How ‘chaos capitalists’ sack countries to line their own pockets

Since the 1980s, a new generation of “chaos capitalists” has been undermining progress in emerging economies. Under the pretext of “efficient markets,” they seek to exploit real or perceived weaknesses.

Recently, hedge funder Jim Chanos appeared on a CNNMoney’s Markets Now program that was promoted heavily on the CNN, with the title “Chanos got China right.”

Amid the global crisis, Chanos predicted that China would collapse. Nevertheless, CNN characterized his 2009 call as “brilliant”.

The question is, why?

Interplay of shorting and media

Like CNN, most international media portrays Chanos as a “financial wizard” who has made a fortune from shorting companies ever since 2001, when he targeted US energy company Enron and predicted it would collapse.

In fall 2009, Chanos predicted China would head the way of the "old Soviet Union". In January 2010, the New York Times reported Chanos’s prediction China’s economic crash would resemble “Dubai times 1,000 — or worse.” A few months later, Chanos said on Charlie Rose China was on a "treadmill to hell.”

Chanos likes to cultivate financial ploys with dominant media. In the early 1980s, when his target was the insurance firm Baldwin-United, he “guided” Forbes writer Dick Stern through his analysis. In the mid-80s, the Wall Street Journal accused short-sellers like him of spreading rumors and impersonating a Journal reporter to access insider information. With Enron in 2001, Chanos fed Fortune’s Bethany McLean — who prospered from a book deal — information, along with Joe Nocera, another high-profile business reporter dogged by conflict of interest concerns. In the process, Chanos, along with other hedge funders like Steve Cohen and Daniel Loeb, were sued for pushing negative stock research reports that helped drive down prices.

After Chanos made his China prediction, David Barboza of the New York Times, following in the footprints of CNBC and Politico.com, reported “contrarian investor sees economic crash in China.” As these stories failed to create a backlash against China, Fortune, among others, released a story about “Chanos vs. China,” in which the hedge funder said China was a huge real estate bubble.

As China’s progress prevailed, Chanos began a new round in 2015, when Joe Nocera of the New York Times again released a major report about “The Man Who Got China Right.” Now China’s fall was sold as a commodity bubble. “You dismiss [skeptics and contrarians] at your peril,” Nocera warned. While the story did not prove true, it contributed to the tripling of Chanos’s fund to $3 billion in half a decade.

But as China’s growth still prevailed, Chanos began his most recent media round, this time with CNN, where he declared: “Nobody ever makes any money in China.” This in spite of myriad US subsidiaries who have thrived in China, from Apple and Boeing to GM. Chanos also warned countries in Africa and South America as well as Australia, who rely on Chinese commodity demand — and dismissed the success of Chinese firms such as Tencent and Alibaba as “accounting” and “corporate” frauds.

Assessing economic reality

That’s the Chanos game — well-timed interviews, shorting companies and nations, and collusion with dominant international media. But what about the truth?

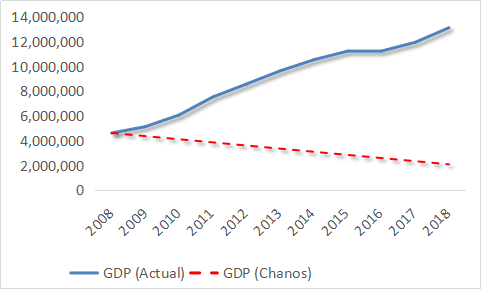

During the Great Depression, US living standards declined almost 30 percent in four years. But that was not Chanos’s yardstick. Instead, he made an explicit comparison with the collapse of the Soviet Union, which caused the Russian GDP to decline 45 percent in the 1990s. In reality, between 2008 and 2018, the Chinese economy will triple to $13.1 trillion. Meanwhile, foreign multinationals operating in China have reaped great profits, along with investors.

