Top Stories

Major capital gains

Updated: 2011-08-26 11:03

By Andrew Moody (China Daily)

|

Nick Luckock, director of financial services at Actis. Nick J B Moore / for China Daily |

|

Edwards Tse, chairman of management consultants Booz & Co in Greater China. Geng Feifei / China Daily |

|

Chris Zhang, managing director of ACE VC Ltd, says his company has raised 50 million pounds ($81.47 million) to invest in China start-up businesses. Nick J B Moore / for China Daily |

Venture capital, private equity from overseas playing an increasingly important role in Chinese economy

Chris Zhang seems somewhat out of place to be a potential new player in China's burgeoning venture capital market. His office in an innocuous business park in the east end of London, which houses an Internet food business he also runs, appears worlds apart from the gleaming skyscrapers normally associated with high finance.

The 31-year-old serial entrepreneur, who has lived in the UK for 10 years, is, however, managing director of ACE VC Ltd, which has raised 50 million pounds ($81.42 million) to invest in China start-up businesses. His will be one of a number of European-based businesses now providing finance to Chinese companies.

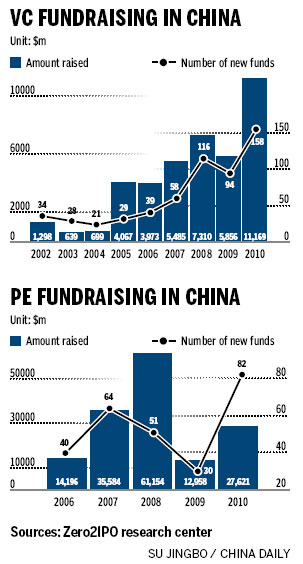

Around 1,000 private equity and venture capital firms raised $39 billion last year and invested around $16 billion in China, making the country the largest market in Asia for this type of finance, according to Zero2IPO, which researches the sector in China.

"There is a need for this type of finance in China because everyone wants to be an entrepreneur. People want to be rich and they don't believe they can achieve this by working for somebody else," he said.

Although it is yet to be officially announced, ACE's first investment is set to be in a tea house business, which Zhang believes has the potential to expand internationally, even emulating US global chain Starbucks in the coffee market.

"It is not a traditional tea house but one with a great service offer and we think it could be a success not just in China but all over the world," he said.

Zhang said the excitement in the China venture capital and private equity market is similar to that in Silicon Valley in the late 1990s when investment flowed into the dotcom sector.

"What is happening in China now is similar to what happened in the Google times. Magic is happening all the time. The environment is full of money and there are not enough good projects out there," he said.

The venture capital and private equity market in China is very much in the early stage of development and dates back only to the late 1990s when major foreign players such as UK giant 3i and US companies Sequoia and KPCB began entering the market.

A recent feature of the market has been the emergence of Chinese companies. According to the Beijing Private Equity Association, up to 80 new local companies are entering the market each year.

One of these is Liuhe Private Equity, which is based in Shanghai and employs 30. It was co-founded by Steven Wang, its chief executive officer, and some partners in 2005.

"I would say the private equity market is still very much in the early stages. There is, however, an oversupply of money available for private equity investments," he said.

Wang is typical of many who work for Chinese venture capital and private equity companies in that he has both international skills and experience - in his case, an MBA from Harvard and time at the Boston Consulting Group.

He said the market is being spoiled by amateurs entering the market, typically entrepreneurs who have sold their businesses and have grouped together with people in a similar position to form investment companies.

"You might have someone who ran a small factory in Guangzhou or a coal mine and who has made 50 million yuan ($7.82 million) who does this," he said.

"The problem is that they don't do any proper analysis and they often pay too much for their investments which means valuations for everyone else become too high."

Zhang at ACE said such amateur operations do not fully understand the very concept of venture capital or private equity.

"If you are a venture capitalist you are an LP - a limited partner of a pooled investment - and are not hands on. They want to be GPs (general partners), however, and want to take power and control. They are always heavily involved in each deal. That is not how it is supposed to work," he said.

The difference between venture capital and private equity is often difficult to define. Venture capital invariably tends to be early stage finance, often for start-up businesses.

Many Chinese universities have incubator units for technology businesses that need this capital to get off the ground. Deals often range from a few million dollars up to $50 million.

Private equity, or PE, as it is known, often kicks in at the $50 million threshold and can involve quite substantial sums.

It is usually invested in established businesses that are ambitious and want to grow fast and the private equity investor is looking to exit at a profit after three to five years by either an IPO on one of China's stock exchanges or a trade sale to another company. Some private equity companies also seek longer-term investments of up to 10 years.

In Hong Kong, Richard Zhang, partner and the head of the Greater China office for London-based private equity company Apax Partners, said a company such as his is only interested in the bigger deals.

"The minimum deal for a global equity house such as ourselves would be more likely than not $100 million and above cheque size," he said.

"We are a very patient, long-term investor and tend to stick with a portfolio of companies for a very long time. There is always going to be an exit and that can be anything from three to five years to seven to 10 years."

