companies.

Initial press reports suggest the USTR has identified 1,300 product lines with an import value of $50-60 billion in high-tech areas to be targeted for special duty of up to 25 percent. The covered products account for about 10-12 percent of US goods imports from China.

In response, China announced special tariff of 15 percent on 120 US products with an import value of $1 billion and 25 percent on eight product categories with an import value of $2 billion. The target of special duty accounts for less than 3 percent of Chinese imports from the US.

The unprecedented tariff actions and other measures have dampened Sino-US relations. The trade sanctions show China is rapidly closing the technological gap with the US, which raises doubts on whether the US will be able to maintain its technological supremacy in the future.

US ploy to attract West to its side

The three tariff measures carry significant geopolitical implications. The first measure is not economically significant at this stage, as the additional tariff is miniscule in the context of overall trade, and Chinese growth is now mostly domestic-driven. However, the signal that the US is willing to use Section 301 means potential escalation of conflicts in the future, which could affect bilateral trade (which was more than $580 billion last year) and throw the global trading system into disarray.

Recent US trade actions on steel and aluminium under Section 232 of an arcane 1962 law and its use of Section 301 to impose new tariffs on China have disturbed the international trading order and raised questions over the US' adherence to the multilateral trade system. The US' case against China at the WTO is intended to show Washington is playing by the multilateral trade rules and hoping for other Western economies to join in the complaint against Beijing.

The third measure on the restriction of Chinese investment in high-tech companies in the US applies to European companies in many cases as well. China's commitments in the US high-tech companies are mainly through investments in startups and setting up of laboratories. Chinese investments in European technology companies are different from those in the US; they are often through mergers and acquisitions. Any US rules on Chinese hi-tech investment will affect European companies that have operations in the US and prohibit its purchase by Chinese enterprises.

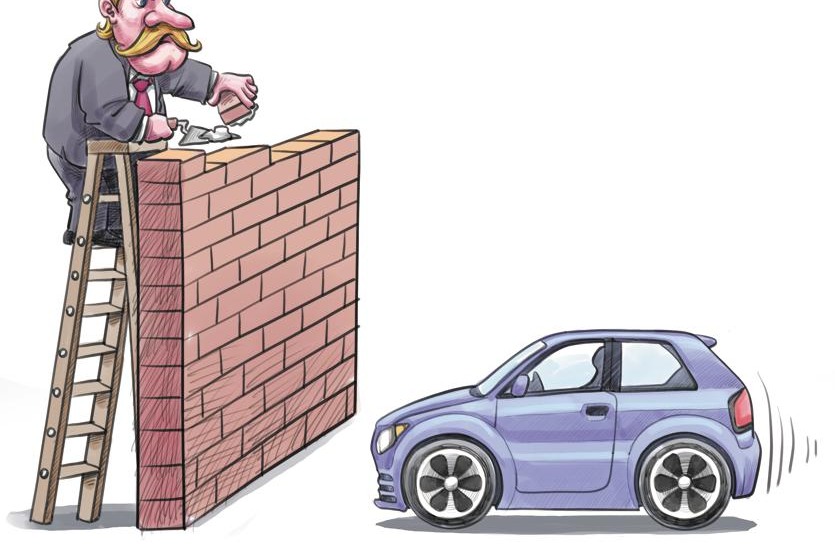

From naming China as a strategic competitor in its National Security Strategy earlier this year to the latest imposition of a special tariff, the US' position on China in trade has changed from engagement to containment. The trade sanctions and de facto technological embargo are attempts to slow Chinese economic growth.

It is still not certain whether US attempts to contain China will work. When one looks at the trajectory of China's economic and technological ascendancy today and compares it to the rise of the US at the turn of 20th century, the parallels in many areas are evident.

Convince world about China's peaceful rise

Both countries' trajectories were based more on a domestic build-up in human and physical capital, with their vast local markets providing the natural shield from the vagaries of international trade. Great Britain failed to contain the US at that time. It's doubtful whether Washington can succeed now with Beijing given that China's international influence is now so pervasive. A good indicator is that China now supplies the most significant number of soldiers to the UN Peacekeeping Force among all permanent UN Security Council members.

News that Chinese Vice-Premier Liu He and US Treasury Secretary Steven Mnuchin are engaged in talks to resolve their differences has somehow calmed the market. It is believed that the current US policies reflect more the gut reactions of Trump and not a national consensus. The mid-term US election in November will likely force a decision on what direction Washington will take vis-à-vis its trade policy.

In the current febrile American political atmosphere, China should take care not to inadvertently give cause for US politicians on their campaign trail to stir up further anti-Chinese sentiment, as extremist politicians will use foreign bashing, especially China-bashing, populism to get votes. Keeping Sino-US ties on an even keel is in the best long-term interest of both countries.

Winning over the Europeans to China's side of discourse is an equally important task ahead for Beijing. While the discussion on the Belt and Road Initiative has won over most developing countries, many developed European countries remain wary of China's ultimate intention once it becomes the world's leading economy. China has surprised the world with its rapid ascendancy on the global technology and military fronts. China's extraordinary achievements understandably stoke fears on whether the country will become too assertive in the future.

The current challenge presents an acid test for China as it comes of age. Skillful handling of the US sanctions and winning over the Europeans in dealing with the WTO complaint and investment prohibition case will go a long way toward buying much goodwill for China and convincing the world that China is working within a global framework in its peaceful rise.

The author is an adjunct research fellow at East Asia Institute, National University of Singapore.