Battery sector charges ahead for superior tech

Unique pursuit of two methods puts China in position to lead next-generation electric cars

Driven by robust new energy vehicle demand, China's power battery industry has seen growing sales and production, with emerging technologies expected to accelerate its high-quality development, officials noted.

Power batteries serve as the core component of NEVs and are the main driver in automotive electrification. With government support, China leads in both the quality and quantity of batteries, said Guo Shougang, deputy director of the equipment industry department at the Ministry of Industry and Information Technology.

Guo made the remarks at a conference held by the China Automotive Battery Innovation Alliance on Thursday in Beijing.

The data of the battery alliance show that China's battery installation reached 387 gigawatt-hours in 2023, accounting for more than half of the global total. CATL, BYD and CALB were the top three providers.

From January to April, the installed capacity of power batteries reached 120.6 GWh, a year-on-year growth of 32.6 percent.

The alliance predicts that China's NEV industry will continue to grow in 2024, with production expected to reach 10.83 million units, a year-on-year increase of 31.9 percent. Power battery installation is forecast to reach 527 GWh this year, up 35.9 percent year-on-year.

A key reason for the achievements of China's power battery industry is its pursuit of two technological paths; simultaneously developing lithium iron phosphate, or LFP batteries, and ternary lithium batteries. China is the only country in the world to establish this dual-track approach, said Xu Yanhua, secretary-general of the battery alliance.

The installation of LFP batteries reached 79.8 GWh in the first four months, up 28.6 percent year-on-year, accounting for 66.1 percent of the total. Meanwhile, ternary battery installations reached 40.8 GWh, with a year-on-year growth of 41.2 percent, representing 33.8 percent of the total.

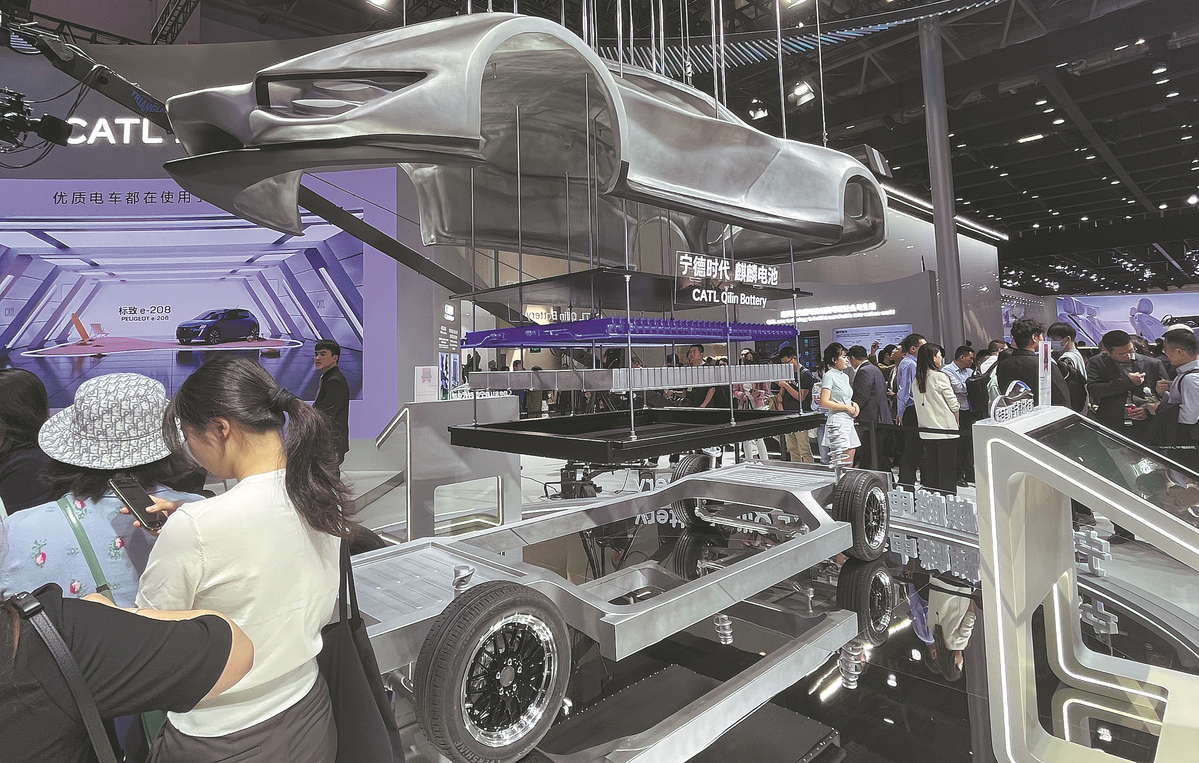

The rising energy density of LFP batteries highlights their advantages in cost and safety, leading to an increase in market share in recent years. At the Beijing auto show in April, Chinese battery giant CATL unveiled its latest LFP battery, Shenxing Plus, which is able to power 1,000 kilometers on one full charge or 600 km after a 10-minute charge.

Battery providers have also developed new technologies to power NEVs. Fully solid-state batteries are widely acknowledged as the preferred solution and represent a crucial advantage in the competition for next-generation battery technologies, said Ouyang Minggao, an academician of the Chinese Academy of Sciences.

The solid-state electrolytes offer benefits like increased battery energy density, enhanced safety and extended battery life.

Chinese battery provider Gotion High-Tech unveiled its all-solidstate battery in mid-May, aiming for small-scale production by 2027 and mass production by 2030.

Fully solid-state batteries are expected to achieve industrialization by 2030, as challenges in durability and safety remain. In the meantime, semi-solid-state batteries are being used in vehicles.

SAIC's IM Motors launched the L6 sedan in mid-May with a semisolid-state battery variant. Integrating both liquid and solid electrolytes, the battery, built by Qingtao Energy Development, operates at a maximum of 900 volts. It enables the L6 to achieve a peak charging power of 400 kilowatts, which after 12 minutes is enough for 400 kilometers.

In late December, a Nio ET7 with a 150 kilowatt-hour semi-solid-state battery pack — codeveloped by Nio and Beijing Welion New Energy Technology — completed a 1,044 km trip on one charge with 36 km still available.

China produces about 70 percent of the world's lithium-ion batteries but has only 6 percent of its lithium resources, prompting the search for alternatives like sodium-ion battery technology, which has substantial cost, safety and sustainability advantages over lithium-ion batteries.

In January, JAC Group delivered its first electric model powered by HiNa Battery's sodium-ion batteries, with an energy density of 140-160 watt-hours per kilogram. It is expected to increase to 160-180 Wh/kg in two years through innovations in design and materials.

The battery alliance predicts that until 2030, China's power battery market will be dominated by high energy density liquid batteries and LFP batteries, with ongoing performance improvements.

By 2035, the market share of LFP batteries will decrease, while high energy density liquid batteries with cost advantages will increase. Solidstate and sodium-ion batteries in vehicles could grow to 10 percent or more by the same year.

Chinese battery enterprises have been expanding their global presence across the industry chain. According to statistics from the alliance, 10 Chinese battery manufacturers have built plants in 12 countries, with a planned capacity exceeding 500 GWh.

In 2023, the export of power and energy storage batteries accounted for 21 percent of the total shipment volume, marking an increase of 10 percentage points compared to 2022.