Focus

Move to improve tax rule means business

Updated: 2011-03-15 07:53

By Hu Yinan and Cao Li (China Daily)

Not enough, some say

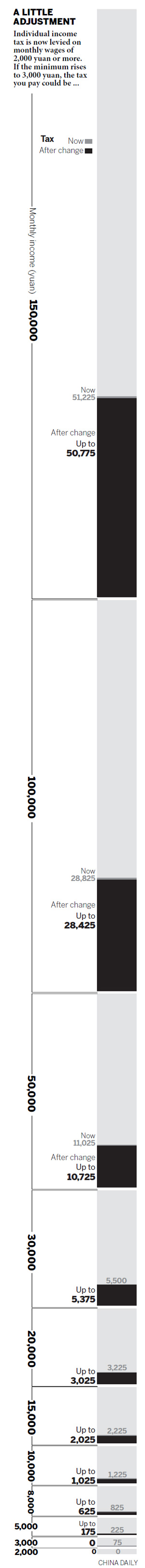

With its top marginal rate at 45 percent for monthly incomes of more than 100,000 yuan, China's individual income tax is nominally more progressive than in most countries. But researchers say that tax collection begs for serious improvement, and it takes a package of tax reforms, not just raising the individual income tax entry, to fix things.

These other measures include imposing more taxes - including inheritance tax, gift tax and property tax - as well as taxing more on luxury spending, Zhang said.

Family burdens, too, need to be taken into account in individual income tax, said Liu Jianwen, director of the Research Center of Fiscal Law and Taxation Law at Peking University. "Say there's a family with two wage earners and another with just one. It's not fair to tax them the same way."

Thresholds and rates should be adjusted relative to inflation and exchange rates, and the highest tax rate of 45 percent should be kept, Liu said.

Individual income tax files for the well-off also should be connected to their IDs, he said, so tax authorities could more accurately and effectively track their income.

Specials

Earthquake Hits Japan

A massive 8.8 magnitude quake hit the northeast coast of Japan on March 11,2011.

NPC & CPPCC sessions

Lawmakers and political advisers gather in Beijing to discuss major issues.

Labor crunch

Worker scarcity is no longer confined to eastern areas, minister says.