Online finance now 'due for consolidation'

Updated: 2014-04-08 07:25

By Zheng Yangpeng (China Daily USA)

|

|||||||||

Finance | Zheng Yangpeng

The emergence of Internet finance in China is providing more funding channels for small and medium-sized enterprises, but that's not necessarily good news for all lenders in the domain.

Emmanouil Schizas, senior economic analyst of the Association of Chartered Certified Accountants, an international professional organization, said major consolidation might be on the way for China's vigorous Internet finance sector, which has by his count "tens of thousands" of small companies.

|

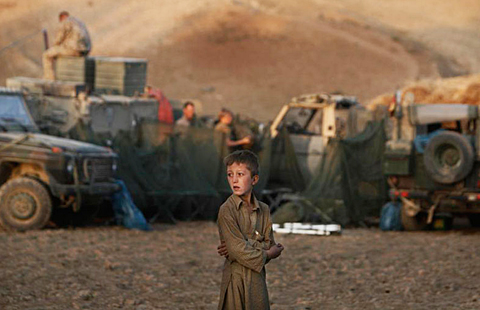

Internet finance companies at an international finance expo in Beijing. China's online finance businesses are providing more funding channels for small and medium-sized enterprises. But the way for them to survive, experts said, is differentiation, which means finding specific niche markets in a vast business population. Wu Changqing / For China Daily |

"If you look at China's peer-to-peer lending sector, there are probably 1,000 firms. But ideally there should be two or three players. The amount of consolidation the sector will have to undergo anyway is enormous. Media reports say that 90 percent of them will fail by the end of the year. But even (100 left) is way too many," said Schizas.

The way to survive, he said, is real differentiation, which means finding specific niche markets in a vast business population.

"The test for survival is whether they do anything different in terms of the four raw materials of business financing: information, control, collateral and risk appetites," said Schizas, who is also acting head of the ACCA's small business policy team based in London.

For example, if a platform makes it substantially easier and cheaper for investors to create a diversified portfolio, that's adding value. Some P2P lending firms give the option of automatic bidding on loans, but very few give investors any diagnosis of how interrelated the different positions are, so that they know how much "real diversification" they get, he said.

"The Internet service sector is really concentrated. What comes to mind when you think of online shopping (in the West)? It is Amazon, Amazon and Amazon. That's it," he said.

And despite all the frenzy and buzz the concept of "Internet finance" has generated in China, he said, various forms of "Internet finance" don't themselves add much value. That's true of P2P operations, third-party payments or online money funds. They're just "new incarnations" of what banks have been doing for a long time.

Internet finance, at its essence, is still about moving money from the capital markets through intermediaries to borrowers. What is new, he said, is that Internet finance firms can aggregate a large amount of information from transactions in particular platforms.

This is true of Alibaba Group Holding Ltd's lending operations, where its dominance of e-commerce in China enables its payment system, Alipay, to generate huge volumes of transaction and payment data from the companies and individuals that use it.

By mining this proprietary data, Alipay can assess the risk and creditworthiness of would-be borrowers and therefore price loans to them.

This in turn allows it to overcome one of the most important barriers that keep SMEs from getting the access to finance they need - the lack of reliable credit information on potential SME borrowers in many parts of the world.

Compared with traditional banks, Schizas said, intermediation via the Internet makes transaction and due diligence cheaper, and it also makes it easier for borrowers to diversify their portfolios because of the low transaction cost.

But the ACCA is not convinced that this amounts to a disruptive innovation in the business model. It cites evidence from the United Kingdom, where online lenders mostly target mainstream business borrowers, which the banks were already targeting.

Disruption will begin in earnest when entirely new types of information are part of investment decisions, making money accessible to businesses that have had little access to funding.

Contact the writer at zhengyangpeng@chinadaily.com.cn

(China Daily USA 04/08/2014 page15)

Vigil marks one month since MH370 vanished

Vigil marks one month since MH370 vanished

The world in photos: March 31-April 6

The world in photos: March 31-April 6

Simply child's play

Simply child's play

Photo special: Weird buildings in China

Photo special: Weird buildings in China

Jackie Chan holds charity concert marking 60th birthday

Jackie Chan holds charity concert marking 60th birthday

Microsoft to end support for Windows XP

Microsoft to end support for Windows XP

Poor weather greets baby prince

Poor weather greets baby prince

22 miners trapped in Yunnan coal mine flood

22 miners trapped in Yunnan coal mine flood

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Chinese, US defense chiefs begin talks

Time runs short in black box hunt

US warns China over yuan

Hagel's insensible remarks

Media: Japan, US differ in alliance expectations

Pro-Russians declare independence in Donetsk

China tours by Pentagon chiefs

Chinese military institutions visited by US officials

US Weekly

|

|