Tectonic shifts hit traditional lenders

Updated: 2015-04-02 08:04

By Jiang Xueqing(China Daily USA)

|

|||||||||

Banks are battling the triple threat of technology, shifting consumer demand and a fleet of new online rivals, reports Jiang Xueqing.

Commercial banks in China are racing to keep pace with fast-changing consumer demand, an explosion of smart and mobile technologies and nimble Internet companies that are upending the financial world through innovative services.

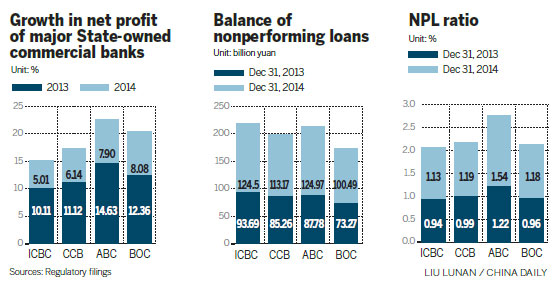

Most listed banks' profit growth slid to a single-digit range last year as the economy slowed and interest rates were further liberalized, cutting lenders' margins. But another key factor was Internet-driven financial disintermediation, a process that reduces or removes the role of the middleman that banks have traditionally played.

Top banking executives are making strenuous efforts to identify new profit drivers, and Internet finance is seen as having huge potential.

According to Jiang Jianqing, chairman of Industrial and Commercial Bank of China Ltd, Internet finance is an "inevitable choice" for the bank, which is the largest State-owned commercial lender by assets.

"Internet finance is a vibrant area with great potential for growth. It will become a major part of the Chinese economy," Jiang said. "The real challenge for ICBC won't come from our traditional competitors, but whether we can adapt to the Internet-based financial ecosystem and changes in customer demand.

"We need an innovative and enterprising mindset to embrace these changes."

ICBC will rely on big data to build its new online world. The bank has established three platforms covering e-commerce, instant messaging and direct banking. It has also developed three product lines: e-payments, online financing and Internet-based investment and wealth management.

The bank launched a business-to-consumer e-commerce platform 14 months ago that now has 16 million registered users. Transactions have exceeded 100 billion yuan ($16.12 billion), said ICBC President Yi Huiman.

Yu Liang, president of developer China Vanke Co Ltd, said that his company's transactions on the platform reached 120 million yuan within just a month.

"We will explore closer cooperation with the ICBC e-commerce platform and provide integrated services during the entire process of online home buying, online payment and online finance," Yu said. "We hope that our sales on the platform will exceed 10 billion yuan this year."

Zhang Yue, a principal at The Boston Consulting Group, said: "For commercial banks, building an e-commerce platform is a way to explore new channels to acquire customers and sell products, rather than enter an entirely new business area in hopes of quickly making high profits."

Depending on their goals, banks can hire e-commerce specialists to run such platforms or just use these platforms as "laboratories" for experimenting with new ideas, she said.

Mid-sized lenders are also seeking a technology-driven transformation.

China Merchants Bank Co Ltd is building an integrated Internet finance architecture that will feature "platform, flow and big data" to transform its business model.

As of Dec 31, the number of customers for its retail e-banking service had reached 36.13 million, with a total of 1.33 billion logins. The number of mobile banking logins amounted to 749 million.

The bank is also promoting its Small Business E Home, a platform providing financial services including credit ratings, lending and asset management via the Internet for small and medium-sized enterprises. As of Dec 31, the platform had 538,000 registered members. Logins reached 1.1 million in 2014.

Many bankers said they believe that the major competition for banks in the future will come from mobile interconnections. Cao Guoqiang, vice-president of China CITIC Bank Co Ltd, said the bank will increase its investment in mobile banking this year.

"We aim to integrate the online and offline features of all of our businesses except for cash withdrawals, so that we can acquire customers through all channels," Cao said.

This year, China CITIC Bank will launch direct banking services and build online-to-offline "smart communities" to expand and improve its platform for direct sales of wealth management products.

Beyond offering simplified and standardized financial services, the bank will step up cooperation on products and channels with e-commerce platforms, telecommunications operators and third-party payment service and data providers.

Despite the efforts by many banks, the reality is that transforming a traditional lender's business model and its mindset from offline to online is not going smoothly in some cases.

The core founders of Xiaoma Bank, an online wealth management platform that was launched by Baoshang Bank Ltd last year, have already left the institution and formed their own company that uses the Internet to provide personal wealth management.

Zhang Cheng, former general manager of Xiaoma Bank, said that he wanted to have his own business and the existing management system of traditional banks restrained innovation.

Contact the writer at jiangxueqing@chinadaily.com.cn

(China Daily USA 04/02/2015 page13)

US returns ancient Royal Seal of King Deokjong to S. Korea

US returns ancient Royal Seal of King Deokjong to S. Korea

'Tomb-sweeping services'

'Tomb-sweeping services'

Top 5 features of China's property market

Top 5 features of China's property market

Magnificent scene: buildings amid heavy fog in Shanghai

Magnificent scene: buildings amid heavy fog in Shanghai

6 cultural differences between China and the US

6 cultural differences between China and the US

Mother illustrates her pregnancy

Mother illustrates her pregnancy

In memory of movie star Leslie Cheung

In memory of movie star Leslie Cheung

Top 10 best employers in China in 2015

Top 10 best employers in China in 2015

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

54 dead after Russian trawler sinks in ocean

China rips Japan's draft policy report

China can better protect nationals abroad

US 'miscalculated' on AIIB: Albright

PMI indicates that factories are expanding again

Chinese woman charged with fraud remains in US jail

46 countries apply to AIIB

Tales of a nomad

US Weekly

|

|