Economy

China's economy at the crossroads

Updated: 2011-07-13 09:40

By Li Xiang (China Daily)

|

Last week, the State Council, China's cabinet, called attention to the problem of local government debt, pledging to reduce the overall level and saying that the risks associated with local government financing vehicles are controllable.

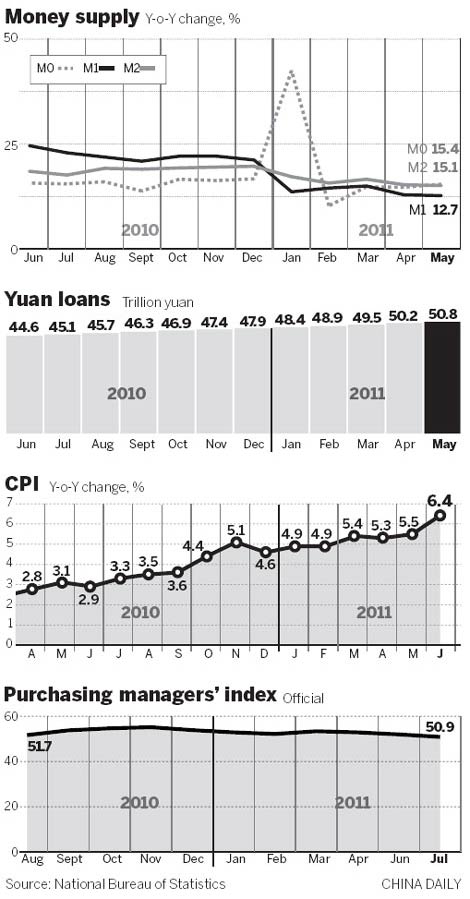

Meanwhile, some economists are predicting that China's growth will weaken to 9.4 percent in the second quarter, down from the first quarter figure of 9.7 percent.

"We think that the economy is more likely to weaken further in early Q3 with an increasing risk of PMI falling below 50," wrote Sun Chi, an economist for China at Nomura Securities Co Ltd in a report.

Beijing has also expressed concern about the risk of a sharp decline in economic growth. Zhou Xiaochuan, the governor of the People's Bank of China, said on Monday that the central bank would work to "avoid big fluctuations" in economic growth.

"We should implement a prudent monetary policy in a proactive and safe way to handle the relationship between maintaining stable and relatively rapid growth, by adjusting economic structures and managing inflationary expectations," he said.

Economists and market watchers are divided on whether policymakers in Beijing should alter the country's monetary stance to avoid the risk of a significant slowdown in the world's second-largest economy.

"We think that policy tightening is excessive at a time when economic growth is slowing and liquidity is under pressure. The market is facing a most difficult time," said Dong Xian'an, chief economist at Peking First Advisory Co Ltd.

"Private companies have fallen victim to China's monetary-tightening campaigns," he said.

However, Li Daokui, an adviser to the central bank, said that the tightening stance "should not and will not" be altered. He suggested that other measures, such as a reduction in taxes and the legalization of some "gray-market" lenders, could be taken to address the concerns of the country's small and medium-sized enterprises.

No matter what arguments the economists and policymakers have made, investors have voted with their feet.

The benchmark Shanghai Composite Index (SCI) tumbled on Tuesday, following a short-term rally after the market hit this year's low (thus far) of 2610 in June. The banking and property sectors are among the worst performers, with financial stocks slumping by more than 12 percent since April, due to concerns about the debt situation and financial vulnerability.

Observers expect the SCI to move sideways between 2600 and 3200 points for the rest of the year, as the market still lacks a consensus on the prospects for the Chinese economy.

"The current economic situation is so complicated that it requires a delicate, flexible and effective policy response, and the government is faced with a big challenge," said Wei Jianing, deputy head of the Macroeconomic Research Department at the Development Research Center of the State Council.

However, some economists are encouraged by the fact that China is still experiencing a process of rapid urbanization and modernization that could continue to support economic expansion. The government is also fully aware of the risk of asset bubbles and has been careful in implementing policy tools to adjust the overall economy.

"If inflation could be kept below 4 percent (for the whole of the year), China's economy is likely to achieve a soft landing as the latest tightening measures start to take effect," Wei said.

Specials

90th anniversary of the CPC

The Party has been leading the country and people to prosperity.

The write stuff

'Pen capital' goes back to drawing board for answers to economic changes taking shape in Zhejiang

Say hello to hi panda

An unusual panda is the rising star in Europe's fashion circles