Economy

Cities lag in setting home-price targets

Updated: 2011-03-26 07:30

By Wang Qian (China Daily)

A week before the deadline, only 32 of more than 600 have complied

BEIJING - Nearly 95 percent of cities and regions in China have not released their 2011 targets for housing-price control as of Friday, a week from the deadline.

On Jan 26, the central government launched a series of tightening measures to cool down the real estate market, including price caps and the requirement that all local authorities set an annual home-price control target by the end of March.

So far, only 32 second- and third-tier cities have complied. China has more than 600 cities and municipalities.

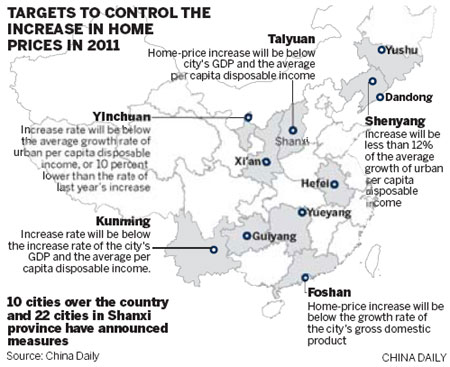

Several cities have set the target of a 10 to 15 percent home-price increase in 2011 over the previous year, while most of the others linked the price target with the average increase of urban per capita disposable income and the growth of the local gross domestic product (GDP).

In February, Yinchuan, capital of Northwest China's Ningxia Hui autonomous region, became the first city to release its target. Authorities there said the home-price increase will be lower than the average growth of urban per capita disposable income, or 10 percent lower than the rate of the price increase in 2010.

Kunming and Taiyuan both said their home-price increase will be lower than the local GDP growth and the average per capita disposable income. But neither would elaborate on the actual percentage.

First-tier cities, including Beijing, Shanghai, Guangzhou and Shenzhen, have not released their targets.

An official with the Shanghai Municipal Housing, Land and Resources Administration who declined to be named told China Daily on Friday the home-price control target will be rolled out on time in the first quarter, but would give no further details.

Wang Qiang, an official with the press office of the Beijing Municipal Commission of Housing and Urban-rural Development, said no information about home-price increase caps has been released.

The Land Resources and Housing Administrative Bureau of Guangzhou will make public the target for controlling the city's home-price increases next week, a staff member surnamed Hu said on Friday.

Peng Peng, a researcher at the Guangzhou Academy of Social Sciences, told the Nanfang Daily on Thursday that the reason so many cities have not released the target is that the central government has not set an exact target.

"If the target is too loose, the central government will be unsatisfied, while if it's too strict, the local governments will be facing great pressure," Peng said.

Insiders said housing prices in the second- and third-tier cities are affordable, but first-tier cities are facing soaring home prices and the target is hard to set.

"No governments want to lose money because of the target they set for the real estate market," Peng said.

The coming week will probably see a flurry of home-price targets for 2011 being released nationwide.

The series of tightening moves shows the central government's determination to cool down the overheated property market in China.

China Business News quoted an industry insider on Thursday as saying that the State Council is sending teams to check the progress made on the price cap policy, and this will press the local authorities to release their targets as soon as possible.

The National Development and Reform Commission issued a notice on Wednesday lowering some fees charged in home construction and sales, which will help homebuyers and developers save up to 4.1 billion yuan ($ 603 million).

But not everyone is optimistic about the prospect of stabilizing the property market.

Ren Zhiqiang, chairman of real estate developer Huayuan Group, said on Friday that although China has taken so many "so-called strict measures" since 2003, developers have earned more than enough from the government policy every time.

"For some cities, the target set for controlling housing prices is likely to become an excuse for growth," Ren said.

Gao Changxin and Xu Fan contributed to this story.

China Daily

Specials

Tea-ing up

More turning to Chinese tea for investment opportunities like vintage wine

A cut above

The ancient city of Luoyang is home to a treasure trove of cultural wonders.

Rise and shine

The Chinese solar energy industry is heating up following recent setbacks in the nuclear sector