Killer competition claims another victim

Updated: 2015-11-10 07:53

By Chai Hua In Shenzhen And Gao Yuan In Beijing(China Daily)

|

|||||||||

Behind Fu Chang's sudden bankruptcy is a tale of quality issues, financial mismanagement and slowing growth of the mobile phone industry

There was a time when the basketball court for staff of a Shenzhen-based manufacturer was full of action and energy.

Now, no one is in a mood to play. Fu Chang (Fosunny) Electronic Technology Co's sudden announcement of bankruptcy has knocked the wind out of everyone's sails.

A few steps away, a five-floor factory building, home to "No 2 molding injection plant", appears barren. Its rolling door is not rolling anymore.

And workers are not working anymore either. Not very long ago, they were busy producing plastic components and accessories for some of the biggest names in China's mobile phone industry. Telecoms giants Huawei Technologies and ZTE Corporation were clients.

Fu Chang's machines and molds are gathering dust. Its employees are waiting for an opportunity to get back to their jobs. There is now unconfirmed talk of a restructuring and government intervention.

Fu Chang made headlines as thousands of workers and business partners took to streets to claim their pay and seek help from the local government.

A source said the district government, representatives of Fu Chang's employees, ZTE, Huawei, various suppliers, investors and lawyers met on Oct 16 and agreed to restructure the company.

According to Shenzhen city's market supervision administration, Fu Chang raked in 459 million yuan ($72.86 million) in sales in 2014. According to its website, it was listed as China's most promising high-tech company in 2009.

All this makes the bankruptcy and sudden shutdown mysterious to its workers, suppliers and clients, none of whom had any inkling even one week before the bankruptcy.

Huawei told China Daily that Fu Chang's troubles caused its losses and created an emergency, forcing it to switch to other suppliers, to keep up its product deliveries.

An industry insider disclosed that Huawei usually has two suppliers for its key products. As it transpires, the two suppliers this time belonged to Fu Chang, exacerbating the problem for Huawei.

Yet, being a large corporation, it could quickly move to contain the impact of FuChang shutdown. But the 100-odd small-sized suppliers of Fu Chang were not so lucky.

Fan Wanfu, a director of an abrasive paper factory that supplies to Fu Chang, said his firm is owed 1.2 million yuan. But he feels helpless and stops shy of seeking the money back because other suppliers are owed several millions of yuan.

Yang Sibin, a Fu Chang employee, said he never imagined the company would one day shut because "they have received so many orders and could not finish".

It is learnt that Fu Chang employees were first told the company might face some financial problems. Some senior employees volunteered to donate one month's salary totaling tens of millions yuan to the company, to ride out the crisis. But that would not have sufficed.

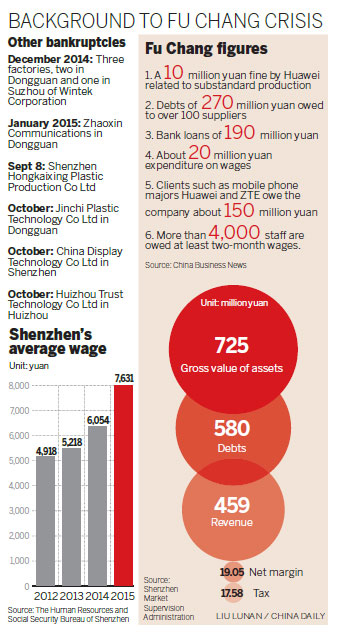

For, the company owes about two months of salaries to its 3,800 workers, 270 million yuan to its suppliers and 190 million yuan to banks, according to China Business News.

Fu Chang is not a case in isolation. Since last December, several cases of bankruptcy have been reported in the Shenzhen-Dongguan belt that caters to the mobile phone industry.

For instance, in December 2014, Wintek Corporation, the second-largest producer of touch panels in Taiwan, closed its three factories on the mainland.

In January this year, Zhaoxin Communications in Dongguan admitted failure to carry on due to funding problems. Gao Min, its chairman, even tried to commit suicide to "take responsibility".

