Economy

European investment shows slow growth

Updated: 2011-07-22 11:09

By Ding Qingfen and Hu Haiyan (China Daily European Weekly)

|

|

The final assembly line at Airbus' A320 plant in Tianjin. Companies from the EU invested $3.46 billion in China from January to June this year. Nelson Ching / Bloomberg |

Analysts aren't worried about June's lethargic growth rate

Growth of foreign direct investment (FDI) from the European Union to China slowed in June, but many experts say it's just a short-term fluctuation.

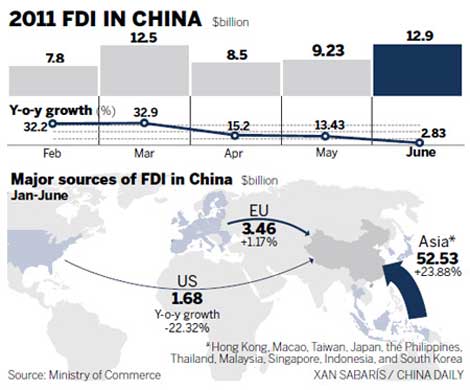

Statistics from the Ministry of Commerce show that investment from the EU grew a mere 1.17 percent to $3.46 billion (2.45 billion euros) from January to June. Comparatively, FDI from the EU picked up 9.02 percent to $2.93 billion during the first five months of this year.

Albeit slow, the EU's overseas investment is making a comeback from 2010, when it saw a decline of 62 percent when compared to the previous year.

Lu Jinyong, director of the China Research Center for Foreign Investment at the University of International Business and Economics (UIBE) in Beijing, says that the monthly slower growth rate of FDI doesn't indicate a trend.

"There is no need to worry, given that it is normal that there are always fluctuations in the short-term FDI amounts," Lu says. "Monthly FDI figures cannot be taken as an indication of a trend. It may be caused by many factors, such as the influence of some large projects and the EU companies' adjustment of their global strategies."

Li Xunlei, an economist at Guotai Junan Securities, says that the uncertainties in the global economy and the bleak outlook for certain EU countries have also contributed to the slow growth.

"Actually, the EU economy is still under many uncertainties. Under current circumstances, it is hard for the EU companies to invest significantly in China. As a matter of fact, EU countries are looking for the investment from China to help them boost their own economies," says Li.

|

He also points out that the appreciation of the yuan and China's rising labor costs would make developed economies, such as the EU and the United States, stop outsourcing manufacturing business to China.

"Looking at FDI into central and western China, it has witnessed faster growth compared with the coastal regions. It shows that many foreign investors choose to invest in China's western region because they wish to reduce the cost of labor and energy," says Li.

Overall overseas investment in China increased by 18.4 percent for the first half of the year to reach a total of $60.89 billion. From January to June, Hong Kong's investment in the Chinese mainland ranks first at $39.99 billion.

June registered the slowest growth rate for overall FDI since September - 2.83 percent - a sharp decline from the 13.43 percent increase in May.

Ministry spokesman Yao Jian said earlier that China will remain a major destination for global FDI in the medium and long term and there is no sign of a significant drop coming.

"The general picture is China's FDI growth has been fluctuating for several months, but overall, China's (favorable) environment of attracting FDI has remained unchanged," Yao said at the ministry's monthly news conference on July 15.

"It's normal and understandable that the growth of EU's investment in China has slowed," said Yao.

He predicted that FDI in China would continue to grow this year and could exceed last year's total of $105.7 billion.

"China's consumption market is very large, and the labor cost advantages could be maintained for a certain period even though labor costs have been climbing," said Yao.

Lu from the UIBE says the advantages of labor costs and resources are not as attractive as before for EU investors because of higher costs.

"But what's changing is that more EU investment is going to many other areas, such as service sectors, instead of the manufacturing sector like before," says Lu.

Because of the expanding domestic consumption, an increasing number of foreign companies plan or are investing in the Chinese market, especially consumption-led industries.

Earlier this month, the Swiss food giant Nestle SA said it will pay $1.7 billion for a 60 percent stake in China's largest listed confectionary company, Hsu Fu Chi International Ltd. The deal is awaiting regulatory approval.

Breaking down industries in the first six months, the service sector attracted the most FDI - $28.05 billion or 21.4 percent. The FDI growth in manufacturing and agriculture was 15.63 percent and 15.13 percent, respectively.

China's overseas direct investment (ODI) in Europe has been growing on an unprecedented scale and soared by 297 percent last year to $2.13 billion.

"The slower growth of EU investment in China doesn't mean the trade between China and the EU is getting sluggish; actually, China's ODI in the EU has increased. Both China and the EU need investment from each other," Lu says.

From January to June, China's ODI in the EU surged by 99.2 percent to $860 million.

"China's investment in the EU has been on rise during the past few years, and the EU will be a hot spot for Chinese ODI, especially through mergers and acquisitions," said Yao, the ministry spokesman.

Specials

China-US Governors Forum

The first China-US Governors Forum is held July 15 in the Salt Lake City, the United States.

My China story

Foreign readers are invited to share your China stories.

Rare earths export quota

China kept its export quota at almost the same level as last year.