Offshore yuan centers on the up

Updated: 2015-05-25 07:01

By Alfred Romann in Hong Kong(China Daily USA)

|

|||||||||

In a little more than two years, the number of offshore yuan centers has multiplied, helping investors in more countries skip a step in their currency transactions when doing business with the Chinese mainland.

Offshore yuan centers in Singapore, Bangkok and Kuala Lumpur, along with planned centers in Seoul and Qatar, complement centers further afield in cities such as London, Zurich and Nairobi, which all facilitate the use of the yuan in global trade and finance.

There are now 14 offshore yuan centers globally and six of them are in Asia. Outside Hong Kong and Macao, in Asia there are centers in Taipei, Singapore, Kuala Lumpur and Bangkok, which joined the group in January. Negotiations are underway to make Seoul into one.

|

Office workers walk around during the lunch break in the financial district in Singapore. The total daily turnover of yuan foreign exchange transactions in the city-state doubled to $31 billion the year after it became an offshore yuan center in late 2013. AFP |

In Singapore, the total daily turnover of yuan foreign exchange transactions doubled to $31 billion the year after it was named as an offshore yuan center in late 2013, according to the Asia Securities Industry & Financial Markets Association.

For the time being, these centers can send yuan back to the mainland based on quotas granted under the Renminbi Qualified Foreign Institutional Investor program. Hong Kong's quota is 270 billion yuan ($43.5 billion), and Taiwan's quota is 80 billion yuan, while Singapore can repatriate 50 billion yuan, according to Fitch Ratings data.

The change in the accessibility of the yuan in the past couple of decades has been significant.

In the early 1990s, foreigners in the Chinese mainland had no legal access to the yuan, not even to buy simple goods on the streets of Chongqing or Tianjin. Instead, they had to rely on foreign exchange certificates.

This system was phased out in 1997. By then, China had been working for four years on how to make its national currency more accessible.

Less than two decades later, not only is it quite easy for foreigners to access the yuan either in China or outside, but it is also the fifth most-used currency in global trade.

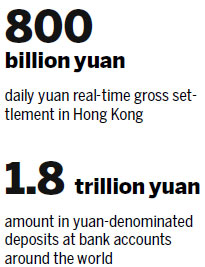

There is more than 1.8 trillion yuan deposited in yuan-denominated bank accounts around the world and the International Monetary Fund is considering including the Chinese currency among the handful of currencies it uses for its international reserves.

"We are in the middle of that (review by the IMF), but you can see where the direction of the currency has been going," Markus Rodlauer, a deputy director and mission chief for China with the IMF, said at a press briefing last month.

Decades of slow and careful steps toward both facilitating access to the yuan and spreading its use well beyond the country's borders are now paying off. The yuan is increasingly visible and is part of the national reserves of countries that have currency swaps with China.

"Is the capital account closed? We have RQFII. We have Stock Connect. We have Qualified Domestic Institutional Investor. We have a lot of holes happening there. The China (Shanghai) Pilot Free Trade Zone is something we have spent a lot of time trying to understand," said Sherry Madera, minister counselor and director for financial, business and professional services and technology with the United Kingdom Trade & Investment at the ASIFMA 5th Offshore RMB Markets Conference in Hong Kong last month.

What was needed, Madera said, was "much more openness to bring more offshore RMB onshore".

The RQFII and the QDII programs both allow for investments in yuan and the movement of the currency in and out of the country.

"From a very, very close perspective... I would suggest that it is pretty open already," said Madera. "If you are looking at getting involved in trading with RMB, there are quite a lot of vehicles and elements that you can utilize right now."

The other side of this particular equation, access to the yuan market outside of China, is also growing rapidly. The number of offshore yuan trading centers with deals in place to provide clearing services is growing rapidly.

For the time being, the largest offshore yuan center in the world is Hong Kong.

Hong Kong handles around 70 percent of all yuan transactions outside the Chinese mainland. While the total value of transactions that the special administrative region handles continues to grow, its share of total transactions globally is dropping as other centers expand.

Addressing the ASIFMA conference, Vincent Lee, executive director of the Hong Kong Monetary Authority, said Hong Kong remained the largest offshore yuan center in the world. About one-third of the mainland's external trade was carried out through Hong Kong, he added, with about half of all inward investments, as well as outbound direct investments out of the mainland, moving through the city.

"In the coming years, in view of the increasing use of the RMB internationally... there will be more opportunities for the use of the RMB in Hong Kong, given our close ties with the mainland."

The yuan real-time gross settlement system in Hong Kong moves about 800 billion yuan every day.

"We are working with other financial centers to grow corporate awareness of RMB business," Lee said. "RMB business has grown very fast in the past few years but ... we still need to do some more work to promote awareness, particularly outside of Hong Kong and outside Asia.

"We will continue to work with these centers to grow the business and to promote awareness," Lee said.

Yuan business is growing very fast at the moment, he added, but it is still quite small internationally.

A number of countries with offshore yuan centers are increasingly important to this trade, suggesting the use of the yuan is spreading globally.

Between February 2013 and February 2015, offshore centers outside Hong Kong saw their share of yuan settlements rise from 17 percent of the total to 25 percent.

Through clearing facilities provided by Chinese banks such as the Industrial and Commercial Bank of China or Bank of China, clients can convert foreign currencies directly into yuan without converting into dollars.

Other financial centers around the world have set up offshore yuan centers. The biggest is London, a global financial center, and the introduction of trading and clearing services in yuan has not been difficult.

London accounted for 42 percent of global foreign exchange trading, larger than any other financial center, said Madera of UKTI.

"Being a global center means that players in the UK are looking at global opportunities," she said. "Chinese inward investment needs to be competitive. Sometimes we forget this."

Rapid growth in the number of these centers is creating new opportunities for investors and powering the overseas use of the currency.

It is still early and hard to say exactly how overseas use of the yuan will evolve and who will be first to take advantage of this trend. What is certain is that it is happening.

(China Daily USA 05/25/2015 page13)

- Fourth generation of 'face-kini' soon to hit beach in Qingdao

- Tibetan town captures photos of their 'panda deity'

- 600 arrested in Beijing's vice crackdown

- Building collapse in Guizhou caused by landslide: govt

- Xi welcomes Japan delegation but warns against historical distortion

- Chinese Vice-Premier stresses flood control

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Chinese premier arrives in Chile for official visit

John Nash: A life of great struggle and even greater success

Cleveland police say 71 people arrested overnight in protests

US charges a reflection of 'anxiety'

Expansion of free trade possible on Chile visit

Chilean president sees promising prospects for relations with China

Mathematician John Nash killed in car crash

Chinese premier encourages firms to upgrade cooperation with Peru

US Weekly

|

|