Yellow metal set to glitter again

Updated: 2014-07-19 07:01

By Wu Yiyao in Shanghai (China Daily)

|

|||||||||

Prices of gold are set to surge in the short term, amid heightened concerns over geopolitical stability, following the downing of a Malaysian airliner on Thursday, analysts said on Friday, adding that crude prices may see further fluctuations.

Gold prices moved up by 1 percent on Friday after reports that the problems in Ukraine may escalate. "Gold prices are sensitive to geopolitical conditions as hedging demand picks up amid tension," said Yang Fei, an analyst with Shanghai Seewonder Financial Information Technology Co Ltd.

Investors usually buy gold as an alternative investment option. Such purchases increase when the geopolitical environment becomes uncertain and the tension does not ease, Yang said.

|

|

Gold futures for August delivery jumped 1.3 percent to settle at $1,316.9 an ounce at Comex in New York, the biggest gain in four weeks. Trading was 29 percent above the 100-day average, according to data compiled by Bloomberg.

Gold prices in Europe dipped some 0.4 percent after profit-taking on Friday afternoon. The dip was reasonable and is often seen as a follow-up to the overnight surge, said Yang.

A report from China Finance Online said gold prices may climb in the short and medium term as more investors seek safe-haven investments.

Crude oil prices jumped some 2 percent after the air mishap, but analysts said prices may fluctuate in the near future.

Unlike gold, crude oil is not seen as a safe-haven asset. Instead, oil prices are more dependent on supply and demand, said Liu Jun, an analyst with BOC International Futures Co Ltd.

Nymex crude oil reached an intra-day high of $103.29 on Thursday, up 2 percent. A research note from CITIC Futures Co Ltd said it expects the supply and demand of crude to pick up in the second half of 2014.

"The recent fall in crude prices is a seasonal adjustment. Though the downing of the airliner may pose short-term concerns over crude supplies, the current stock and demand are more than balanced," said Liu.

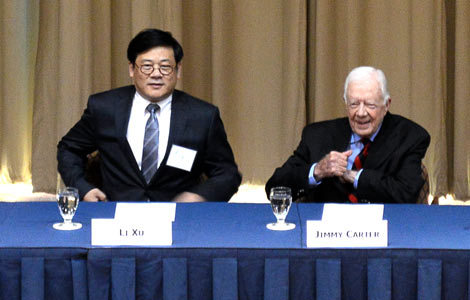

Ex-President Carter lauds US-China relations

Ex-President Carter lauds US-China relations

Chinese president arrives in Argentina for state visit

Chinese president arrives in Argentina for state visit

Powering the future

Powering the future

China, Brazil strengthen close ties

China, Brazil strengthen close ties

Closer ties between China, US start with students

Closer ties between China, US start with students

Chinese banking delegation visits Bay Area

Chinese banking delegation visits Bay Area

China and Brazil build friendship

China and Brazil build friendship

Empress Wu Zetian to land in New York

Empress Wu Zetian to land in New York

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

China 'shocked' at Malaysian plane crash

Portuguese Baidu launched

Security system showcased at BRICS summit

China helping Brazil tap into its own energy

Malaysian airliner downed in Ukraine, 295 dead

Xi promotes cooperation on railway across South America

China urges U.S. not to abuse trade system

Couple's $15m to Harvard starts $100m fund for needy

US Weekly

|

|