Apax opened an office in Hong Kong in 2005 and in Shanghai two years ago and has been involved in a number of high profile deals.

It took a stake in SouFun.com, China's largest real estate information website, and saw its shares jump more than 70 percent when it listed on the New York Stock Exchange recently.

Last month it advised private equity funds to buy Golden Jaguar, the fast growing China restaurant chain which is located mainly in many of China's larger shopping centers.

Zhang said it is part of the company's strategy to make investments in businesses such as these that are likely to benefit from ever-rising consumer spending in China.

"I would say there is no typical deal for us but generally speaking, our investments in China are very much tied to the rising domestic consumption trends underpinned by continued economic development and urbanization in China," he said.

Some have expressed concern about the speed of growth of the China venture and private equity market. Blackstone, the major US private equity company, is one that has been relatively cautious.

Antony Leung, senior managing director and chairman for the group in Greater China, has said he is prepared to be patient.

"China's economy is not short of money and many deals' valuation are high. Some of the pre-IPO deals were valued higher than public companies. Blackstone is a conservative company to some extent, so if we think a deal's valuation is too high, we will not invest."

One of the major concerns about the Chinese economy is that many SMEs (small- and medium-sized enterprises) are suffering from a funding shortage, exacerbated by the government's credit-tightening policies designed to bring down rising inflation.

Edwards Tse, chairman of management consultants Booz & Co in Greater China, based in Beijing, sees a role for venture capital and private equity as vital for plugging that gap.

"SMEs are suffering somewhat because the banks are geared toward lending to larger enterprises and are not paying much attention toward smaller companies. There is a funding gap," he said.

"But to be attractive to the venture capital and private equity companies, they need to have a good story to tell. This type of finance is not for the mom and pop shop round the corner."

Wang at Liuhe Private Equity wonders whether there is a role to play for venture capital or private equity to make up or the shortage of bank lending.

"We are not looking for companies who have difficulty getting loans. Our advice to companies is not to over extend themselves and the ones we have invested in tend to have good reserves of cash."

The major risk takers remain the venture capital companies. Many of the businesses they invest in fail but the funds make a return on their investment by the exponential returns of the winners they pick.

Because it is an undeveloped market, it is often even more difficult in China to predict which businesses will succeed.

Zhang at ACE has adopted a novel approach to this by setting up its own academy that mentors entrepreneurs before the company makes any investment.

"A lot of young entrepreneurs have no corporate experience and the failure rate can be as high as 99 percent. Many people have good ideas but they just don't know how an enterprise works and we aim to give them that experience," he said.

From his offices over-looking London's Tower Bridge, Nick Luckock is looking for opportunities in the financial services sector in China.

He is director in financial services at Actis, a private equity company which specializes in emerging market economies and also has major operations in Africa and Latin America.

"The market in China is very competitive. There are at least 20 other private equity firms looking to invest in the financial services sector as well so we have to differentiate ourselves and be able to add something beyond the capital," he said.

The financial services sector is restricted to foreign companies with the major international banks being unable to set up retail branches in China.

Actis, which has 15 staff members in its Beijing office, is looking to invest in Chinese businesses in niche sectors such as companies which distribute insurance and others that offer wealth management services.

"We are particularly interested in those businesses which target their services at the affluent middle class sector rather than high net worth individuals," he said.

Luckock, who is constantly traveling and had visited Brazil, India and China in the previous three weeks, said his institution was in position to use its international connections to help Chinese companies expand abroad.

"We worked with a Chinese bank recently that was interested in buying a stake in an African bank we were invested in so you have these flows going both ways," he said.

The private equity market is held back to some extent by poor auditing standards in some Chinese SMEs.

The companies themselves sometimes are keen to bring in private equity partners so they can get their accounting standards in order, particularly if they are seeking an IPO in the near future.

Zhang at Apax said this is often a vital role for a private equity company to play.

"Putting in quality standards and improving the compliance level as well as stronger governance is very helpful for a company to further develop," he said.

Wang at Liuhe Private Equity said one of the hidden bonuses of the economy slowing down as a result of the government's credit-tightening measures is the ability to do more thorough due diligence.

"Several years ago, even a mediocre company was able to get money. In a period of uncertainty, we are often no longer in a race with other companies and we can spend more time getting to understand a company and do lengthy due diligence before making an investment," he said.

Many experts believe venture capital and private equity are playing a significant role in the development of China's private sector.

They are not only providing risk capital but also expertise in helping companies develop their businesses, whether they want to float on the stock market, build a brand or to make acquisitions overseas.

"Private equity companies bring with them often a knowledge of the sector the company is involved in and they also have experience of international markets and also a wide range of contacts," said Zhang at Apax.

"A lot of Chinese companies are often nervous about going abroad because they lack contacts."

China Daily

Specials

Biden Visits China

US Vice-President Joe Biden visits China August 17-22.

Star journalist leaves legacy

Li Xing, China Daily's assistant editor-in-chief and veteran columnist, died of a cerebral hemorrhage on Aug 7 in Washington DC, US.

Hot pots

Tea-making treasures catch the fancy of connoisseurs as record prices brew up interest