UnionPay: payment leader

Updated: 2015-10-30 11:25

By Jack Freifelder in New York(China Daily USA)

|

|||||||||

China UnionPay's ambitious approach to building partnerships has helped it become the largest payment-card network in the world, according to the author of a recent market report.

"CUP has aggressively forged partnerships with bank card issuers and processors across the globe, and buoyed by network reciprocity agreements, its cards are accepted at more than 37 million merchants, putting its brand acceptance on par with Visa and MasterCard," David Morris, a consultant who wrote the report for Packaged Facts, told China Daily.

China UnionPay Co has passed competitors such as Visa Inc, MasterCard Inc and American Express Co, the report said.

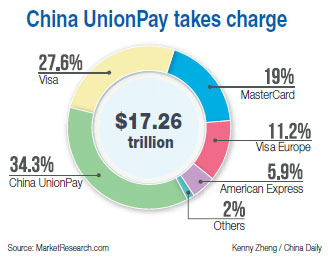

Packaged Facts, a division of Maryland-based MarketResearch.com, said the global payment-card market generated $17.26 trillion in purchase value in 2014.

Transactions using CUP cards totaled $5.92 trillion in 2014, which is 34.3 percent of the market. The company's share in 2014 was an increase of 40 percent year-over-year, the report released on Tuesday showed.

Visa (27.6 percent), MasterCard (19), Visa Europe (11.2) and American Express (5.9) followed CUP in the ninth edition of Packaged Facts' Commercial Payment Cards: US and Global Market Trends.

"CUP's presence is felt most strongly in markets close to home, where it has leveraged burgeoning cross-border travel trends and deepening economic ties to sign agreements with more financial institutions in those countries," Morris said. "But CUP is also gathering more steam in Japan and Australia, as well as the Asia-Pacific region more broadly."

China's continued uptake of payment cards also should be buoyed by an expanding middle class, high international travel rates and the government's push to move China toward a consumption-based economy, the report said.

David Sprinkle, research director for Packaged Facts, said that "China UnionPay has strategically moved abroad, furthering its goal of being 'wherever the Chinese go.' It has become a global institution that is more aggressively competing with established western networks on their own turf."

Payment card purchase volume has grown more than 50 percent since 2011, and the report forecasts that number will continue to grow around 11 percent between 2015 and 2018.

China UnionPay, established in 2002 in Shanghai by the State Council and the People's Bank of China, is the only national bank-card organization approved for use in clearing transactions in China.

In October 2014, China's State Council announced that it intends to end China UnionPay's control over bank-card transactions. The move will help open up the country's bank-card clearing market as part of a greater liberalization of the financial sector.

Foreign firms are now permitted to apply for qualification for bank-card clearing services, according to a post on the central government's microblog.

jackfreifelder@chinadailyusa.com

(China Daily USA 10/30/2015 page2)

Ryan nominated for speaker

Ryan nominated for speaker

Top 10 news apps favored by smartphone users

Top 10 news apps favored by smartphone users

Intimate Transgressions: More than just pain

Intimate Transgressions: More than just pain

Want a butler at your home?

Want a butler at your home?

Rescue operations in full swing as quake death toll hits 365

Rescue operations in full swing as quake death toll hits 365

Merkel's visits to China aimed at forging 'special' ties

Merkel's visits to China aimed at forging 'special' ties

Netherlands king enjoys local flavors of Yan'an

Netherlands king enjoys local flavors of Yan'an

NBA MVP Curry scores 40 points, Warriors win opener

NBA MVP Curry scores 40 points, Warriors win opener

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Tu first Chinese to win Nobel Prize in Medicine

Huntsman says Sino-US relationship needs common goals

Xi pledges $2 billion to help developing countries

Young people from US look forward to Xi's state visit: Survey

US to accept more refugees than planned

Li calls on State-owned firms to tap more global markets

Apple's iOS App Store suffers first major attack

Japan enacts new security laws to overturn postwar pacifism

US Weekly

|

|