Chanos’s prediction, based on the collapse of the Soviet economy, would have meant the plunge of Chinese GDP from $4.6 trillion in 2008 to $2.1 trillion today. In other words, Chanos’s projection of the Chinese economy proved to be almost 700 percent smaller than the actual reality.

Figure: How Chanos got China wrong: China’s GDP, 2008-18

CNN prides itself as the “world’s most trusted name in news.” So to claim “Chanos got China right” would seem a little off — as if global news hubs would allow themselves to be played by private interests.

Exploiting private capital to destabilize emerging economies

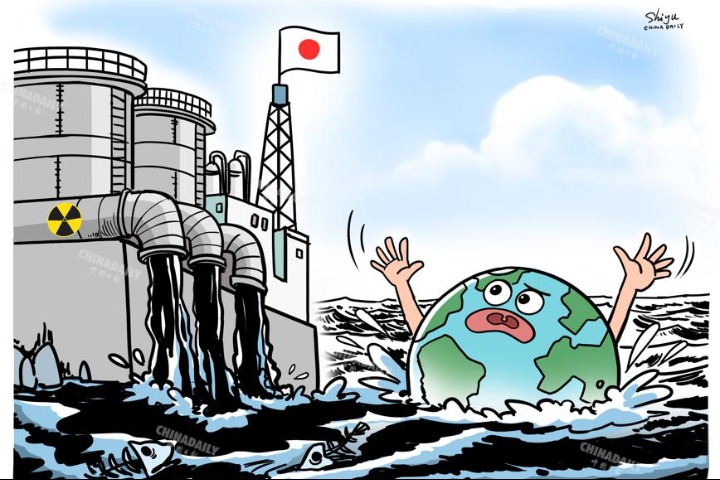

Historically, these financial plays may have intensified since the 1980s, when George Soros made early fortunes starting with the destabilization of Chile, shorting the British pound in 1992, and currency plays amid the Asian financial crisis in late ‘90s. What’s less known are the economic consequences of his “philanthropy” in regions where destabilization has caused massive drops in living standards and increases in his personal fortunes.

More recent examples include hedge funds such as NML Capital — subsidiary of Elliott Management, a hedge fund co-led by Paul Singer — as well as Aurelius Capital and Dart Management. In late 2001, Argentina defaulted on $132 billion in loans during a disastrous depression. While 93 percent of creditors accepted discounted bonds, a small minority — all US hedge funds — didn’t, even though they had bought many of their bonds at a huge discount after Argentina had defaulted. Thanks to a 2012 ruling by a New York court, Argentina was pressed to a $2.3 billion settlement, which meant a return of 1,180 percent to Singer’s NML.

While the chaos capitalists’ methods differ — Chanos likes to short his victims, Soros prefers arbitrage to paralyze his targets, Singer likes to buy up sovereign bonds on the cheap and go after countries for unpaid debts — they use private capital to enrich themselves at the expense of sovereign nations, and use lobbying in Washington and political donations to make and break US presidents, mayors and governors.

In addition to liable companies, chaos capitalists target increasingly vulnerable economies. Soros’s Open Society initiatives are in Eastern Europe and emerging Asia in which “color revolutions” promote financial ploys. Starting with Peruvian debt in 1996, Singer has gone after Argentina and the Republic of Congo, and gives sizable donations to anti-Iran groups. All see great opportunities in a destabilized Russia.

Since 2015, Chanos has focused on “frontier markets”, particularly Nigeria and South Africa. He manufactures perceived liabilities with media. In these “short-and-distort” campaigns, the manipulator shorts the stock — or the country — and then spreads misleading or false negative information to drive the price down, leading to huge profit when the investor eventually closes the short position.

When dominant international media collude with chaos capitalists, emerging economies face real threats, as the wealthy few are allowed to enrich themselves by impoverishing entire nations.

Dan Steinbock is the founder of Difference Group and has worked with the India, China and America Institute in the US, the Shanghai Institutes for International Studies and the EU Center in Singapore.