Business

China's art market throws down the hammer

Updated: 2011-02-23 11:26

By Andrew Moody and Fu Yu (China Daily)

Europeans remain keen to get a piece of this buying action. In Hong Kong's Central district on Queen's Road, Edouard Malingue, son of the founder of the famous Galerie Malingue in Paris, opened a gallery in September.

One of its first events was a Picasso exhibition showing 40 works ranging from $330,000 to $15 million, which attracted a lot of interest from mainland buyers. The gallery specializes in 20th century European and American art.

"I looked at opening a gallery in London or New York but Asia seemed a much stronger market than in the West. It was also a place with fewer galleries and wasn't somewhere where everything had been previously done by someone else in the art world," said Malingue.

"I thought about locating in Singapore but Hong Kong was closer to the mainland. I discarded either Shanghai or Beijing because the administration is cumbersome and the import taxes are really frightening."

Malingue said a number of people from the mainland attended his Picasso exhibition.

"They tended to ask interesting questions about Picasso and his creative process. Some were very specific about investment and the potential return they could get after six months, a year or two years," he said.

The gallery owner said a sign any market was taking off was when you had interior decorators at art fairs and exhibitions.

"In places like Miami and New York they are everywhere and you are beginning to see that here. I am confident of the decision to have a gallery here to cater for the Chinese," he said.

Within the art market in Hong Kong there is a sense of anticipation about Art Hong Kong, the annual art fair held in May. One of the key questions again this year will be whether there will be more interest from the mainland.

Last year's event attracted 46,000 visitors, up 65 percent on the previous year and works by the leading contemporary artists, such as Damien Hirst, were sold to Chinese collectors.

"There was certainly an upswing in the VIP attendance from the mainland and there were a number of high profile sales," said Magnus Renfrew, the fair's director.

"I think the Chinese market is going to play an increasingly important role over the next five to 10 years."

"When people have their houses, their yachts and their cars, they begin to look for other ways to express their wealth."

Renfrew said the number of Chinese people buying art at the moment could be exaggerated.

"At the moment it is a relatively small pool of buyers and collectors but as time moves on, it will have a trickledown effect and impact every level of the market."

The holy grail for many of the international auction houses is to be able to hold their own auctions on the mainland.

At present, Chinese law prevents them from doing so, although many exhibit works there that are eventually sold in Europe or the United States.

Christie's, which has offices in Beijing and Shanghai, has a licensing arrangement with the Beijing auction house Forever which can hold auctions using its brand.

Jonathan Stone, the Hong Kong-based Asia managing director of Christie's, said he believes China is the right place to invest.

"We are significantly investing in the region and in people on the ground. We are also looking at ways globally to support Chinese participation in the market," he said.

He believes Chinese purchases of high profile works of art has to some extent propped up the art market during the economic crisis.

"I think what is encouraging is that even in the darkest days of the economic crisis, although the sales volume was clearly reduced, there was still a hunger for great works of art and lot prices were going up, even though there was some reduction of the volume in the market."

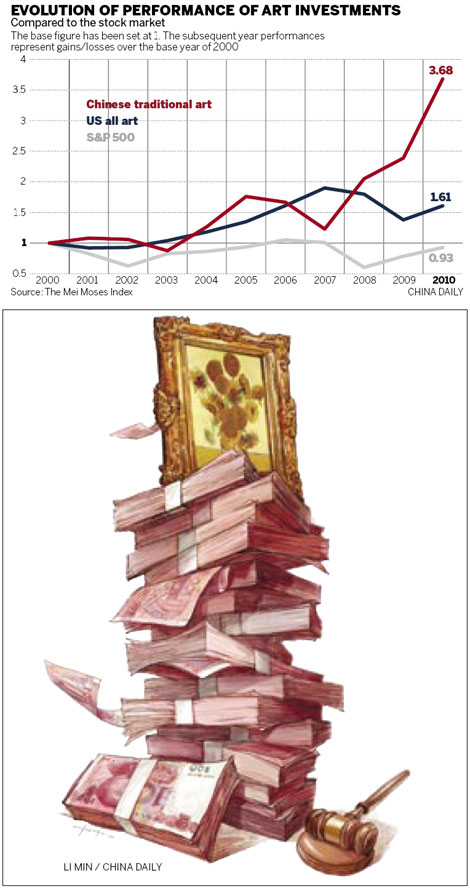

Professor Mei, the creator of the art index, believes what we could be seeing is a major sea change in balance of power in the art world from Europe and the West to the East.

He believes with Chinese ceramics and other heritage items becoming a new driver in the market, China could usurp both London and New York as leading auction centers.

"It is already the third biggest without the international buyers these other centers attract. I think Beijing could overtake New York as the world's No 1 auction market within 10 years and probably within five," he said.

Professor Yu at the China Central Academy of Fine Arts is concerned whether the Chinese new rich, unlike their European and Western counterparts, see art merely in financial terms.

"The monetarization of fine arts in China is on an unprecedented scale. I think there is a need for buyers to focus more on the art itself than the high prices it can fetch," he said.

Zhang Lan, the chair of South Beauty, however, insists it is not the machismo of high prices that fuels her interest but her love of art itself.

"Once I think one artist has got the potential, I will buy his or her work but never sell it. I will grow with this artist and the artwork will influence my life and the way I do business," she said.

China Daily

Specials

Kremlin buddies

Dmitry Medvedev and Vladimir Putin inspect Olympic preparations.

Lantern Festival

The Lantern Festival is celebrated across China.

New York Fashion Week

Models line up before a show during New York Fashion Week.