Citadel account frozen amid probe

Updated: 2015-08-04 07:49

(Agencies)

|

|||||||||

Citadel Securities LLC, the trading firm started by Ken Griffin, owns one of the 34 accounts frozen by Chinese bourses as authorities investigate whether algorithmic traders are disrupting the nation's stock market.

Bourses in Shanghai and Shenzhen have increased the number of suspended accounts from 24 announced on Friday, according to their websites.

The probe is focused on spoofing, a practice that involves placing and then canceling orders to move prices. Owners of the other frozen accounts include Infore Capital Management Co Ltd, a Shenzhen-based asset management company, and YRD Investment Co, a Beijing-based hedge fund.

The investigation of spoofing is part of the government's unprecedented effort to shore up investor confidence after a $4 trillion stock market rout. As the Shanghai Composite Index's record-long boom went bust in mid-June, investors faced the world's highest volatility as well as trading halts that at one point froze half the companies on mainland exchanges.

"In the Chinese market, quantitative investment is something very new-with investors and regulators needing some time to understand each other," said Gerry Alfonso, a sales trader at Shenwan Hongyuan Group Co, China's third-largest brokerage by market value.

"Some of those quant funds provide considerable liquidity to the market. As long they don't increase the volatility of the stock, they are likely to be welcomed by regulators."

Citadel Securities confirmed that an account named Citadel (Shanghai) Trading Ltd was suspended by the Shenzhen exchange.

"We continue to otherwise operate normally from our offices, and we continue to comply with all local laws and regulations," the firm said in a statement.

Griffin, whose net worth of $6.2 billion ranks 231st on the Bloomberg Billionaires Index, founded the precursor to his investment firm Citadel LLC more than two decades ago. He has since branched out into market making and execution services through Citadel Securities.

Infore Capital had trading accounts of four funds suspended from July 31 to Oct 30 and is "actively working with the regulators to investigate and verify the trading strategies," the firm, which oversees about 5 billion yuan ($805 million), said in a statement on its website. He Jianfeng, the chairman of Infore Capital, serves on the boards of Chinese appliance maker Midea Group Co and Zhejiang Shangfeng Industrial Holdings Co, a maker of fans.

Two of YRD's funds have been suspended. The company, which oversees about 11 billion yuan, said it will seek to have the bans lifted as soon as possible and is preparing to brief regulators.

YRD said it withdrew orders for stocks that had fallen by the 10 percent trading limit during the July 8 trading session, and did not intentionally manipulate the market. It said trading that day was extreme and orders by YRD funds were "mechanically carried out".

The Shanghai Composite Index declined 5.9 percent on July 8 as more than 700 mainland stocks fell by the daily limit, according to data compiled by Bloomberg. The gauge dropped 1.1 percent on Monday, bringing its decline from a June 12 high to 30 percent.

While spoofing may have contributed to recent declines in Chinese stocks, the main driver was probably a pullback by leveraged investors, Zhang Haidong, the chief strategist at Jinkuang Investment Management Co in Shanghai, said on Friday.

Apart from the investigation into spoofing, regulators are probing "malicious" short selling and have examined the futures trading accounts of foreign investors. They have also banned stock sales by major shareholders and compelled State-run institutions to support the market with equity purchases.

The investigation will make algorithmic trading firms more cautious about entering the nation's markets, according to Daniel Weinberg, a senior partner at high-frequency trader Optiver Holding BV in Sydney.

Tsingtao gets ready for huge beer festival in China

Tsingtao gets ready for huge beer festival in China

Stunning Shu brocade and embroidery techniques

Stunning Shu brocade and embroidery techniques

Kazan games: Diving in the sky

Kazan games: Diving in the sky

Torrential rain wreaks havoc in Jinan

Torrential rain wreaks havoc in Jinan

A glimpse of Chinese cultural relics in foreign museums

A glimpse of Chinese cultural relics in foreign museums

Flying Tigers show in New York

Flying Tigers show in New York

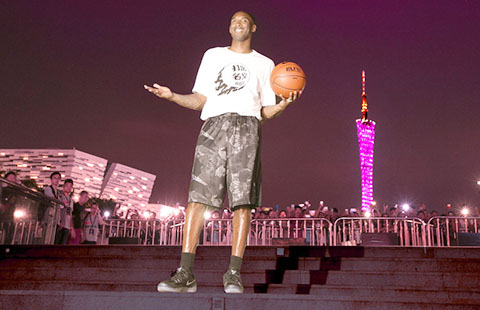

Kobe Bryant frenzy grips Guangzhou

Kobe Bryant frenzy grips Guangzhou

Three generations keep traditional lion dance alive

Three generations keep traditional lion dance alive

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Obama issues challenge on climate change

GOPs begin pivotal debate week

Negotiation seen as key to China, US cyber solution

Beijing plans 'Silicon Valley' park for traditional culture

Obama issues challenge on climate change with power plant rule

China role crucial in UN plan

Biden associates resume discussion about presidential run

Malaysia seeks help to widen search for MH370

US Weekly

|

|