Economy

China's ODI 'set to grow' despite setbacks

Updated: 2011-03-23 07:12

By Ding Qingfen and Bao Chang (China Daily)

BEIJING - China's overseas direct investment (ODI) is on a long-term upward trend despite a recent slowdown, partially due to political unrest in some African countries, Yao Jian, Ministry of Commerce spokesman, said on Tuesday.

|

||||

Chinese companies invested in 680 overseas enterprises in the first two months of 2011, with investment growing by 13.1 percent from a year earlier to $5.27 billion, the ministry announced on Tuesday.

"It is true that political turmoil overseas could exert a negative impact on Chinese investment, but we are confident that China's ODI will grow in the long run thanks to the rising competitiveness of Chinese companies," Yao said at a monthly news briefing.

China's commitment to transform its economic development pattern to focus on innovation and green technology is also a plus, he added.

|

|

Domestic businesses have suffered setbacks in Africa, the prime destination for China's international projects.

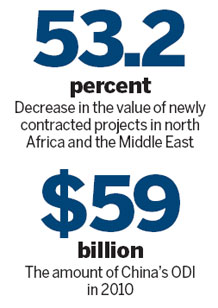

Ministry statistics showed that the value of newly contracted projects in north Africa and the Middle East decreased by 53.2 percent year-on-year to $3.47 billion from January to February, with declines of 45.3 percent in Libya, 97.1 percent in Algeria and 54.2 percent in the United Arab Emirates.

A ministry official, who declined to be named, said China will cease investment in Libya, at least for the short term, after the evacuation of Chinese nationals.

Echoing the ministry, some experts said short-term political chaos in some countries will not prevent future overseas investment and that prospects generally were good.

"The ODI will catch up with and surpass China's FDI in the next five years," said Zhou Shijian, senior trade expert with Tsinghua University and also an adviser to the ministry.

In 2009, China became the world's fifth largest ODI investor, rising from 12th in 2008. In 2010, China's ODI surged 36.3 percent to $59 billion, while its FDI rose 17.4 percent to $105.7 billion.

"Overseas investment is a good way to help China reduce the risks of holding large foreign exchange reserves," he added.

By the end of 2010, China's foreign reserves amounted to a record $2.9 trillion, an 18.7 percent increase year-on-year. The amount accounts for about 30 percent of total worldwide reserves.

Overseas investment targets a wide range of sectors, including finance, mining, manufacturing and retail, and experts predict a greater focus on mining, and more interest in energy.

Upgrading innovation capabilities and reducing energy consumption are key parts of the 12th Five-Year Plan (2011-2015).

Specials

'Super moon'

The "Super Moon" arrives at its closest point to the Earth in 2011.

Radiation test

The probability of being exposed to a life-threatening level of radiation is quite slim.

Panic buying of salt

Worried Chinese shoppers stripped stores of salt on radiation fears.