Society

Manufacturing slows amid credit squeeze

Updated: 2011-06-02 07:27

By Wang Xiaotian, Hu Yuanyuan and Yu Ran (China Daily)

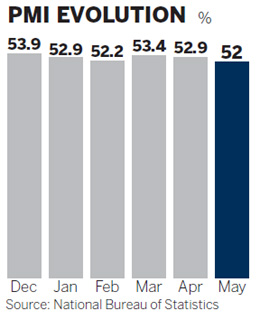

BEIJING - The purchasing managers' index (PMI), a key gauge of manufacturing activity, hit a nine-month low in May, sparking fears that ongoing monetary tightening measures may slow economic growth.

|

|

But analysts said the economy would still manage a soft landing as the country tries to curb inflation and shift the economic growth pattern.

The PMI dropped to 52 in May, the China Federation of Logistics and Purchasing said on Wednesday.

The figure was down from 52.9 in April and 53.4 in March and showed across-the-board declines in all categories.

"The consecutive drops in the PMI indicate that the central bank's tightening monetary policies have been overdone," said Dong Xian'an, chief economist at the Peking First Advisory.

| ||||

"It is possible that the central bank will cut the reserve requirement," Dong said. "With signs of inflation easing and an economic slowdown, China will loosen its tightening policies to help achieve a soft landing."

The effectiveness of the tightening measures seems limited, as the consumer price index (CPI), a main indicator of inflation, is likely to hit a record high in May.

It rose by 5.3 percent in April year-on-year, 0.1 percentage points lower than the 32-month high for March.

The CPI will peak at around 6 percent this year, and make the 4 percent annual target set by the government impossible to reach, said Credit Agricole Corporate and Investment Bank in a research note.

With high inflation, the rising cost of capital and dwindling orders, small and medium-sized enterprises are facing difficulties and some have declared bankruptcy, said a businessman surnamed Pan in Wenzhou, Zhejiang province, whose enterprise produces 40,000 pairs of shoes every day.

But Yao Wei, China economist at Socit Gnrale, said the PMI declined less than expected. In seasonally adjusted terms, it actually picked up, he said.

"If we compare this report with May reports from previous years the deceleration seemed to be much smaller than it appeared to be.

"The moderation may turn out to be temporary if tightening policies do not continue," he said.

He expected that the CPI will reach a new high in May, and the combination of a stable growth momentum and rising inflation will probably force the central bank to hike interest rates within two weeks.

The seasonally adjusted HSBC PMI dropped to a 10-month low of 51.6 in May, down from 51.8 in April, signaling a modest decline.

"The marginal slowdown in the HSBC manufacturing PMI reflects cooling demand as a result of tightening and temporary inventory adjustment," said Qu Hongbin, chief economist with China and co-head of Asian Economic Research at HSBC.

"This is still just a moderation rather than a meltdown in growth, so there is no need to worry about over-tightening."

He added that Beijing is likely to keep tightening mainly through banks' reserves and interest rate hikes in the coming months.

Lu Zhengwei, chief economist at the Industrial Bank, predicted that the central bank may still raise the reserve requirement again in June, and an interest rate hike is likely in June or July.

Gao Changxin contributed to this story.

Specials

China Daily marks 30th birthday

China's national English language newspaper aims for a top-notch international all-media group.

Room at the inn

The Chinese hotel industry experiences a building boom, prompting fears of oversupply.

Pearls of wisdom

Chinese pearl farmers dominate the world market but now want to work smarter, not harder