Chinese public firms see better performance

BEIJING- Chinese public firms saw better performance last year due to a firming economy and structural reforms, with businesses in emerging tech industries reporting stellar profits.

More than 3,500 firms listed in Shanghai and Shenzhen posted combined net profits of 3.36 trillion yuan ($533.33 billion) in 2017, up 19.1 percent year on year, said Gao Li, spokesperson for the China Securities Regulatory Commission.

Their total revenues went up 18.8 percent to 39.25 trillion yuan.

"The performance of listed firms kept improving and there was higher profitability," Gao said. Profits of firms on the main board and the small and medium-sized board gained around 20 percent last year.

Analysts believe the solid economy provided the foundations for improving corporate profits. China's GDP expanded 6.9 percent year on year in 2017, picking up pace for the first time in seven years.

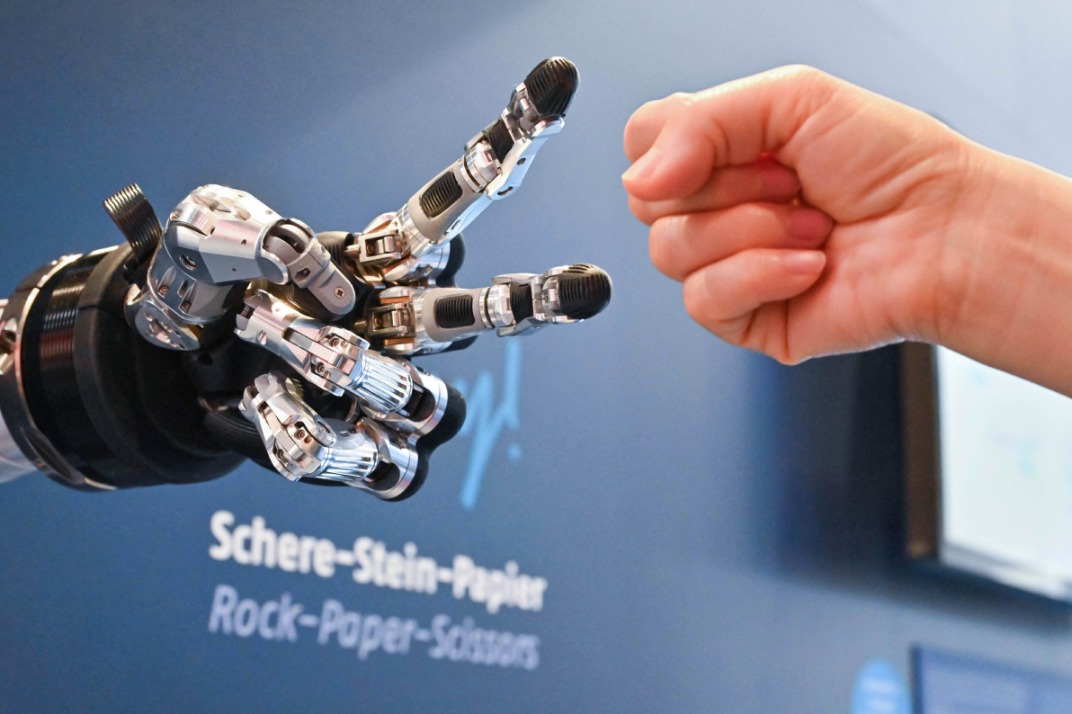

Emerging tech firms led gains trend as the country's economic transition has started to move domestic industries up the value chain. High-end equipment manufacturers saw profit growth of 91.83 percent, followed by 27.24 percent for biomedicines and 22.64 percent for new materials.

Businesses in emerging sectors raked in nearly 400 billion yuan of profits, up 21.8 percent year on year.

Bucking the trend, 6.3 percent of the listed firms logged losses, down from 6.92 percent in 2016. Companies on China's NASDAQ-style ChiNext Board reported a combined profit decline, weighed down by two loss-making companies including debt-ridden Leshi Internet Information & Technology Corp.