Jump-starter goes to town

Updated: 2015-02-20 16:02

By Selena Li(HK Edition)

|

|||||||||

Invest Hong Kong is seeing an uptick in young entrepreneurs looking to set up shop in the city as they seek to conquer the world. Selena Li reports.

A clearer picture is emerging as Hong Kong, an ideal "business" destination, begins to shape itself as one of the fastest growing startup hubs.

"The percentage of our clients that are really entrepreneurs rather than bigger multinational companies from mainland China or around the world has started to grow," said Simon Galpin, director-general of investment promotion at Invest Hong Kong (InvestHK), the government agency responsible for attracting and facilitating foreign direct investment into Hong Kong.

The push-pull factor behind it, Galpin said, is the rapid growth in Asia, particularly the Chinese mainland market, and the flattened economies of North America and Europe.

"If you're an entrepreneur and want to start a high-growth business, coming to Asia and starting off your business in Hong Kong is a sensible choice," he said.

"The global elements of Hong Kong will become more important because we are attracting startups and although they're very small, they all have global aspirations. They want to conquer the world."

Startups find a home

According to a survey conducted late last year, there are 1,065 registered startup companies operating in the city's burgeoning co-working spaces, involving more than 2,300 staff.

"What we have noticed is that the organizations that are supporting startups, both in the public or private sector, have grown from just three in 2010 to more than 35 today," Galpin said.

"The Hong Kong startups community is truly global," he said. "About 40 percent are either foreign-born or people returning to Hong Kong to start a business."

With the help of technology, small businesses are able to create a global reach, and that makes Hong Kong a sweet spot for startups, Galpin said, adding a compact place like Hong Kong benefits from its high business efficiency and great accessibility.

"Most startups with a global aspiration are in a real rush. They feel they have got to get their products or services out to the world market before somebody beats them to it," he said.

Two months ago, just across the border, the Shenzhen hub of Qianhai opened an innovation hub designated for young entrepreneurs to start their businesses.

"I think Qianhai will complement HK," Galpin said. "This is a winning combination because if they want manufacturers maybe they can do their prototyping and maybe R&D in Hong Kong, they can do the financing in Hong Kong. But if you want manufacture they can do it just 20 or 30 kilometers across the border in Shenzhen or Qianhai."

"Many professionals in Hong Kong use social media that you have right across the Chinese mainland. They also use social media that are being used in North America and Europe as well. Most startups want to take the advantage of that," he added.

In talking about the rising costs of office space that may push business away, Galpin explained that Hong Kong offers a range of different options at very different prices within a small area.

Beside strong traditional funding support, InvestHK has noticed another emerging opportunity among mainland and Hong Kong high net worth individuals.

"Not just Hong Kong, but also mainland entrepreneurs are using Hong Kong's family offices for wealth management. But normally they are willing to make more traditional investments, like property and stocks," Galpin said.

"If we can communicate that there are these new opportunities with all this fast growth of startups in Hong Kong, we hope that some of those more traditional investors will support the startups too."

InvestHK makes use of partners and intermediaries, including law firms, consulting firms already engaging with wealthy individuals and making efforts to reach out to angel investor networks as well.

"One of the reasons we do the venture program is to reach out to some of the wealthy individuals," Galpin said.

"Understandably many family offices - not just mainland but foreign or Hong Kong family offices - like to be quite low profile, they don't want to be bothered by anybody trying to sell them an investment opportunity. So it takes a bit of a time to build up trust with some of these key individuals.

InvestHK organized the 2014 StartmeupHK Venture Programme, the world's second-largest startup contest, which saw 550 entries filed from 47 economies, compared to 384 entries from 39 economies in 2013.

The department aims to at least double the size and scale of the next startup venture program next January.

"Looking forward, we think Hong Kong is at a kind of tipping point. And with a little bit more promotion, a little bit more push, we can really position Hong Kong as not just one of the fast-growing startups communities, but one of the more influential ones."

Location, location, location

One added benefit Hong Kong enjoys is that it is home to more than 3,500 regional headquarters and regional offices, Galpin said.

But mainland megacities are not too far behind, it would appear. The capital's Chaoyang district is shaping up to be the next Central as the wave of headquarters economy sweeps across megacities like Beijing, Shanghai and Guangzhou.

Galpin agrees that there is no doubt the number of big multinationals choosing to have offices in Beijing and Shanghai will continue to grow.

But a geographical edge and a closer link with global leading financial centers like London and New York helps Hong Kong earn a slightly higher score, he added.

He also pointed out that another notable rival in the region, Singapore, a state that "shares many of the strengths of Hong Kong - its low tax economy, low rates of corruption, its rule of law", is among competitors keeping Hong Kong on its toes.

"Singapore is really is a good staging point for Indonesia and some of the Southeast Asian economies. But it's quite a long way away from Beijing, from Tokyo, from Seoul. So for companies that want to have a single base to cover both north and Southeast Asia, Hong Kong has a bit of geographical advantage."

"I think Hong Kong will be less important as simply a place to manage operations in China but more important for managing global connections and global operations, " Galpin said.

Four years ago, US conglomerate General Electric Co set up its global growth and operations headquarters in Hong Kong, to manage offices in Asia, Europe and Africa.

And Infiniti, the premium brand of Japanese auto maker Nissan, relocated its global headquarters from Japan to Hong Kong in 2012, spurred by anticipations of further growth in luxury demand on the Chinese mainland.

"And even big companies from Europe like Schneider Electric have taken advantage of Hong Kong's global reach," Galpin said.

An annual survey by the Census and Statistics Department shows that the total number of firms with parent companies overseas and in the mainland reached 7,585 in the past year, up by 1.8 percent over 2013.

And more than a fifth of the 3,784 companies that serve as regional headquarters or offices in the SAR were confident about their prospects and indicated that they may expand their business in Hong Kong over the next three years.

Contact the writer at selena@chinadailyhk.com

|

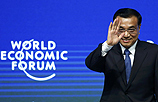

Simon Galpin, director-general of investment promotion at InvestHK says rapid growth in Asia, particularly the Chinese mainland market, and the flattened economies of North America and Europe are driving entrepreneurs with global ambitions to Hong Kong. edmond tang / China Daily |

|

While there may be fears in some quarters that rising costs of commercial space may drive business away, it is an indisputable fact that Hong Kong offers a range of different options at very different prices within a small area. provided to china daily |

(China Daily USA 02/20/2015 page7)

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

California port chief optimistic on new labor agreement

NBA China CEO sees the sport proliferate

China tilts to Kabul with US pullout

No letup seen for business travel

Chinese visitors set to celebrate New Year worldwide

China No 1 dumper of plastic into ocean

Chinese students gather in Washington

Upbeat on US-China relations

US Weekly

|

|