Shrugging off Brexit blues, perhaps it's time to scale new heights

Updated: 2016-08-05 11:34

(China Daily USA)

|

|||||||||

|

In the aftermath of Brexit, investors’ attention is now focused almost entirely on the US economy, of which positive data have emerged in the recent weeks. Maybe, it’s time to shrug off the Brexit woes and concentrate on the local equity and property markets. Provided To China Daily |

It's been a little more than a month since Britain shocked the world by voting to quit the European Union (EU). While millions of Britons are still indulged in what has become known as the "great remain sulk", the rest of the world has long shrugged off the Brexit blues.

Even in the United Kingdom, the extent of the damage Brexit has inflicted on the British economy is subject to debate. The British pound has depreciated most significantly against the US dollar. It's been reported that many multinational firms in Britain are holding back investment plans amid the uncertainties in negotiations on trade and other economic arrangements with the EU.

British consumers have complained about the price increases for a wide range of imported goods arising from the currency depreciation. But the pound's fall has helped boost growth in exports of British goods and, more importantly, services.

What worries global investors most is the specter of Brexit-induced market turmoil. Some economists have warned that Brexit could trigger another global financial crisis.

But, in less than a week after the "leave" vote, jittery capital markets have regained their composure. The US stock market has since continued to scale new heights, while bond yields have slipped to record lows.

Hong Kong - the region's most international market - has embarked on a stocks rally that seems to have taken many investment analysts off guard. Investors are now calling Brexit as some kind of an economic aberration that had happened far away and long ago. Their attention is now focused almost entirely on the US economy.

The US is not only one of the SAR's key export markets - it has a direct influence on capital flow and the cost of funds through the linked exchange rate mechanism that pegs the Hong Kong dollar to the greenback. Such a mechanism has helped promote Hong Kong as a safe haven for capital, or hot money, on the strength of the US dollar.

Brexit has forced the International Monetary Fund and other august financial organizations to lower their forecasts of global economic growth for this year. But, for Hong Kong, the primary concern is how long the stock market rally will last and how high property prices will go.

- New lab will explore South China Sea resources

- 40 telecom fraud suspects returned to China from Kenya

- Cheery promotional video introduces G20 city Hangzhou to Europe

- Researchers claim intelligence services targeted Chinese airline

- Tunnel-bus production center faces delays

- Chinese Valentine's Day Special: Love conquers everything

- Nepal's newly elected PM takes oath

- Texas gun law worries incoming students

- China vows to deepen economic, trade cooperation with ASEAN

- Fire guts Emirates jet after hard landing; 1 firefighter dies

- Egypt's Nobel-laureate scientist dies of illness in US

- THAAD muscle flexing unmasks anxiety over declining hegemony

Top swimmer Sun Yang makes sweet revenge

Top swimmer Sun Yang makes sweet revenge

Lin Yue and Chen Aisen win Olympic gold medal

Lin Yue and Chen Aisen win Olympic gold medal

Artist creates mini-mes for loving couples at Qixi festival

Artist creates mini-mes for loving couples at Qixi festival

Skyscraper demolished outside ancient city

Skyscraper demolished outside ancient city

Chinese Valentine: Love conquers everything

Chinese Valentine: Love conquers everything

Ace swimmers make record-breaking splash in Rio

Ace swimmers make record-breaking splash in Rio

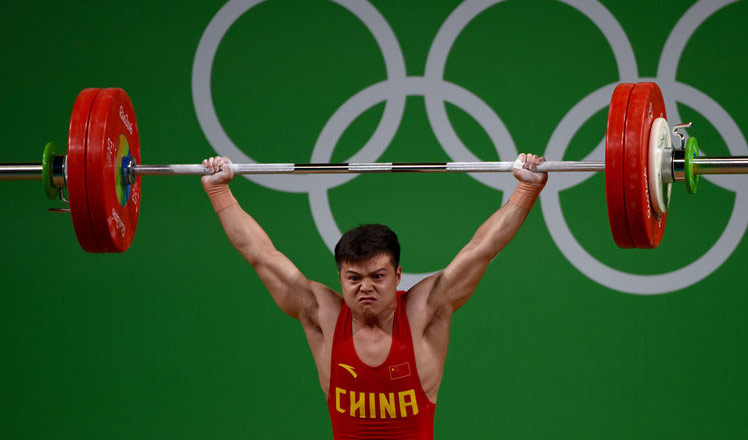

Chinese weightlifter Long smashes world record

Chinese weightlifter Long smashes world record

China wins first diving gold of Rio Games

China wins first diving gold of Rio Games

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

US launches airstrikes against IS targets in Libya's Sirte

Ministry slams US-Korean THAAD deployment

Two police officers shot at protest in Dallas

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

Effects of supply-side reform take time to be seen

Chinese State Councilor Yang Jiechi to meet Kerry

Chinese stocks surge on back of MSCI rumors

US Weekly

|

|