Getting intervention right will take careful targeting

Updated: 2014-04-08 07:25

By Mike Bastin (China Daily USA)

|

|||||||||

Economy | Mike Bastin

Not just for the first time this year but perhaps for the first time since the immediate aftermath of the global financial crisis of 2007-8, the Chinese central government appears to have acted decisively to arrest what could be an unacceptably rapid economic slowdown.

Despite the considerable national and international media attention attracted by this recent intervention by Beijing, specific measures introduced recently appear to amount only to further tax cuts for small business, greater investment in rundown urban areas and an acceleration in the construction of a few railway lines.

Recent economic data have caused concern at the rate of China's economic slowdown. Manufacturing activity in particular remains below government targets. But just how serious is the current state of the Chinese economy and what should the government be doing? This year's growth target of 7.5 percent is the same as last year's but, unlike 2013 when growth exceeded the target with a figure of 7.7 percent, recent data indicates an annual growth rate below target.

In spite of recent figures growth is still on course for somewhere in the region of 7 percent. On the face of it this figure may appear to represent quite a major slowdown in China's meteoric economic rise over the last 20 to 30 years but, when compared with growth forecasts around the world, it commands considerable admiration and respect. Despite some sort of global economic recovery the world's most-developed countries are not predicted to experience GDP figures that even approach China's 7 percent plus.

Even Germany, still widely recognized as the major engine of European growth, is only facing a growth forecast of 1.7 percent. The US cannot do much better with only 3 percent growth forecast for this year. However, the most telling differential is that between China's 7-7.5 percent likely growth for this year and the overall world economy average forecast of only 2.5 percent.

In a nutshell the Chinese economy should outperform the world economy this year at three times the latter's average growth rate. That said, when double-digit growth was recorded nearly every year between 1999 and 2011, recent economic data do require close attention and careful, limited and targeted government intervention.

Certainly, anything like the massive stimulus package injected into the Chinese economy in reaction to the global financial crisis is out of the question. Any investment of similar magnitude will doubtless risk worsening public sector debt and may also add to over-capacity.

However, carefully targeted government intervention and investment is most definitely needed in order to maintain a decent level of economic momentum. While GDP always, and always will, grab the headlines, the government should also shine the spotlight on employment levels and opportunities and inflation. Any intervention and investment program should be linked inextricably to the impact on these economic indicators first and foremost.

So, where and what carefully targeted government investments do we need to see right now? First of all, looking long term and thinking strategically, the Chinese government has to accept the fact that any substantial "trickle-down" effect from China's richest provinces and cities has not happened and will not happen. In so doing, clear options emerge for any short-term tactical government-led initiatives.

Of immediate importance, therefore, are China's poorest geographic regions, provinces and cities, mainly West and Northwest China in particular. These areas will only emerge as significant engines of economic growth with consistent government investment and incentives targeted at all industrial sectors.

For any major economic development to snowball across Western China's further reaches, an initial focus on one major city is required and Lanzhou fits the bill for numerous reasons. In the same way that Shenzhen was selected as the initial torch-bearer of economic emergence, so should Lanzhou be identified as the catalyst to wealth creation across West China.

Short-term initiatives and long-term planning should also include an accelerated program of partial privatization of China's amorphous and unwieldy utility companies. Implementation should start right now with telecommunications being the first guinea pig privatization.

Overall, the Chinese government is quite right not to overreact and adopt a far greater interventionist role at this time. In fact, this managed slowdown does not threaten China's long-term economic growth path but probably ensures far greater likelihood of a more sustainable path in the longer term.

The author is a visiting professor at the University of International Business and Economics in Beijing and a senior lecturer on marketing at Southampton Solent University's School of Business.

(China Daily USA 04/08/2014 page15)

Vigil marks one month since MH370 vanished

Vigil marks one month since MH370 vanished

The world in photos: March 31-April 6

The world in photos: March 31-April 6

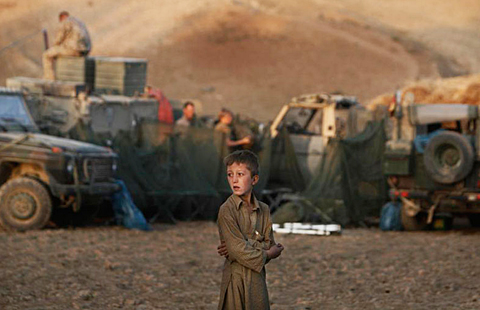

Simply child's play

Simply child's play

Photo special: Weird buildings in China

Photo special: Weird buildings in China

Jackie Chan holds charity concert marking 60th birthday

Jackie Chan holds charity concert marking 60th birthday

Microsoft to end support for Windows XP

Microsoft to end support for Windows XP

Poor weather greets baby prince

Poor weather greets baby prince

22 miners trapped in Yunnan coal mine flood

22 miners trapped in Yunnan coal mine flood

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Chinese, US defense chiefs begin talks

Time runs short in black box hunt

US warns China over yuan

Hagel's insensible remarks

Media: Japan, US differ in alliance expectations

Pro-Russians declare independence in Donetsk

China tours by Pentagon chiefs

Chinese military institutions visited by US officials

US Weekly

|

|