Cars

Vehicle sales on road to recovery

Updated: 2011-07-08 09:08

By Li Fangfang (China Daily)

5.3 % growth in first six months banishes fears of yearly downturn

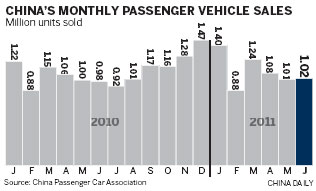

BEIJING - Passenger vehicle sales are well on the road to recovery, after stalling in April and May, with 5.3 percent year-on-year growth in the first six months of 2011.

Analysts had voiced concerns at the possibility that 2011 could be the first year to record decreasing sales after April recorded the first year-on-year drop since 2009. This, along with poor sales in May, sparked fears of a downturn for the whole year.

The increase followed a drop in sales for vehicles in general in April and May, caused partially by the termination of the government's two-year incentives to boost sales.

The March earthquake and tsunami in Japan was another factor. The tsunami caused extensive damage to factories producing vehicle parts.

Increased sales for this year are still a far cry from the dizzying 46 percent in 2009 and 32 percent in 2010.

But Rao Da, secretary-general of the CPCA, said that this year's figures represent long-term sustainable development for the sector.

"The current market performance is what the government expects. So it is unlikely to launch new incentive measures to spur sales in the second half," Rao said.

"The second half of this year will see Japanese automakers pushing sales as production returns to normal," Namrita Chow, senior analyst with consulting firm IHS Automotive, said.

UBS Securities also predicted this week that China's passenger vehicle sales are expected to grow by 10 percent, year-on-year, in the second half of this year.

It added that in the next three years automakers in China will expand production capacity by 11 percent annually.

"Competition in China is likely to intensify in the coming months as the Japanese look to regain lost ground and the South Koreans will fight to keep newly acquired market share, while international automakers, such as General Motors and Volkswagen, will pull out all the stops to keep their current strong foothold," Chow told China Daily.

"The Chinese market is seeing slower growth overall, which will result in price wars and increased competition."

General Motors, the biggest foreign automaker in China, said this week that it sold 1,273,502 units of vehicles during the first half of 2011 in the world's biggest auto market, up 5.3 percent over last year.

Its joint venture Shanghai GM's sales were up 25 percent year-on-year during the period, to 600,002 units, while sales of minivans at Shanghai-GM-Wuling were down 5.4 percent year-on-year to 641,324 units.

"The sales data show that GM's passenger car ventures in China are still making profits for the US automaker, prompting it to strengthen its production capacity in the country," Chow said.

South Korean automakers Hyundai and Kia have both reported positive sales in June and increased market share.

Specials

90th anniversary of the CPC

The Party has been leading the country and people to prosperity.

My China story

Foreign readers are invited to share your China stories.

Green makeover

Cleanup of Xi'an wasteland pays off for ancient city