Weak trade figures 'signal slowing economy'

Updated: 2014-04-11 07:07

By Lyu Chang (China Daily USA)

|

|||||||||

Tough times seen for industry as exports contract for the second consecutive month

China's trade momentum fizzled out in March, with imports and exports unexpectedly declining in what analysts said was yet another sign of economic deceleration - and a warning of prolonged difficulties for manufacturers.

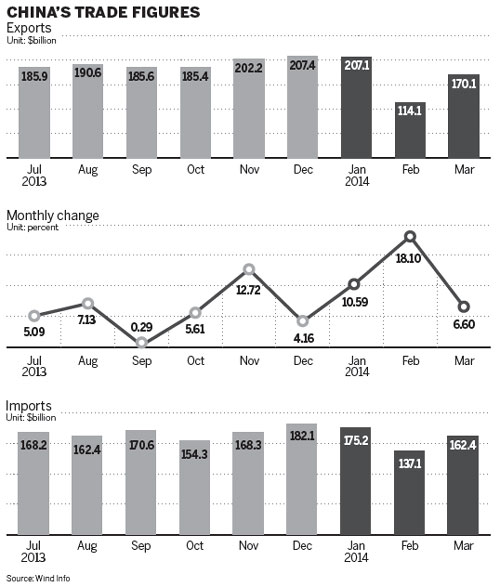

Total trade contracted 9 percent to $332.5 billion, the Customs Administration said on Thursday. Exports tumbled 6.6 percent year-on-year to $170.1 billion after dropping 18.1 percent in February. It's the first time since 2009 that exports declined for two consecutive months.

An even bigger downside surprise lay in the figure for imports, which contracted 11.3 percent to $162.4 billion in March. Imports increased about 10 percent in January and February.

The trade balance swung to a larger-than-expected surplus of $7.7 billion from a deficit of $23 billion in February.

First-quarter exports fell 3.4 percent, while imports rose 1.6 percent, producing a trade surplus of $16.7 billion, down 59.7 percent from a year earlier.

Zheng Yuesheng, a spokesman for the customs agency, told reporters in Beijing that the main reason for the export decline in March was "weak demand in Hong Kong".

Exports to Hong Kong fell 43.6 percent in March and 31.3 percent in the first quarter, according to Barclays Research.

"We maintained steady growth with our major trading partners, witnessing a large decline in trade only with Hong Kong", Zheng said. "But exports to Hong Kong will experience a clear rebound from May onward, driving up the growth in overall exports and trade."

Elsewhere, the figures were more in line with expectations. Trade with the European Union, the country's largest trading partner, increased 6.3 percent year-on-year in the first quarter to 836 billion yuan ($134.7 billion), while trade with the United States edged up 1 percent to 749 billion yuan, highlighting a tepid economic recovery that's likely to continue for the rest of this year.

First-quarter total trade with members of the Association of Southeast Asian Nations went up 2 percent, while trade with Japan rose 2.6 percent, despite ongoing political tension.

Wang Haifeng, a researcher at the Institute for International Economic Research at the National Development and Reform Commission, said that the first-quarter trade figures didn't necessarily mean much for full-year trade growth.

"Some special factors distorted export and import figures, such as fake export reporting early last year," he said. "China's trade with Hong Kong can be explained by the 'hot money' outflows due to an undervalued renminbi from the fourth quarter of 2013 through this year."

Submitting fraudulent export receipts to government authorities is a way for "hot money" for investment to evade much of the usual scrutiny that capital inflows face in China. This practice usually involves capital flows from Hong Kong.

Wang said that the import figures are a reflection that the real estate and vehicle industries have started to stagnate.

Other analysts said that exports remain stronger than the official figures suggest, and most of them forecast that China will meet its full-year target of 7.5 percent trade growth.

"We continue to expect investment and construction activity to accelerate following project announcements by the central government and local governments since the middle of March. We maintain our full-year GDP growth forecast of 7.2 percent and look for a recovery in growth momentum," a report by Barclays Research said.

lvchang@chinadaily.com.cn

|

Li Yi / China Daily |

(China Daily USA 04/11/2014 page18)

People enjoy cherry blossoms in Washington

People enjoy cherry blossoms in Washington

Prince William, Kate unveil portrait of Queen Elizabeth

Prince William, Kate unveil portrait of Queen Elizabeth

Hagel gets recipe of goodwill

Hagel gets recipe of goodwill

US, China firms team up on green truck play

US, China firms team up on green truck play

21 injured in Pennsylvania school

21 injured in Pennsylvania school

Bakers perform with dough in pizza championships

Bakers perform with dough in pizza championships

People enjoy cherry blossoms in Washington

People enjoy cherry blossoms in Washington

Top 10 China archeological discoveries for 2013

Top 10 China archeological discoveries for 2013

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Another possible signal heard in search

Sebelius resigns after Obamacare woes

Suspect claims he killed 40 as hitman

Soybean talks focus on biotech issues

US Asian carp find plates in China

US, China firms team up on green truck play

Ships sale to Taiwan 'unlikely'

Hagel gets closer to PLA

US Weekly

|

|