IMF forecasts subdued global growth, urges action

Updated: 2016-10-05 00:15

By CHEN WEIHUA in Washington(chinadaily.com.cn)

|

|||||||||

The global economic growth is subdued, and economic stagnation could fuel stronger protectionism, according to a report released on Tuesday by the International Monetary Fund (IMF).

In its October 2016 World Economic Outlook (WEO), the IMF forecast global growth at 3.1 per cent this year and 3.4 per cent in 2017, the same as IMF predicated in July shortly after the Brexit.

The pickup in 2017 will be driven mainly by emerging market strength, the report said.

The WEO report has marked down its growth prospects for advanced economies while marking up those for the rest of the world. But prospects for 2017 for both country groupings remain unchanged.

"Taken as a whole, the world economy has moved sideways," IMF chief economist and economic counsellor Maurice Obstfeld told a press briefing on Tuesday morning in Washington.

The IMF forecast China's economy, the world's second largest, to grow 6.6 per cent this year and 6.2 per cent in 2017, down from growth of 6.9 per cent last year.

It said that policymakers in China will continue to shift the economy away from its reliance on investment and industry toward consumption and services, a policy that is expected to slow growth in the short term while building the foundations for a more sustainable long-term expansion.

But it said China's government should take steps to rein in credit that is "increasing at a dangerous pace'' and cut off support to unviable state-owned enterprises, "accepting the associated slower GDP growth" the IMF said, according to the report, echoing a recent warning by the Bank for International Settlements.

The IMF also forecast India's GDP to expand 7.6 per cent this year and next, the fastest pace among the world's major economies.

It forecast the growth of emerging market and developing economies to speed up this year for the first time in six years, to 4.2 per cent, slightly higher than the July forecast of 4.1 per cent. Next year, emerging economies are expected to grow 4.6 per cent.

The WEO report said that advanced economies will expand just 1.6 per cent in 2016, less than last year's 2.1 per cent pace and down from the July forecast of 1.8 per cent.

The IMF has marked down its forecast for the US this year to 1.6 per cent, from 2.2 per cent in July, following a disappointing first half caused by weak business investment and diminishing pace of stockpiles of goods.

But it said US growth is likely to pick up to 2.2 per cent next year as the drag from lower energy prices and dollar strength fades. "Further increases in the Federal Reserve's policy rate "should be gradual and tied to clear signs that wages and prices are firming durably," the report said.

The report said uncertainty following the Brexit will take a toll on the confidence of investors. It forecast the UK growth to slow to 1.8 per cent this year and to 1.1 per cent in 2017, down from 2.2 per cent last year. Meanwhile, the euro area will expand 1.7 per cent this year and 1.5 per cent next year, compared with 2.0 per cent growth in 2015.

Growth in Japan, the world's third largest economy, is expected to remain subdued at 0.5 per cent this year and 0.6 per cent in 2017, according to IMF.

"A return to the strong, sustainable, balanced, and inclusive growth that Group of 20 leaders called for at Hangzhou in September still eludes us," Obstfeld said.

The director of IMF's research department explained that dissatisfaction with the recent growth rates is due to the belief that the trend shift in global output away from mature and relatively slow-growing economies, toward emerging and developing economies, should raise global growth over time.

"But this has not happened," he said.

He said the financial crisis has left a cocktail of interacting legacies–high debt overhangs, non-performing loans on banks' books, deflationary pressures, low investment, and eroded human capital–that continue to depress potential output levels.

"Because investors and consumers become more cautious when they fear income growth may lag for longer, realized growth can fall as well," he said.

The IMF report expressed concern that persistent stagnation, particularly in advanced economies, could further fuel populist calls for restrictions on trade and immigration. Obstfeld said such restrictions would hamper productivity, growth, and innovation, citing the examples of Brexit and the anti-trade rhetoric on US presidential campaign trail and describing them as uncertainty for investors.

"It is vitally important to defend the prospects for increasing trade integration,'' he said. "Turning back the clock on trade can only deepen and prolong the world economy's current doldrums."

The IMF report emphasized the urgent need for a comprehensive, consistent, and coordinated policy approach to reinvigorate growth, ensure it is distributed more evenly, and make it durable. By using monetary, fiscal, and structural policies in concert–within countries, consistent over time; and across countries – the "whole can be greater than the sum of its parts" according to Obstfeld.

Top 10 Chinese cities with 'internet plus transportation’

Top 10 Chinese cities with 'internet plus transportation’

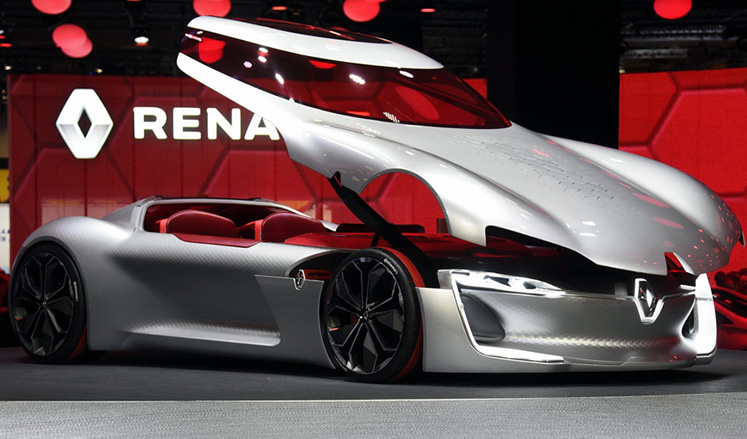

New energy cars shine at Paris Motor Show

New energy cars shine at Paris Motor Show

23 baby giant pandas make debut in Chengdu

23 baby giant pandas make debut in Chengdu

Heritage list salutes Chinese architecture

Heritage list salutes Chinese architecture

Happy hour for prince and princess in Canada

Happy hour for prince and princess in Canada

Chinese and Indian sculptures on display at the Palace Museum in Beijing

Chinese and Indian sculptures on display at the Palace Museum in Beijing

Rescue work at the typhoon-hit provinces

Rescue work at the typhoon-hit provinces

Wonderland-like sunrise in East China

Wonderland-like sunrise in East China

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Trump outlines anti-terror plan, proposing extreme vetting for immigrants

Phelps puts spotlight on cupping

US launches airstrikes against IS targets in Libya's Sirte

Ministry slams US-Korean THAAD deployment

Two police officers shot at protest in Dallas

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

Effects of supply-side reform take time to be seen

US Weekly

|

|