On Sept 8, Shenzhen Hongkaixing Plastic Production Co Ltd announced bankruptcy, leaving 35 million yuan in debts to its 214 suppliers. One month later, another Dongguan company, Jinchi Plastic Technology Co Ltd, followed in its footsteps.

Experts believe the key reason for bankruptcies is intense competition.

Wang Jingwen, an analyst at Shanghai-based information technology consultancy Canalys China, said that the China smartphone market remains stagnant quarter-on-quarter and competition among major brands has never been stiffer.

"It is one of the stiffest markets worldwide. Even big companies such as Huawei faced challenges although it gained an impressive market share in China," Wang said.

Xiang Ligang, an independent smartphone market researcher and founder of industry site cctime.com, has echoed those views.

"Severe competition marks every stage of the supply chain," he said.

A professional from a Shenzhen-based listed accessories maker said he expected a 60 percent decrease in his company's mobile phone business.

Fierce competition means that large corporations such as Huawei and ZTE leave "extremely feeble profits" to their suppliers, said Li Honghui, senior vice-president of Shenzhen-based Comtech, a provider of electronic components and solutions.

Xiang agreed that a slowing market growth is set to pile on more pressure on suppliers.

Companies that don't adapt quickly, rework their business model and upgrade technology risk closure, said experts.

Li of Comtech said companies with excess production capacity and those that rely on low-value, standardized products will not survive the current situation.

An IDC report indicated Chinese companies are moving to higher-end markets as the profit margin in sub-1,000 yuan devices has become extremely thin due to years of tough competition.

In addition, rising labor costs in southern China are also squeezing their profit margins. From 2012 to 2015, the average wage in Shenzhen surged 55 percent from 4,918 yuan to 7,631 yuan.

In retrospect, some say the Fu Chang disaster was waiting to happen. Yang, its employee, said the company once used waste and left over materials in re-injecting molds.

Qin, another employee, said the company was fined several times by Huawei because it used substandard goods that did not meet required quality standards.

Worse was to befall Fu Chang. After the massive explosions at a Tianjin chemical storage unit in August, the Shenzhen administration tightened fire control supervision. This hurt Fu Chang badly as it had to shift its painting shop from the top floor of its factory building to other companies at a substantial cost.

While Huawei and ZTE apparently agreed to accept Fu Chang's existing products if they pass quality tests, new orders would be made only upon satisfactory appraisal of both the new management and the company's R&D set-up.

Fu Chang's middle-level managers will be retained and its suppliers will have a say in the selection of the company's general manager.

But Yang remains concerned. "There is uncertainty over the factory reopening. But I can't afford to wait anymore."

That's the attitude of Fu Chang's suppliers as well. As of now, a game of basketball at Fu Chang's staff facility appears unlikely in the near future.

Contact the writers at grace@chinadailyhk.comand gaoyuan@chinadaily.com.cn

|

Outside the Fu Chang (Fosunny) Electronic Technology Co factory in Shenzhen. Chai Hua / China Daily |

(China Daily USA 11/10/2015 page15)

Internet celebrities share spotlight with leaders and stars

Internet celebrities share spotlight with leaders and stars

Heavy smog hits Beijing

Heavy smog hits Beijing

Eleven-year-old girl donates organs to save six people

Eleven-year-old girl donates organs to save six people

Top ballet dancers light up Beijing

Top ballet dancers light up Beijing

Top 10 wealthiest Chinese on Forbes rich list

Top 10 wealthiest Chinese on Forbes rich list

Obama launches Facebook page, sends message on climate

Obama launches Facebook page, sends message on climate

Washington 'showing anxiety in stance adopted toward Beijing'

Washington 'showing anxiety in stance adopted toward Beijing'

Tug of war

Tug of war

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Obama, Netanyahu at White House seek to mend US-Israel ties

China, not Canada, is top US trade partner

Tu first Chinese to win Nobel Prize in Medicine

Huntsman says Sino-US relationship needs common goals

Xi pledges $2 billion to help developing countries

Young people from US look forward to Xi's state visit: Survey

US to accept more refugees than planned

Li calls on State-owned firms to tap more global markets

US Weekly

|

|