Op-Ed Contributors

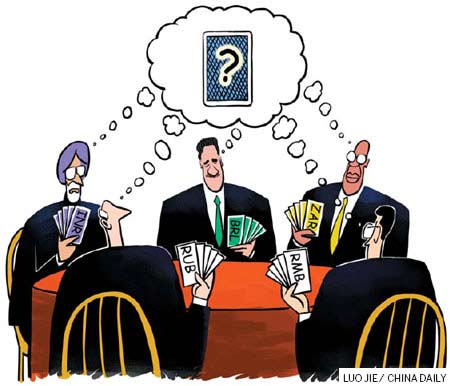

BRICS can build common currency

Updated: 2011-04-08 10:35

By Ahmed Sule (China Daily European Weekly)

On April 14, the third BRIC summit will be held in the southern Chinese city of Sanya and will for the first time feature South Africa, which will join Brazil, Russia, India and China to discuss matters of common interest to the bloc such as trade, politics, climate change, and global security. And so, BRIC becomes BRICS.

Ever since the chief economist at Goldman Sachs coined the acronym BRIC in 2001, each of these economies has continued to grow in dominance and influence. By the end of 2010, the BRIC economies accounted for about 25 percent of the global land mass and 40 percent of the world's population.

With a combined GDP of $8.7 trillion (6.2 trillion euros) in 2010, the BRIC economies have accounted for 30 percent of global economic growth since 2000 and 45 percent of global economic growth since the beginning of the financial crisis.

Goldman Sachs says the BRIC economies will potentially constitute four of the five largest economies by 2032.

The growing influence of the BRIC economies can be seen in their prominence in global trade. The Standard Bank Group says the combined BRIC share of world trade increased from 6.9 percent in 1999 to about 14.2 percent in 2008.

Furthermore, BRIC collective trade with the world increased almost six-fold from $790 billion in 1999 to $4.4 trillion in 2008. In addition to their contribution to global trade, BRIC economies have contributed to an increase in trade among developing countries, which is growing three times faster than the trade growth rate among advanced economies.

BRIC economies have contributed up to 60 percent of trade between low-income countries (LIC) and non-LIC emerging economies with bilateral trade between the BRICs and LICs increasing by about 25 percent a year in the last decade.

Intra-BRIC trade, or trade among the BRIC members, has also played a significant role in global trade. Despite the fact that intra-BRIC trade is small in relation to BRIC trade with other blocs such as the European Union and the United States, it has accounted for the fastest growth rate in global trade in the last decade.

This growth trend is expected to continue as BRICS economies become more dominant. The IMF says intra-BRIC trade, which is valued at more than $170 billion, has grown at the rate of 30 percent a year since 1999 and now accounts for 8 percent of global trade.

Intra-BRICS trade is mainly characterized by Russia, Brazil and South Africa providing natural resources to satisfy the industrial and infrastructural needs of India and China.

During the 10-year period up to 2009, intra-BRIC trade increased nine fold compared to global trade, which doubled over the same period.

In recent years, the US, which used to be the largest trading partner for most of the BRICS economies, has gradually seen its position challenged by partners of the BRICS.

Goldman Sachs says three of the four countries that make up the BRIC have a BRIC counterpart as one of their top two trading partners. For instance, China has overtaken the US as Brazil's largest trading partner, while in 2009 China overtook the US to become South Africa's largest export destination.

Despite the increasing trend of intra-BRICS trade, the bulk of these trades is still denominated in US dollars, rather than the currencies of the BRICS economies.

There are several factors contributing to the popularity of the dollar as a vehicle currency in international trade, such as the size, economic strength and stability of the US economy.

As a consequence of using the dollar in intra-BRICS and international-BRICS trades, the BRICS economies have amassed a sizeable portion of its foreign reserves denominated in US dollars.

BRICS economies hold 40 percent of the world's currency reserves, the majority of which is denominated in US dollars.

In recent years, the BRIC economies have signaled their intention to move away from the use of the dollar toward the use of local currencies in cross-border trade settlements.

In November 2010, Russia and China agreed to use their currencies in bilateral trade. Furthermore, at the second BRIC summit in April 2010, the leaders of the four BRIC economies agreed to study ways to make use of their currencies in bilateral trades.

However, despite these expressions of intention, the dollar continues to constitute a sizable part of intra-BRICS and international BRICS trade.

There are several reasons why it would be worthwhile for the BRICS group to substitute the use of the dollar in intra-BRICS trades.

First, it will help the BRICS economies to diversify their foreign reserve exposure away from the dollar. In the aftermath of the global financial crisis, the stability of the US is being threatened as evidenced by the increased risk of a downgrade or default of US government debt, thereby threatening the role of the dollar as a global reserve currency.

In the event of a US debt downgrade or default, BRICS economies would suffer significant losses due to their exposure to the dollar. Furthermore, policies adopted by the US such as quantitative easing could lead to future inflation, thereby eroding the value of the dollar reserves maintained by the BRICS economies.

