Top name brand merchants close stores in US but expand in China

Updated: 2014-04-22 07:23

By Derek Chen (China Daily USA)

|

|||||||||

When the sun is about to set in New York, it rises here in Shanghai. Abercrombie & Fitch, founded in the Big Apple, opened its first Chinese flagship store in Shanghai on April 19. That's as the fashion company shut 62 US stores in its fiscal year 2013, according to a statement in February. It's scheduled to close an additional 180 stores there by 2015, Business Insider reported.

Gap Ltd opened a 2,000-square-meter Old Navy store in Shanghai in March, its first in China. The company entered the Chinese market in October 2010 and now has 77 own-name stores and 12 outlets in the country, according to its corporate website.

It, too, shut North American stores, 128 in the fiscal year ending February 2013 and 108 in the following period, its last two annual reports said. Globally, Gap had net openings, driven mainly in Asia, particularly in China and Japan. Net sales saw single-digit annual growth.

The trend set by Abercrombie and Gap will most likely continue.

RadioShack Corp, a household name in the US, plans to close as many as 1,100 stores, almost one-in-five of the total, the consumer electronics retailer said last month. Still, it opened its first store in Shanghai in March. Although it is its only store in China so far, the company plans to open at least 15 in major Asian markets over the next year, CEO Joseph Magnacca has said.

Why are these retailers struggling in their home market? Domestic retail demand is barely growing in the US. For any operator to expand there, it almost has to be at the sacrifice of someone else. In China, however, the industry's growing. The entire pie has expanded at a double-digit annual rate for the past several years. China's total social retail consumption for the first two months of 2014 increased 11.8 per cent year-on-year, according to latest National Bureau of Statistics data. Retailers can grow without eating into others' market shares.

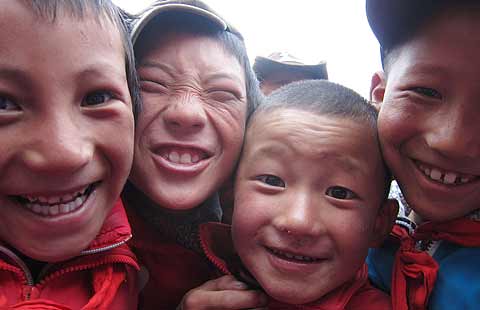

China, with the world's biggest population and second-largest economy, has become a spotlight for many US retailers.

For example, Apple Inc's total China sales - including Hong Kong and Taiwan - exceeded $8.8 billion in the fourth quarter, according to the company's latest earnings report. That's a 29 percent annual increase. Sales in its home market dipped 1 percent. Apple's first-quarter sales are expected to be released on April 24.

The company had retailed products in China for nearly six years when its first store opened in Beijing. It now has 13 stores nationwide with hundreds of reseller outlets and points of sale in the thousands. China is Apple's second-largest market after the US, which it's expected to vault past in the next few years.

Store rollouts in China don't, however, guarantee success.

US consumer electronics giant Best Buy Co Inc had to exit the Chinese market after several years. MediaMrkt, which sells electronics and appliances and is owned by Germany's Metro AG, met a similar end in China, where the market is increasingly competitive and demands a prudent strategy from newcomers.

Chinese success requires a long-term strategy, tailor-made products and the right locations. Retailers need to be prepared to lose money for the first two to three years. Some retailers enter directly, others through partners, some with a hybrid model.

Product offerings cannot simply be copies of the US version. They must meet Chinese consumers' demands, especially for the fast fashion brands. Location is critical. Some operators closed stores, not because the products were unpopular but because they were wrongly situated.

Smart retailers carry out in-depth research before any international expansion and seek advice or assistance from consultants. Many work directly with agencies to secure the ideal retail space.

From San Francisco to Shanghai, Boston to Beijing, New York to Nanjing, stores close in the US but open in China.

Derek Chen heads up JLL's retail tenant representation business in China. Chen assists international brands to expand into the Chinese market.

(China Daily USA 04/22/2014 page15)

Obamas host White House Easter Egg Roll

Obamas host White House Easter Egg Roll

Photo Story: Dying man seeks caregiver for ailing wife

Photo Story: Dying man seeks caregiver for ailing wife

Wrongly jailed man lands stable job

Wrongly jailed man lands stable job

Fire erupts in E China appliance plant

Fire erupts in E China appliance plant

Gaza rockets hit south Israel, army strikes back

Gaza rockets hit south Israel, army strikes back

US, China schools join hands

US, China schools join hands

Lincoln to enter China's car market

Lincoln to enter China's car market

Helping Chinese New Yorkers to become Google-literate

Helping Chinese New Yorkers to become Google-literate

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Obama appoints Chinese American to commission

Tesla to power up across China

New fines for eating rare species

Chinese reporters shop till they drop in LA

Why are Americans obsessed with MH370?

Japanese lawmakers visit Shrine

Charges near over China kickbacks in car exports

West Point, Berkeley become must-stops for Chinese CEOs

US Weekly

|

|