Dual-track approach to treat housing ills

Many people believe housing prices are increasing rapidly because the People's Bank of China has printed a lot more currency notes than needed. But the fact is the other way round: The booming property market has generated the need for more currency notes.

In general, a piece of undeveloped land is almost worthless. And if that land is used for agriculture, it hardly creates any money, because it cannot be used for other purposes. But if the land is used for property development, it starts generating money. The reason is simple: The developer has to borrow money from a bank to buy the land, and then get more loans to build houses. When the houses are built, the buyers have to get mortgage loans from banks to pay the developer. All the steps in this process generate money, with higher housing prices generating more money.

Housing prices have risen in recent years for several reasons, including people's rising incomes, high-income people's investment or speculation in the property market, local governments' efforts to boost housing prices to increase their fiscal revenues from land sales, and the increasing eagerness of ordinary people to own a property.

But there is no denying there are bubbles in the property markets of many cities. And the fact that the rental-to-sale ratio of properties is much lower than the benchmark interest rate of banks is enough to prove this.

But why have the regulatory measures failed to rein in the property market over the past decade?

First, the regulatory measures don't have clear targets, as they are aimed at curbing housing prices across all categories. A recent survey by Peking University shows the average household income of the top 10 percent of urban residents in China was 287,000 yuan ($44,913) in 2014 and is expected to reach 376,000 yuan this year based on 7 percent growth year-on-year.

Now, suppose the top 10 percent households live in first-tier cities, more than half of them cannot afford the current housing price of 60,000-70,000 yuan per square meter. Which means, the ultimate beneficiaries of the housing prices regulation are likely to be the top 5 percent of households, which in no way serves the original purpose of curbing rising housing prices.

Second, the method used to regulate the real estate market is problematic. Over the past decade or so, every time the economy has faced problems, the local governments have relaxed the regulations, even encouraged residents to buy homes. But when the economy is overheated, the governments tighten the regulations to curb rising housing prices. The result: fluctuating housing prices.

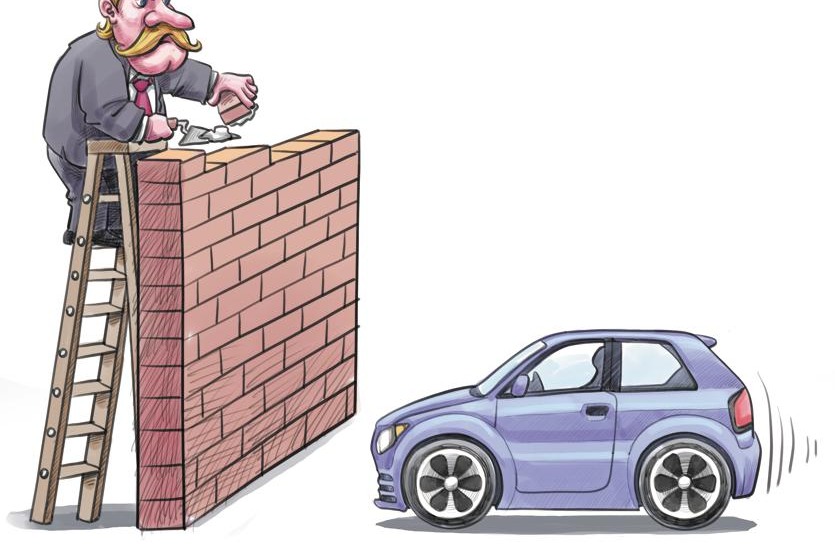

Third, the regulatory means are not reasonable. For example, tightening bank lending is the right way to control housing prices, because it dampens demand. But tightening credit and the supply of land to developers is counterproductive, as it shrinks housing supply and thus pushes up prices.

The central government has repeatedly stressed the need to establish a long-term mechanism to control property prices. The direction has been set and the specific measures have become clearer. Still, the following points should be taken into consideration.

Any house has two uses-as a residence or an investment vehicle. So excessive dependence on administrative regulations can be counterproductive, as evident in the stock market crash in 2015. The best way to punish speculators is to let the market teach them a strict lesson: a bubble will burst after reaching a certain size dragging down prices.

But the regulatory measures seem to tell the speculators that the bubbles will never burst, because once the housing prices rise to a certain level, the government will intervene to stabilize the prices. True, banks may suffer losses if housing prices drop drastically, but that would force them to remember that the property market is not always bullish.

The government should adopt a dual-track management approach to distinguish between people buying homes to live in and those doing as a means of investment, and then take differentiated measures to cool down the property market. For those buying property as an investment, the government should not put a price limit but instead strengthen credit monitoring and management to curb speculation. In so doing, the government will not leave the adjustment and correction of housing prices entirely to the market.

And to help first-home buyers, the government should take practical measures to control housing prices, the most important of which is to increase the supply of affordable housing. But since foreign experience shows affordable housing often ends up in the hands of the middle-income group rather than the poor, it is necessary for the government to strengthen the supervision of affordable housing distribution.

Moreover, preferential land policies should be adopted to encourage developers to develop long-term rental housing and a tenant protection law enacted to protect the legal rights and interests of the tenants.

The author is dean of the National School of Development at Peking University, and director of China Center for Economic Research.