Business

Emergence of lesser-known brands

Updated: 2011-03-23 10:49

By Patrick Whiteley and Wang Chao (China Daily)

|

Chery Automobile is one of several homegrown brands who are dreaming big. Qilai Shen / Bloomberg |

|

|

Domestic firms aim for slice of high-end car market with new product launches

BEIJING - In China, the automobile industry is galloping at breakneck speed, making it one of the most compelling sectors for investment. Such is the market potential that virtually everyone in the automobile industry wants to make and sell cars in China. While the industry has mostly been dominated by the global biggies, there are signs now that the lesser-known players are ready to take center stage in a fiercely competitive market where the right pricing and positioning is the key for better returns.

The emergence of the lesser-known brands is not something new. Signs of it were visible at an automobile exhibition in Beijing last year, where a slew of Chinese brands unveiled plans to tap the high-end segment of the market.

Local companies showcased nearly 150 self-developed variants and most of them had independent intellectual property rights. What was surprising was that a significant chunk of the new models from these companies were clean energy vehicles.

Under the banner, "Dream, Self-Improvement and Going Beyond", the weeklong expo was probably China's first self-developed car show and also had the support of several key government departments. It also got backing from the China-Europe Association for Technical & Economic Cooperation.

What set that particular auto expo apart from the scores of other events in China is that it was probably the first time that local players were making such a big splash in a milieu often dominated by marquee names such as GM, Volkswagen, Ford, Toyota or Mercedes-Benz.

Much of the action at that event was centered on the high-end sedan market in China, with several local companies announcing plans for new launches.

One of the reasons why the action is heating up in the high-end sedan market could be traced to the changing consumer preferences and stringent traffic regulations in major cities.

Dong Yang, secretary-general of the China Association of Automobile Manufacturers (CAAM), said that Chinese companies will continue to make technological strides.

"I think Chinese brands are still like children, while foreign brands are like adults," he said. "You can say that an adult is more powerful than a child, but will it be so in the future?"

In 2009, the market share of local car manufacturers surpassed 40 percent in the passenger car segment and exceeded more than 45 percent last year, according to the CAAM.

But the highest-selling passenger vehicles have not been sedans, but minivans and small budget cars. This year the focus will shift to high-end models, said Jia Xinguang, an auto analyst.

"The challenge is to create top-quality products and build new brands in a fiercely competitive market," he said.

Among the local brands, Geely Automotive Holdings perhaps has a unique advantage. Its purchase of Swedish car brand Volvo last year has close parallels in its Ningbo declaration of 2007 wherein it decided to move up the value-chain by making high-end cars.

Geely has created three sub brands, Global Eagle, Englon and Emgrand, with the latter being its top-end model.

By sewing up the Volvo deal, Geely not only got the rights for the Volvo brand, but also gained access to some of the best automotive safety technologies in the world.

Geely is now phasing out its 30,000-yuan ($4,571) cars and moving up the ladder with its Emgrand series. Cars in this series are priced upwards of 100,000 yuan, with the top-end model selling at around 160,000 yuan.

Geely Chairman Li Shufu has recently indicated that Geely will launch as many as 42 new models over the next three years across various segments.

Jia, however, said that despite the significant advances made by Geely, it has not been able to make an impact with its new models.

"Building a brand is not just about selling cars, but more related to quality and service," he said. "It might take 10 years for Geely to build a high-end brand or even longer. It has to be patient and careful because its high-end brand reputation can suffer if it does not pay attention to details."

Like Geely, Chery Automobile is another homegrown brand, who is dreaming big. The company has made a mark for itself in the budget car segment with its QQ sub-compacts priced around 25,000 yuan. Recently the company entered the upper tiers of the auto market with its Rely sedans priced at around 143,000 yuan.

Ma Deji, vice-president of Chery Automobile, feels that it would take some time for Chery to establish its presence in the high-end market, as it does not have any tie-ups or joint ventures with foreign companies.

"It is hard to build a high-end image because we don't have a successful example to follow," Ma said.

At the same time, Ma admits that it would not be easy to change consumer perception overnight. "What we need is time. We have a track record of only 13 years, whereas brands like Mercedes-Benz and BMW have decades of experience. Despite the short history, our products have a good reputation in the market," he said.

Admitting that domestic companies are shifting gears, Ma said, "the car industry is like the home appliance industry. First we import, then we assemble spare parts for foreign companies and finally produce our own brands".

He said that the current battle between auto companies on pricing will change in subsequent years. "Now we are competing for low prices, after two to three years, when we achieve breakthroughs in core technologies, hopefully we can compete with top brands."

BYD, backed by US billionaire investor Warren Buffett, is another budget-car maker that has high hopes and has been making high-end passenger cars since 2007.

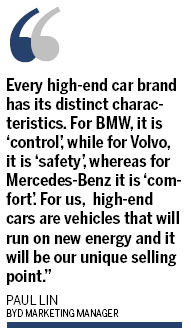

BYD marketing manager Paul Lin said the company spent a considerable sum of money to develop its high-end 6 series models. "But it is a race against time as every other brand is developing its own high-end variants. So we need to be faster than other brands to make our mark in this segment," he said.

Last year, BYD teamed up with Daimler to make an all-new electric car brand for the Chinese market. "Our alliance with Mercedes-Benz has been approved by the government, and we will soon launch the new models," Lin said.

"Every high-end car brand has its distinct characteristics. For BMW, it is 'control', while for Volvo, it is 'safety', whereas for Mercedes-Benz it is 'comfort'. For us, high-end cars are vehicles that will run on new energy and it will be our unique selling point."

Among the crowded market, there are also several smaller but well-known players who have made a mark for themselves. One such company is Haima.

Founded in the late 1980s, Haima went through different identities: First a local spare parts manufacturer; then a joint venture company of Mazda, and later on a subsidiary of FAW.

Based on the technology acquired from the Mazda joint venture, it has developed its own brands, which include minibuses, passenger cars, multi-purpose vehicles, sports utility vehicles and new energy cars.

Haima said that during the past five years it has invested more than 2 billion yuan in developing 10 new passenger models. Over the next five years, the company plans to invest another 3.6 billion yuan for developing 18 new car models.

State-owned car giants are also flexing their muscles in the automobile market. Chang'an Automobile Group is expanding its annual production capacity to roll out more vehicles.

Last year, Chang'an became the nation's fourth most productive automaker, selling 2.37 million units. Homegrown brands accounted for nearly 74 percent of Chang'an's sales with mini-vans and budget cars accounting for the lion's share.

Chang'an is now planning to make high-end vehicles and has started work on a new production base in Beijing to make mid- to high-end passenger cars and new energy cars. The company is also concentrating on building its brand and went for a brand makeover recently to take on players like Geely and Chery.

"We are still preparing our high-end brands, it will be launched in the near future. Our goal is to raise the high-end car sales to 30 percent of our self brands by 2015," said a Chang'an spokesperson.

"Most multinationals grow quickly through mergers and acquisitions. I think the same logic applies to the auto industry."

"I believe the number of auto companies will drop significantly in the next 10 years. We have to build mid-to high-end brands to gain more competitiveness," she said.

China Daily

Specials

'Super moon'

The "Super Moon" arrives at its closest point to the Earth in 2011.

Radiation test

The probability of being exposed to a life-threatening level of radiation is quite slim.

Panic buying of salt

Worried Chinese shoppers stripped stores of salt on radiation fears.