High-tech heavyweights eye US investments

Updated: 2015-09-30 08:10

By Lyu Chang(China Daily USA)

|

|||||||||

Online giants and privately owned companies made up the majority of firms that traveled with the business delegation on Xi's US state visit

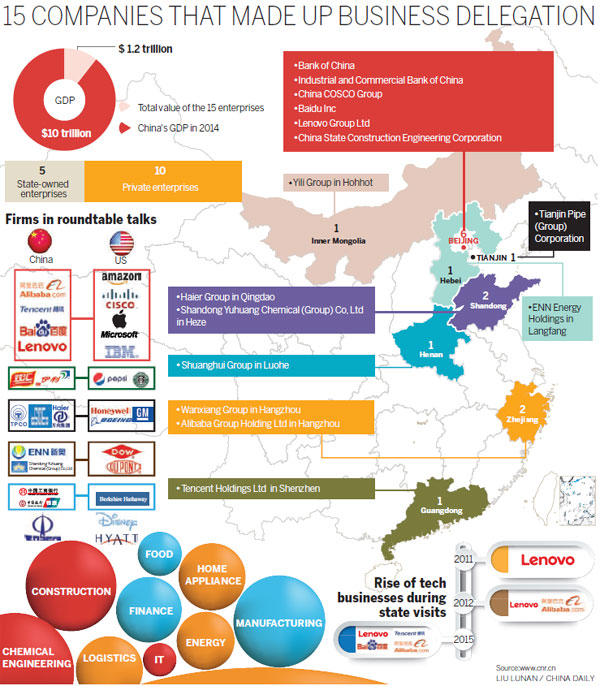

There was a distinct change in the makeup of the business delegation that accompanied President Xi Jinping on last week's state visit to the United States. Of the 15 Chinese companies that took part in the trip, four were major tech giants while 10 were privately owned businesses.

This was in sharp contrast to the previous visit in 2012 when Xi was vice-president.

|

A group of CEOs and other executives applaud as Chinese President Xi Jinping (not pictured) arrives for a photo call at Microsoft's main campus in Redmond, Washington, on Sept 23. Included in the group are (front row, L-R) Facebook CEO Mark Zuckerberg, JD.com CEO Richard Liu Qiangdong, Cisco Systems Inc CEO John Chambers, Alibaba Executive Chairman Jack Ma and IBM CEO Ginni Rometty. Reuters / Ted S. Warren / Pool |

Three years ago, 11 companies made up the business delegation, with Alibaba Group Holding Ltd the only Internet company, while just four were privately owned. In short, this illustrates the areas of future investment for Chinese companies in the US, which will revolve around high-tech and online-related industries.

"All these companies represent the future investment trend from China," Jiang Heng, a deputy researcher at the Chinese Academy of International Trade and Economic Cooperation in Beijing, said.

For the first time, Internet heavyweights Baidu Inc, Alibaba and Tencent Holdings Ltd, or the BAT contingent, were among the delegation. It also included other businesses from a broad range of industries, including energy, construction, finance, chemicals and consumer electronics.

Still, the BAT group highlighted the prominence of the high-tech sector's role in driving future growth in China.

"No other country apart from the US has such a grouping of companies as BAT," John Ross, senior fellow at Chongyang Institute for Financial Studies at Renmin University of China in Beijing, said. "I think the inclusion of Internet companies from China in President Xi Jinping's trip is important and shows the technological upgrading of the country's economy."

China had 668 million Web users by June this year, according to China Internet Network Information Center - the largest number of any country. Online businesses here have attracted billions of dollars in sales and investment, with the e-commerce sector showing signs of tremendous growth potential.

Yet the global reach of US tech companies is still considerable compared to their Chinese counterparts.

Development work on what later became the World Wide Web was started in the late 1960s and 1970s. A decade later, the US dominated the global online market, with brands such as Apple Inc and Microsoft Corp leading the Silicon Valley pack. Then in the 1990s, Google Inc burst onto the scene with its sophisticated search engine.

But during the past 15 years, China has caught up, with companies such as Alibaba, Tencent and Lenovo Group Ltd. "China has overtaken countries such as Germany and India, which were previously ahead of it, and is second only to US," Ross said. "This is a big strategic step forward."

China's economy is going through fundamental changes with the "new normal" of slower but sustainable growth replacing the old model. High-tech industries, domestic consumption and the service sector will have crucial roles to play.

After decades of double-digit expansion, China's economy in the second quarter of this year grew at 7 percent. That was the slowest pace in nearly a quarter of a century as weak overseas demand, rising labor costs and a stronger currency hit the country's exports.

Low-end manufacturing has also faced increased competition from cheaper rivals in Vietnam, Cambodia and other parts of Southeast Asia.

To drive China's economy forward, the emphasis will be switched to high-tech manufacturing as well as online services, such as e-commerce. Already spending on IT services is up 165 percent during the past eight years.

