Economy

Japan set to boost China investment

Updated: 2011-06-16 11:04

By Ding Qingfen and Zhou Siyu (China Daily)

Manufacturing facilities to move from areas hit by quake, tsunami

BEIJING - Japanese investment in China is set to surge as it transfers manufacturing bases from areas damaged by the March earthquake and tsunami, boosting China's foreign direct investment (FDI), the Ministry of Commerce said on Wednesday.

To aid Japan's economic recovery, China plans to "send trade and investment delegations to the country in the coming months, and increase imports from Japan", Yao Jian, ministry spokesperson, said.

Yao was speaking at a monthly news conference during which the ministry announced China's FDI figures for the past five months.

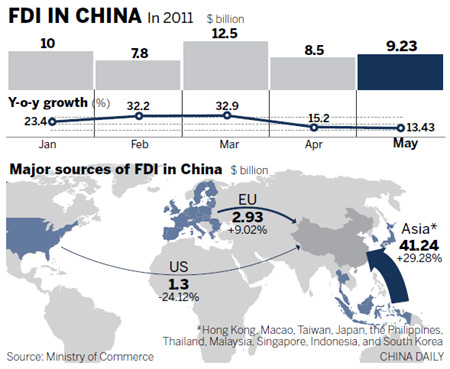

FDI rose 13.43 percent year-on-year in May to $9.23 billion, the lowest increase this year, compared with 15.21 percent in April.

But it surged 23.4 percent, from January to May, to $48 billion, with 10,543 foreign entities setting up in China.

The country's non-financial outbound investment grew 42.3 percent year-on-year to $20.4 billion in the first five months.

"With China's investment environment improving, we expect the FDI will increase further this year," Yao said, while admitting that rising costs could hamper FDI growth.

Following the March earthquake many Japanese companies will move their manufacturing facilities to China, Yao said.

From January to March, Japanese companies invested $1.83 billion in China, making it the country's largest investor, from second largest after Singapore in 2010. The figures for April and May are not yet available.

Japan's largest supermarket chain operator, Aeon, plans to open at least 2,000 stores in China in the next 10 years, chief strategy officer Jerry Black said.

Japan is facing its worst crisis since World War II after the March 11 earthquake, ensuing tsunami and the radiation leak at Fukushima. Economists expect Japan's GDP will shrink for a third straight quarter in April-June before recovering in the second half of the year.

An aging population, declining consumption and pessimism among companies are adding to Japan's economic woes.

"It is highly possible that Japanese companies will move production lines to China," said Zhou Shijian, a senior trade expert at Tsinghua University.

In a recent exclusive interview with China Daily, Dai Hakozaki, deputy director of the Japan External Trade Organization Beijing, said China is likely to witness a new wave of Japanese companies transferring production lines. Regions hit by the quake and tsunami were major manufacturing areas and provided vital parts for the auto and electronics industry.

As a result, Japanese manufacturers in China have suffered due to the loss of these components.

China is the largest export destination for Japanese goods, but imports from Japan grew by only 4 percent in April and 7.7 percent in May because of the quake.

Japan's auto and mechanical equipment industries are the two main sectors that have invested in China, accounting for a combined 32 percent of Japan's investment in the country from January to September last year.

But some analysts voiced caution.

"We could see a transferring (of production lines from Japan), but it will not happen overnight," Wang Luo, an Asian studies specialist at the Chinese Academy of International Trade and Economic Cooperation, said.

"In years to come, China could be the best spot in Asia for Japanese companies."

Investment opportunities in the country have attracted a large and growing number of international brands.

German chemical giant BASF announced plans on Wednesday to invest 40 million euros ($57 million) in its Shanghai production center to double production capacity.

Italian luxury company Prada plans to add 12 stores a year over the next three years to its existing 18 stores.

From January to May, foreign investment from 10 Asian nations and regions, including Hong Kong, Taiwan and Japan, rose 29.28 percent to $41.24 billion. Investment from the European Union rose 9.02 percent to $2.93 billion.

But investment from the United States dropped 24.12 percent year-on-year to $1.29 billion.

| ||||

"We expect more US investment in China's service sector. But we need to study how to make it happen."

Hao Hongmei, a researcher at the Chinese Academy of International Trade and Economic Cooperation, said "there will not be big fluctuations in investment from the US and EU for the time being. But as China further opens its service market, FDI in the sector could see rapid growth."

From January to May, FDI in the service sector grew 27.68 percent, compared to 20.63 percent for the manufacturing sector.

Lan Lan contributed to this story.

Specials

When two are one

After a separation of 360 years, Huang Gongwang's famous Dwelling in the Fuchun Mountains has been made whole again.

Wealth of difference

Rich coastal areas offer contrasting ways of dealing with country's development

Seal of approval

The dying tradition of seal engraving has now become a UNIVERSITY major