Canada's Couche-Tard makes short-list in $16 billion Sinopec unit sale: sources

Updated: 2014-08-20 11:16

(Agencies)

|

|||||||||

Big deal

The planned divestment comes at a time when Sinopec's domestic fuel sales growth rate has slowed due to falling demand. Gross margins shrank to 2.3 percent in 2013 from 3.3 percent in 2011 and Barclays said in a report that a $1 fall in fuel margin from the current high level of $15-16 per barrel could lower Sinopec Sales net profit by 16 percent.

The sale is expected to generate between $16-20 billion for Sinopec, money which Asia's biggest refiner may use to pay down some of its debt and to reinforce upstream investments. If successful, the sale would mark Asia's second-biggest M&A trade this year, after CITIC Pacific's $36 billion purchase of its parent CITIC Group's assets.

The deal is set to value Sinopec Sales at between $53-66 billion, giving it a price-to-earnings multiple of 13-16.3, according to Reuters calculations.

Sinopec unveiled plans in February to restructure the business, which also includes oil-products pipelines and storage facilities across China.

Advising Sinopec on the sale are China International Capital Corp, Deutsche Bank, CITIC Securities Ltd and Bank of America.

|

|

|

| Sinopec is allowing in private investors | Chinese e-commerce giant in talks with Sinopec |

Former Microsoft CEO Steve Ballmer leaves board

Former Microsoft CEO Steve Ballmer leaves board

Top 10 most attractive Chinese cities at night

Top 10 most attractive Chinese cities at night

Performances to celebrate Chinese Opera Legend

Performances to celebrate Chinese Opera Legend

Missouri governor lifts Ferguson curfew

Missouri governor lifts Ferguson curfew

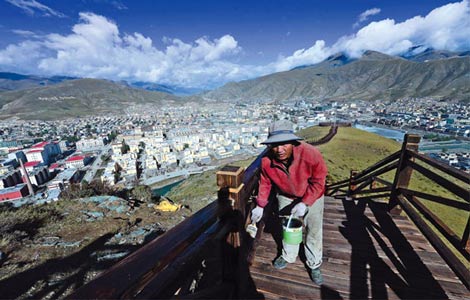

Rebuilding lives

Rebuilding lives

US dominates Chinese world university rankings

US dominates Chinese world university rankings

Residents caught giant alligator in Alabama

Residents caught giant alligator in Alabama

Chinese biotech company rings closing bell at NASDAQ

Chinese biotech company rings closing bell at NASDAQ

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Antitrust probes 'won't deter investors'

Obama vows long-term strategy against ISIL

Ministry says trade growth needs help to reach 7.5%

Xi pledges to make China media more up to date

Missouri gov lifts Ferguson curfew

US police uses China's social media

China's US debt holdings dip lower, again

Anti-trust team lacks real muscle for enforcement

US Weekly

|

|