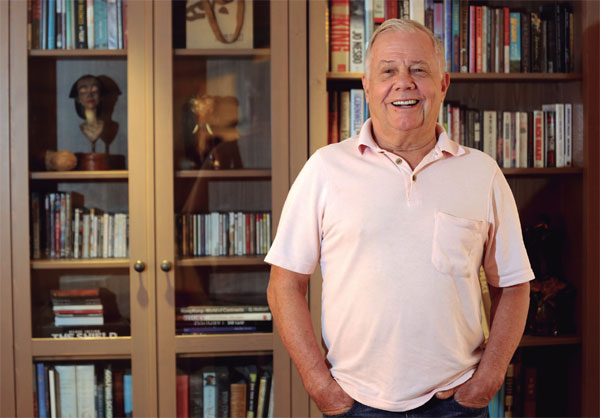

The adventure capitalist who can show you the ropes

|

Investment guru Jim Rogers reckons that China has been slow in opening up its capital markets, and believes that, in the long term, the renminbi will compete with the US dollar and ultimately replace the greenback as the prime international currency. Parker Zheng / China Daily |

"Stumbling" upon Wall Street and acquiring a prestige job there with a big pay check gave Jim Rogers the inspiration to spread his wings and went on to become an authority on investment on a global scale.

"I could have gone to a law school and ended up as a lawyer or to a medical school after graduation. But, suddenly, I was offered the chance of working on Wall Street and they paid me well, so I took it," he tells China Daily.

It was during a summer internship at Dominick & Dominick Inc - one of the oldest privately held investment firms in the United States - that made Rogers aware that Wall Street is the place where people would pay him to exercise his inclination to explore.

After attending Yale University where he majored in history and a stint at Oxford University studying philosophy, politics and economics, the renowned American investor worked as an analyst at three different firms for a couple of years before being hired by Arnhold and S. Bleichroeder - an old German Jewish investment firm - where he worked with a vice-president of the firm, international financier George Soros.

In his book Street Smarts, Rogers recalls: "All of a sudden, my studies of history and current events were more than a theoretical exercise - they had practical value. My passion for getting to know the world was served with a purpose. As a history student, I found it fascinating to learn how the markets were driven by world events. But, what really struck me, for the first time in my life, was how predictably, throughout history, world events had been driven by the markets."

Shortly after, Soros and Rogers founded the legendary Quantum Fund - an offshore hedge fund for foreign investors buying and selling short stocks, commodities, currencies and bonds anywhere in the world. And, over the next 10 years, the portfolio had gained 4,200 percent, while the S&P had gained less than 50 percent.

"I worked incessantly, making myself a master, as much as possible, on the worldwide flow of capital, goods, raw materials and information."

Rogers retired in 1980 at the age of 37, but continued to manage his own portfolio, and began fulfilling his lifelong dream of travelling.

Rogers is reputed to be an adventure capitalist as he had circumnavigated the world twice - once by motorcycle and once by car, both of which were listed in the Guinness Book of World Records. His first Guinness world record was set in 1965 during the Henley Royal Regatta rowing event in the United Kingdom.

"Travel alone teaches you a lot," he points out. From 1990 to 1992, he went on a world trip on a motorcycle, covering more than 100,000 miles across six continents. And, between January 1999 and January 2002, Rogers and his wife Paige Parker toured a total of 116 countries and regions, covering more than 152,000 miles across six continents and three territories on their custom-built Millennium Mercedes.

"If you're an adventurer, you know what the world is like and you can find out what's happening."

To Rogers, the most important thing had been adventure, followed by investing. But, for now, the slots have been taken over by his two little girls - 13-year-old Happy and Baby Bee, aged 8.

He regrets harboring the mentality in the past that having kids is a waste of time, money and energy. Now, he feels otherwise. "I had been completely wrong. I hope to travel around China soon with my girls."

Talking about the criteria for an excellent investor, Rogers says to achieve it, one has to be "very curious, skeptical and independent".

"Don't listen to others. If you're skeptical, you'll be independent and trust your own brain. You shouldn't read just one source of information, but should get more information from various aspects and put them into your head and think independently."

tingduan@chinadailyhk.com