Business

Steelmakers raise prices again

Updated: 2011-02-16 07:51

By Zhang Qi (China Daily)

Increase in the cost of raw materials now being passed on to customers

BEIJING - China's major steelmakers raised prices for a third straight month as downstream demand became stronger and raw material prices continued to rise.

Baoshan Iron & Steel Co, the nation's largest publicly traded steelmaker, raised prices for hot-rolled products by 300 yuan ($50.85) a ton and cold-rolled prices by between 260 and 300 yuan a ton, backed by strong demand from the automobile and construction industries. Baosteel supplies half of China's automotive steel.

The hike was followed by Wuhan Iron & Steel Co which raised wire bar prices by 200 to 300 yuan a ton on Monday.

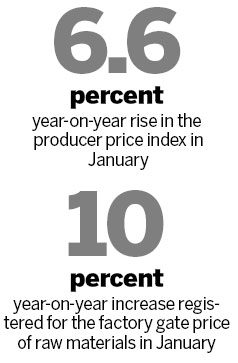

The producer price index (PPI), the main gauge of inflation at the wholesale level, rose 6.6 percent in January year-on-year while the consumer price index (CPI), the main gauge of inflation, rose 4.9 percent during the same month, the National Bureau of Statistics announced on Tuesday.

|

|

Factory gate prices for the mining sector increased 13.7 percent in January year-on-year, while the factory gate price for the raw materials sector rose 10 percent year-on-year.

China's steel lobby, the China Iron and Steel Association (CISA), said in January that demand from the housing and railway sectors will further drive up steel prices this year.

Passenger car sales rose 12.6 percent in January on an annual basis, despite falling 10 percent in January from the previous month, as cities began imposing curbs on vehicle sales to combat traffic congestion, according to the Shanghai-based China Passenger Car Association.

Rebar futures on the Shanghai Futures Exchange rose as high as 5,157 yuan a ton on Tuesday, close to the record 5,230 yuan reached on Friday.

Steel production rose by 60,000 tons a day in early January compared with a month earlier, according to data from the CISA.

Domestic average steel indexes reached 194.5 on Feb 11, up 1.6 percent from the previous week, and a rise of 27.3 percent from a year ago, propelled by rising raw material costs, according to data from the Lange Steel Information Center.

Indian ore with an iron content of 63.5 percent was being offered at $197 to $199 a ton, including freight costs, on Tuesday, a rise of 12 percent this year.

The price of coking coal also surged after production in the top exporter, Australia, was disrupted by massive floods.

Chinese steel mills and traders bolstered iron ore inventories because they expect prices to rise further.

Iron ore imports surged 18 percent to a record in January, compared with December, according to the General Administration of Customs on Monday.

China Daily

Specials

Spring Festival

The Spring Festival is the most important traditional festival for family reunions.

Top 10

A summary of the major events both inside and outside China.

A role model

Alimjan Halik had been selected as the "Cyberspace Personality Who Moved the Hearts of the Chinese in 2010".