Second, the use of local BRICS currencies could facilitate the development of these currencies as global reserve currencies. As the BRICS economies share of global trade continues to increase, its currencies could be used more in international trade, thereby adding to the pool of currencies that could act as global reserve currencies.

Third, the use of BRICS currencies in cross-border trade will help reduce transaction costs and exchange rate variability, thereby promoting greater intra-BRICS trade, which will result in more sustainable growth.

Fourth, greater use of local currencies in intra-BRICS trade will help increase the influence of the BRICS economies in a multi-polar world and give it influence in multilateral bodies such as the IMF, World Bank and WTO.

Fifth, the use of local currencies in intra-BRICS trade could be a precursor to the formation of a BRICS monetary union.

There are three approaches the BRICS economies could consider when using local currencies for intra-BRICS trades.

The BRICS economies could (1) select a particular currency of one of its members to use as the vehicle for intra-BRICS trade, (2) use the local currency of the exporting or importing country in bilateral trade, and (3) consider setting up a BRICS common currency to settle intra-BRICS bilateral trades.

The first approach would involve the BRICS economies agreeing to use the currency of one of its members in all forms of BRICS-to-BRICS trades. They could agree to use the Brazilian real, the Chinese renminbi, the Indian rupee, or the Russian rouble as the currency for intra-BRICS bilateral trade.

For instance, if they all agree to use the rupee for bilateral trade, then even if trade takes place between Brazil and Russia, the currency used would be the rupee. This approach could result in the emergence of the selected local currency as a potential global reserve currency to rival the dollar.

Based on present trends, the renminbi would appear to be the most likely currency to be used under this approach, as China is a creditor country with large current account surpluses, a small budget deficit, remarkable growth and a low public debt as a share of GDP.

Obtaining the agreement of all members of the BRICS countries to select a vehicle currency could, however, prove challenging.

The second approach would involve the exporter invoicing the importer using the currency of either the exporting or importing country. This approach would be similar to the bilateral arrangement made between China and Russia in November 2010.

The BRICS economies would need to agree whether to transact bilateral trades in the currency of the exporting or importing country.

The third approach would involve setting up a currency union, eventually leading to the formation of a BRICS common currency.

This would perhaps be the most difficult approach to adopt, but could have the biggest impact as it would harness the combined strengths of all BRICS economies.

Each country within the BRICS group would have to replace its domestic currency with the BRICS common currency. The BRICS currency would become the official currency of the four countries that make up the BRICS and would be the currency of choice for intra-BRICS trade.

The adoption of the BRICS currency could resolve the potential difficulty under the first approach, that is, the challenge in agreeing to select a single currency of one of the BRICS countries as the vehicle for bilateral trade.

The formation of a BRICS common currency would present a formidable alternative to the dollar and the euro as the global reserve currency. The adoption of a BRICS currency would also improve the probability of the usage of the currency in BRICS-developing economies and BRICS-advanced economies trades.

In addition to stimulating intra-BRICS trade, a BRICS common currency would promote growth and could help integrate the intra-BRICS capital markets.

However, its implementation would require member countries to relinquish control of their monetary policy to an external independent central bank and commit to a stability oriented fiscal policy.

For the BRICS economies to successfully implement the use of a local or BRICS currency in intra-BRICS cross border trade, a number of issues would need to be addressed.

There would need to be a strong political commitment toward the use of a local currency in intra-BRICS trade. This commitment appears to be in place as evidenced by the pledge among BRICS leaders to study ways to make use of local currencies in bilateral trade.

There would also have to be trust among the BRICS countries, as this would help provide a stable environment in which to conduct bilateral trade, as an atmosphere of mistrust among the BRICS members could act as a barrier to the use of local currencies in intra-BRICS bilateral trade.

Since a major long-term aim of the gradual move away from conducting intra-BRICS trade in US dollars is to promote the BRICS local currencies as reserve currencies, it becomes important for the currencies of the BRICS countries to be fully convertible and for the BRICS countries to open up their economies over the long term.

As China is the largest economy among the BRICS countries, it is imperative for China to ensure that its currency is fully convertible with restrictions on moving money into and out of the country lifted, as this would make it more effective in using the renminbi in intra-BRICS and international trade.

In conclusion, whatever approach the BRICS economies adopt in diversifying away from the dollar in cross-border trades, a move by the BRICS economies toward the use of local currency in intra-BRICS trade would promote intra-regional trade, mitigate against the risk of heavy reliance on the dollar and promote a new international currency order, and be more reflective of a multi-polar world.

The writer, a CFA charterholder, is the macro strategist for Diadem Capital Partners Ltd, London.

Specials

Share your China stories!

Foreign readers are invited to share your China stories.

Fill dad's shoes

Daughter and son are beginning to take over the family business of making shoes.

Have you any wool?

The new stars of Chinese animation are edging out old childhood icons like Mickey Mouse and Hello Kitty.