Maersk readies for China's emerging markets

Updated: 2014-04-04 07:12

By Zhong Nan (China Daily USA)

|

|||||||||

Maersk Line, the shipping unit of Denmark's Maersk shipping and oil conglomerate, is speeding up plans to offer a wider range of services in China because more Chinese companies are keen to move to emerging markets to benefit from booming bilateral trade, preferential trade tariffs and investment opportunities.

Jens Eskelund, managing director of Maersk China, said China will continue to grow. But the country will also change, and one of the most important changes is the composition of its foreign trade. Growth in trade with mature markets in the United States and European Union is modest, while trade with new markets in Africa and South America is surging.

In Africa, Maersk Group's logistics arm, Damco, is partnering with a major Chinese petroleum company to expand the African market. Because it needs to send large machinery and equipment from China to plants in Africa, Damco is putting a strong emphasis on timely deliveries and product security with zero damage to the cargo.

More than 30 percent of the African population is landlocked, and statistics show that rural Africa has on average only 34 percent road access compared with 90 percent in the rest of the world, according to a report by the center for African studies at Peking University released last year.

"The African ports that receive international carriers are of a higher standard, but the handling capacity of heavy equipment is relatively limited. Cranes at the ports may not be able to handle lifting more than 50 metric tons. It may take more than a week to arrange transport of a lifter from the eastern region to a port on the western coast," Eskelund said.

The Danish company has built inland container depots to reduce congestion levels at the terminals in certain places and deployed Chinese speaking staff in key destinations in Africa to coordinate with local teams and check all the arrangements before a shipment arrives.

Maersk Line's control desk at the origin can also closely monitor preparations in Africa. Backup arrangements such as trucks and cranes can be arranged in advance to ensure seamless transportation at the destination.

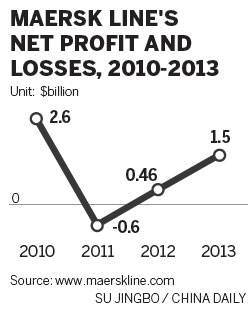

Despite being challenged by a still weak global shipping market, Maersk Line achieved a profit of $1.5 billion from the world market in 2013, up from $461 million a year earlier, thanks to vessel network efficiencies and lower bunker prices.

Large Chinese shipping companies such as China Shipping Container Lines Co and China Merchant Energy Shipping Co reported a net loss of 2.65 billion yuan and 2.18 billion yuan respectively in March. Chang Jiang Shipping Group Phoenix Co, another large Chinese shipping company, is highly likely to be delisted from the Shenzhen Stock Exchange this year after suffering losses for three consecutive years.

"Regarding container transportation, we believe the current focus on becoming an increasingly consumption-driven economy holds great potential for our industry," Eskelund said

"While trade growth in China today may no longer reach the double-digit percentage levels of past years, trade growth in absolute terms will still be significant."

Maersk Line, Mediterranean Shipping Co SA of Switzerland and French carrier CMA CGM SA agreed last year to establish a long-term operational alliance on East-West routes to optimize resources and lower the cost of container shipping. Known as the P3 Network, it is planned to start operating in the second quarter of 2014 if approval is obtained.

Luo Renjian, a researcher at the institute of transportation research under China's National Development and Reform Commission, said it is not unusual for major international shippers to form a bigger union under today's global trade environment because others are dominated by large alliances such as CKYHE and G6 in the world market, which were formed in 2005 and 2011, respectively.

zhongnan@chinadaily.com.cn

(China Daily USA 04/04/2014 page19)

Chinese drama to stage in Silicon Valley

Chinese drama to stage in Silicon Valley

World's unusual graveyards

World's unusual graveyards

China's first 'sea airship' to be put into commercial use

China's first 'sea airship' to be put into commercial use

A 'perfect storm' of smog in UK prompts health alert

A 'perfect storm' of smog in UK prompts health alert

Koala selfie

Koala selfie

Bodybuilders prepare backstage before competition

Bodybuilders prepare backstage before competition

Tanks tackle wildfires in NE China

Tanks tackle wildfires in NE China

10 monks pass highest Tibetan Buddhism exam

10 monks pass highest Tibetan Buddhism exam

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

US soldier kills 3 in army base shooting

China urges rescue of held tourist

British FM welcomes ratification of global ATT

China tops clean energy market

Manhattan fights NJ for China tourists

Satellite to monitor environment, disasters in Europe

Officials urged to focus on food and drug safety

Study zooms in on health of youth

US Weekly

|

|