Jaitley: No disconnect with central bank

Updated: 2015-03-24 08:10

By Bloomberg(China Daily)

|

|||||||||

Indian Finance Minister Arun Jaitley said the government and central bank are having "free and frank" discussions, dismissing speculation of disputes as the Reserve Bank of India undergoes the biggest overhaul in its history.

"There is no question of any disconnect," Jaitley said after a customary annual appearance before the bank's board to explain steps proposed in last month's budget.

Jaitley and central bank Governor Raghuram Rajan are in talks to finalize a structure for a rate-setting committee similar to the Federal Reserve Board or Bank of England, as well as formalize the government's decision to separate debt and monetary management. They have already agreed on a formal inflation target, a decision announced in the budget.

"All issues which concern both the institutions are regularly discussed," Jaitley said at a joint press conference with Rajan on Sunday in New Delhi.

At the same briefing, Rajan said the Reserve Bank agrees with the government's intent to create a separate debt management office. A panel is working on specifics, he said, without sharing more details.

"A public debt management agency as a professional organization, independent of the central bank, independent of the government, is something that is desirable," he said. "It puts discipline on the government debt process."

A Monetary Policy Committee would replace the current rate-setting system once the RBI Act of 1934 is amended. The debate hinges over how much power the government will have in appointing members.

Inflation safeguard

With food prices contributing more than 45 percent to Indian inflation and the nation dependent on timely and sufficient rainfall, interest rates are the only tool available to the central bank in case inflation spikes.

From the fiscal year ending in March 2017 onward, the central bank will target inflation of 4 percent, plus or minus 2 percentage points. Consumer-price inflation accelerated to 5.37 percent in February, still within the target of 6 percent for January 2016.

Shortly after the announcement of the inflation target, Rajan lowered the benchmark repurchase rate for a second time this year. Interest-rate swaps show traders predict he'll cut the rate by a further 50 basis points by the end of this year, a move Jaitley has repeatedly called for.

Unseasonal rains have damaged crops and that "could impact on inflation, on certain shortages", Jaitley told CNN-IBN in an interview on Saturday. The damage has affected more than 5 million hectares in a nation where farming provides a livelihood for more than half its 1.25 billion people, according to figures given by Agriculture Minister Radha Mohan Singh to the upper house on March 4.

"There is no direct one-to-one correlation between rains and prices," Rajan said on Sunday. "Sometimes it helps, sometimes it hurts. What it does mean is we have to be more careful on food management. It means greater vigilance."

|

Arun Jaitley, India's finance minister (center), and Raghuram Rajan, governor of the Reserve Bank of India (second from right), at a meeting in New Delhi on Sunday. Kuni Takahashi / Bloomberg |

(China Daily USA 03/24/2015 page16)

Tokyo's plans to build new US base possibly scuppered

Tokyo's plans to build new US base possibly scuppered

Conversation topics only heard in China

Conversation topics only heard in China

Snow blankets Chicago after spring storm

Snow blankets Chicago after spring storm

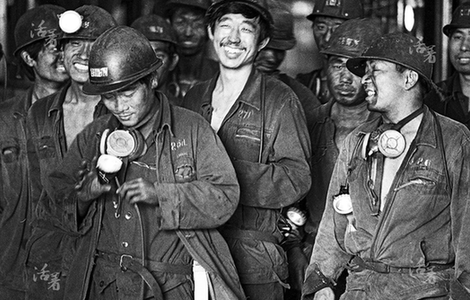

Dramatic changes for Chinese miners in the last 30 years

Dramatic changes for Chinese miners in the last 30 years

Top 10 young Chinese entrepreneurs defining the future

Top 10 young Chinese entrepreneurs defining the future

Singapore Embassy in Beijing mourns Lee Kuan Yew

Singapore Embassy in Beijing mourns Lee Kuan Yew

China joins legendary flower show

China joins legendary flower show

Monks perform tea-picking ritual in Hangzhou

Monks perform tea-picking ritual in Hangzhou

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Beijing 'welcomes interested nations joining the AIIB'

House passes resolution urging Obama to send arms to Ukraine

US to strengthen cooperation on clean energy with China: Pritzker

Boston bomb suspect influenced by Al-Qaida

Students humbled by trip to China

Antitrust policy 'treats

all fairly'

Lee remembered as 'old friend' of Chinese people

Huawei plans big push to sell smart devices in US

US Weekly

|

|