Business

Rules set for yuan FDI by end of year

Updated: 2011-06-14 08:03

By Sophie Leung (China Daily)

HONG KONG - China will issue rules on yuan-denominated foreign direct investment (FDI) into the mainland before the end of the year, a move that will allow easier repatriation of the Chinese currency according to the Hong Kong Monetary Authority (HKMA).

"Once the new rules come out, it will provide a greater degree of certainty and easier access by investors when they have renminbi funding in Hong Kong and elsewhere," said the HKMA's Chief Executive Norman Chan.

China, the world's second-largest economy, will grow 9.5 percent this year, according to economists surveyed by Bloomberg. This is luring investment and boosting capital inflows that add to China's record $3 trillion of foreign-exchange reserves, and hampering central bank efforts to limit gains in real estate and the price of consumer goods.

"China may not want the offshore pool of yuan to return in the form of portfolio investments into equities or real estate as these markets do not need much fresh capital, but they would welcome more foreign direct investment," said Dariusz Kowalczyk, an economist at Credit Agricole CIB in Hong Kong. "There could be more dim sum bond issuance to raise funds for investment in China, which could push up yields."

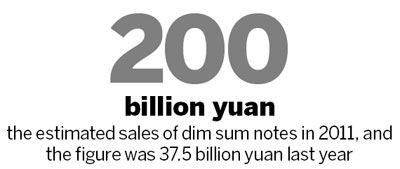

Dim sum note sales may increase to 200 billion yuan ($31 billion) in 2011, from 37.5 billion yuan last year, as global investors bet on the yuan appreciating more than the currencies of Brazil, India and Russia, according to an estimate from Mizuho Securities Asia Ltd. Dim sum bond issuance has reached 68 billion yuan so far this year.

Overseas investment in China rose 26 percent to $38.8 billion in the first four months of the year, China's Ministry of Commerce said last month. Currently, foreign direct investment in yuan needs case-by-case approval from the authorities, Chan said.

Yuan deposits in Hong Kong increased 13 percent from the previous month to 511 billion yuan in April, according to data from the HKMA.

The new rules may lead to large-scale yuan-denominated investment into the mainland and "may slow growth of the offshore pool of yuan", Kowalczyk said. "Plans for simplified new regulations governing yuan-denominated FDI are not a surprise given that it's a logical next step to internationalize the currency."

Bloomberg News

Specials

Wealth of difference

Rich coastal areas offer contrasting ways of dealing with country's development

Seal of approval

The dying tradition of seal engraving has now become a UNIVERSITY major

Making perfect horse sense

Riding horses to work may be the clean, green answer to frustrated car owners in traffic-trapped cities