Malaysia Airlines faces fight for survival

Updated: 2014-07-30 07:44

By Alfred Romann (China Daily)

|

|||||||||

|

|

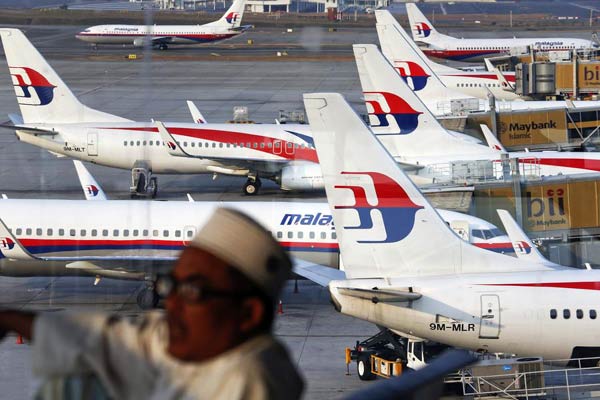

Malaysia Airlines planes are seen on the tarmac at the Kuala Lumpur International Airport March 12, 2014. [Photo/Agencies] |

Carrier struggling after losing two planes within four months, reports Alfred Romann in Hong Kong.

The tragic end of Malaysian Airline System Bhd's flight MH17 in Ukraine with 298 people on board may have sealed the fate of the struggling airline.

No airline before has had to deal with the crash of two wide-body aircraft in such a short span of time. On March 8, flight MH370 vanished with 239 passengers on board. It has never been found and the cause of the disappearance has not been ascertained. Four months later, on July 17, flight MH17 was shot down by a missile.

Few expect MAS to survive in its current form. The reality is that it was already on its last legs before the events in March and July.

And it is not alone.

Other Asian airlines are also struggling. In contrast, their North American peers are recording levels of profits they haven't seen in several decades.

Even before March, MAS had been losing about $1.6 million a day, and it had been in the red for three years. In the past nine months, its market capitalization has dropped 40 percent and its shares have fallen 35 percent so far this year.

"Certainly, we were not satisfied with our performance in 2013," said CEO Ahmad Jauhari Yahya.

The airline's loss for last year, which was larger than in 2012, was due to "higher depreciation, a weakening ringgit and falling yields", according to Yahya. The airline has been struggling for years with rising competition, new market players and the increasing perception of commercial air travel as a commodity, he said.

"If Malaysia Airlines shrinks in size or doesn't continue operating, all these neighbors of ours will be happy to grab market share," said Mohshin Aziz, an aviation analyst at Malayan Banking Bhd in Kuala Lumpur.

"People know it isn't their fault, but it doesn't matter because sentiment is really, really negative," said Aziz. He added that there is little chance that the airline will recover.

At the annual general meeting one month ago, Chairman Md Nor Yusof struck a hopeful tone. That was three months after the disappearance of MH370 and a month before MH17 was downed in Ukraine.

" (It) is worth remembering that for more than 40 years, Malaysia Airlines has brought the world to Malaysia and Malaysia to the world," he said.

The need for drastic change was already on the agenda "well before" March 8, he said, but the events that followed "created a critical point for deep reflection in our history and accelerated the urgent need" for action.

There have been rumors that Malaysia's state investment firm, Khazanah Nasional Bhd, the carrier's major shareholder, wants to privatize the airline after investing more than $1 billion in MAS in the past few years.

Unconfirmed reports have suggested that this may happen in August. Khazanah Nasional, however, has said it would make an announcement when there is one to be made.

But the reality is that the airline simply does not have the financial resources to last out the year, and privatization is now a matter of necessity.

As other Asian airlines stand to benefit from any capacity cuts at MAS, their prospects for higher profits are likely to improve when the open skies agreement of the Association of Southeast Asian Nations takes effect.

This pact will allow airlines in the region to fly to more destinations with fewer restrictions.

But an open skies regime may not radically improve the fate of the region's airlines. Singapore Airlines Ltd was the most profitable airline in the world in 2008, with a profit margin of 13.8 percent. Last year, it ranked 19th with a margin of just 1.3 percent.

SIA and Hong Kong-based Cathay Pacific Airways Ltd enjoyed years of easy growth and high profits due to a combination of high-quality services and regional economic growth. Cathay is struggling with thin margins, although it is in a slightly better position than SIA because of its higher exposure to North American markets, said Aziz.

Cathay Pacific reported attributable profits of HK$2.62 billion ($338 million) for 2013, more than double the year-earlier figure. That translates to a net profit margin of 2.9 percent, on par with industry standards but trailing the performance of US airlines. And today the most profitable airlines in the world are in the US.

The fortunes of US-based airlines have been boosted by a series of mergers and acquisitions that have led to cost savings and efficiency. These moves led to cutting of excess capacity and unprofitable routes.

The airline industry as a whole is expected to see improved profitability this year, estimated at $18.7 billion, slightly lower than anticipated due to higher fuel costs. Global revenues could rise to $745 billion by the end of the year, according to the International Air Transport Association.

But the picture does not look very promising for the sector.

"Overall industry returns remain at an unsatisfactory level with a net profit margin of just 2.5 percent," said Tony Tyler, IATA's director-general and CEO.

Silicon Valley rally calls on Fox News to fire Beckel

Silicon Valley rally calls on Fox News to fire Beckel

Look who's two, Xiao Liwu!

Look who's two, Xiao Liwu!

Philadelphia Orchestra meets the press

Philadelphia Orchestra meets the press

Chinese, US naval hospital ships conduct exchange

Chinese, US naval hospital ships conduct exchange

High rent pressures NYC Asian eateries

High rent pressures NYC Asian eateries

Artists advocate for environmental protection

Artists advocate for environmental protection

Wichita, Kansas to Xi'an, China: Come fly with us

Wichita, Kansas to Xi'an, China: Come fly with us

Amateur team aims for great heights

Amateur team aims for great heights

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Ex-security chief Zhou Yongkang under probe

Prudence urged over solar dispute

US visa delays likely to continue

McDonald's fishing for supplier

OSI group to fund food safety

China's FDI in US set for increase

Glitch delays visas for US-bound students

A musical spoof of the Clinton years

US Weekly

|

|