System to price rare earths

Updated: 2012-08-09 08:03

By Wang Zhuoqiong in Baotou, Inner Mongolia (China Daily)

|

|||||||||

|

A worker displays permanent magnetic materials made of rare earth ores in Xinfeng county, East China's Jiangxi province. Zhou Ke / Xinhua |

New platform introduced in Baotou to avoid market volatility in key metals

China is to set up a national pricing system for rare earth metals within the next month, in addition to its new trading platform, to further regulate the industry and strengthen its control of the resources, essential materials in consumer electronics and other high-tech goods.

Speaking on Wednesday at the Rare Earth Industry Forum in Baotou, in the Inner Mongolia autonomous region, Ma Rongzhang, secretary-general of the China Rare Earth Industry Association, said the association will establish the pricing index with the aim of leveling out price volatility in the market.

The move, still awaiting approval, will also help the country be a stronger competitor in the international market, and play an important part in the sustainability of the sector, although no specific details were given.

The new rare earth trading platform was launched in Baotou.

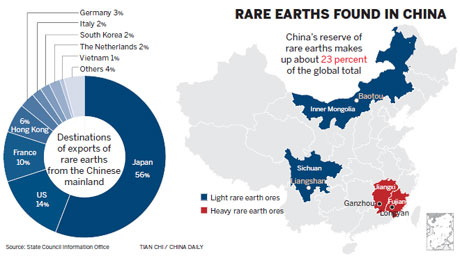

North China's Inner Mongolia autonomous region is home to more than half of the world's light rare earth output.

The platform will be operated by the country's top rare earth producer, the Inner Mongolia Baotou Steel Rare-Earth (Group) High-Tech Co, as well as with nine other firms and institutions including the southern giants Xiamen Tungsten Co Ltd and Guangdong Rising Nonferrous Metals Group Co Ltd.

With a total investment of 100 million yuan ($15.7 million), each shareholder invested 10 million yuan and holds a 10 percent stake in the exchange.

Dudley Kingsnorth, a professor in energy and mineral economics at Curtin University in Western Australia, said he is supportive of the idea, and that it will improve transparency and help avoid volatility.

But he added that the supply of heavy rare earths will be the major concern of the industry in the future.

Chen Zhanheng, deputy secretary-general of the association, pointed out that some of China's rare earth products - traded, for instance, inside some southern provinces to avoid tax - might not necessarily be put onto the national trading platform, but that a stabilized price will benefit everyone.

He also suggested China stockpile more heavy rare earths instead of light rare earths, which are considered as being overproduced.

However, Huang Chang-geng, senior vice-president of Tungsten, said he was still unaware of any specific regulations and systems for the fledgling platform.

China produces 90 percent of all rare earths, while it has 23 percent of world resources, but many in the industry consider this as unsustainable.

The most urgent action is required on heavy rare earth supplies, said Alastair Metcalf, chief executive officer of Hastings Rare Metals Ltd in Australia.

He suggested that China secure stock from other countries for its processing plants, particularly Australia.

In July, the World Trade Organization formed a special group to investigate the issue of stockpiles after the European Union, the United States and Japan complained over what they claimed were Chinese export controls.

Rare earth exports this year are expected to drop to around 10,000 tons, much lower than the industry export quota of 31,000 tons.

In the first half of the year China exported no more than 5,000 tons of rare earths, said Ma. Last year, overall exports were 16,900 tons, about 56 percent of the country's export quota.

Ma said that indicates the rare earth export quota is not a barrier to overseas consumers importing rare earths from China.

Rare earth exports, according to statistics by Chinese customs, were 17.83 percent of its total output of 96,900 tons in 2011.

Smuggling is attributed as the main reason for the export fall, in addition to sluggish demand caused by rising prices, sufficient stockpiles from overseas consumers, and reduced market share of the US products, Ma said.

Rare earths, a group of 17 metals, are essential in the manufacture of high-tech products ranging from smartphones and wind turbines to electric car batteries and missiles.

wangzhuoqiong@chinadaily.com.cn

(China Daily 08/09/2012 page13)

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|