This is in line with the State Council's "Internet Plus" policy that was unveiled earlier this year. The plan will focus on increasing integration of the Internet, cloud computing and big data into traditional manufacturing. Big data is vital to the policy, and is a broad term for processing vast amounts of complex statistics, which can then be boiled down into market and consumer trends.

"The policy is testament to the government's determination to grow China's domestic technology industry," Jiang, the deputy researcher, said. "Also, high-tech is a key sector in the US and that will attract Chinese investment."

That, of course, has already started. Haier Group, a multinational consumer electronics company, has a well established presence in the world's largest economy, while Lenovo, the PC and smartphone manufacturer, is no stranger to the US.

In fact, nearly all the 15 companies that were part of China's business delegation either have operations in the US or plan to expand there.

"All these firms have some sort of relationship with their US counterparts," Jiang said. "Lenovo, for example, acquired IBM Corp's PC operations, while Haier has been in the country for a while."

Shandong Yuhuang Chemical Co Ltd is another Chinese company making inroads. The privately owned firm was included in the business delegation for the first time.

But that was hardly surprising as it recently rolled out a $1.5 billion methanol plant in Louisiana, with an annual production capacity of 1.8 million metric tons.

"There is huge demand in China for methanol, and the gap between supply and demand will expand to 20 million tons every year after 2018," Wang Jinshu, chairman of Yuhuang, said. "It is likely that we will import all the product to China. This will help improve the trade balance and reduce trade friction between China and the US."

In August, the US division of Chinese auto-parts maker Wanxiang Group Corp teamed up with billionaire John Pritzker's private investment firm to invest $1 billion into the country's hotel sector.

The plan is to acquire high-end properties in places such as California. Since 2010, Wanxiang has invested in about 80 real estate projects in the US.

The group, which also owns Fisker Automotive, is an experienced investor in industries such as automotive, real estate and energy sectors. It has over 40 production plants and 13,500 employees in the US.

"We expect to see more co-operation between the world's two largest economies in the years ahead especially in high-tech industries," Jiang said.

Major commercial deals and commitments

1. China signs an agreement with Boeing to buy 300 aircraft, with a total value at $38 billion.

2. China welcomes the renewal of the China-US Agreement for Cooperation Concerning Peaceful Uses of Nuclear Energy.

3. China, the world's leading soybean importer, signs agreements to buy a record 13.18 million metric tons of the oilseed worth around $5.3 billion from the United States.

4. The National Energy Administration of China and the US Department of Energy plan to hold the 8th Joint Working Meeting under the China-US Bilateral Civil Nuclear Energy Cooperative Action Plan in China this October.

5. China and the US initiate cooperation on Green Ports and Vessels, identify priorities and mechanism of cooperation, and set up a working group to implement cooperative activities.

6. China and the US commit to increase cooperation on nuclear security, and make joint contributions to promoting global nuclear security and nonproliferation.

lvchang@chinadaily.com.cn

|

Executive Chairman Jack Ma, of Alibaba, listens with others to President Xi Jinping at a US-China business roundtable, comprised of US and Chinese CEOs in Seattle, Washington, on Sept 23. Reuters / Elaine Thompson / Pool |

(China Daily USA 09/30/2015 page16)

- Typhoon Dujuan makes landfall, disrupts traffic

- China announces contribution to EU's 315 billion-euro investment plan

- Chinese population may face sharp drop from 2017

- Plan in pipeline to save groundwater

- Forbidden City visitor cap to stay during holiday

- Watch your behavior overseas, Chinese tourists told

- Iranian President calls Iran deal victory over war

- LatAm experts praise Xi on yuan, globalization

- Evidence found of summertime water flows on Mars: study

- Dogs surf in contest in California

- France launches air strikes against Islamic State in Syria

- Women's rights are human rights, German chancellor says

-

Highlights of President Xi's speeches at UN

Highlights of President Xi's speeches at UN -

The president's historic journey to the west

The president's historic journey to the west -

China's first lady visits Juilliard School

China's first lady visits Juilliard School

Polish couple brings six daughters to China to study Chinese

Polish couple brings six daughters to China to study Chinese

Top 10 nominated designs at Beijing Design Week

Top 10 nominated designs at Beijing Design Week-

China gifts the UN 'Zun of Peace' for 70th anniversary

China gifts the UN 'Zun of Peace' for 70th anniversary -

China's first lady unveils stamp honoring disabled

China's first lady unveils stamp honoring disabled -

Xi calls for equitable, open, all-round development

Xi calls for equitable, open, all-round development

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Xi pledges $2 billion to help developing countries

Young people from US look forward to Xi's state visit: Survey

US to accept more refugees than planned

Li calls on State-owned firms to tap more global markets

Apple's iOS App Store suffers first major attack

Japan enacts new security laws to overturn postwar pacifism

Court catalogs schools' violent crimes

'Beauty of Beijing's alleys akin to a wise, old person'

US Weekly

|

|