China-US

US investment in China drops 28%

Updated: 2011-05-18 07:46

By Ding Qingfen (China Daily)

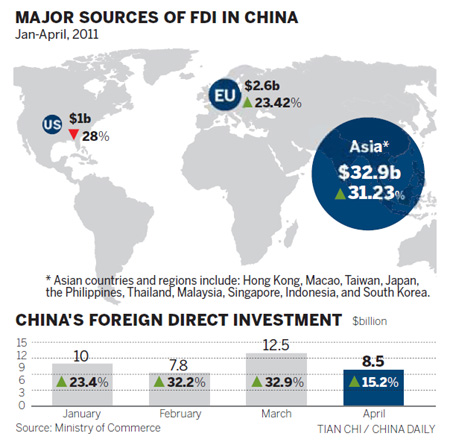

BEIJING - US investment in China dropped sharply by 28 percent, while overall foreign direct investment (FDI) the country received maintained double-digit growth from January to April, the Ministry of Commerce said on Tuesday.

Economists said they believed the US investment decline is temporary, and the Chinese economy, over the long term, will provide US companies with increased investment opportunities.

US investment from January to April decreased to $1.03 billion and the number of US firms setting up in China also fell by 3.85 percent to 475.

|

||||

The ministry said that FDI for April rose by 15.21 percent, from a year earlier, to $8.46 billion, the fourth month that FDI witnessed double-digit growth this year.

"US investment could drop further over the short-term," Song Hong, head of the Department of International Trade at the Chinese Academy of Social Sciences, said.

Song attributed this to a decline in US manufacturing, a key component of US investment, following the global financial crisis. He also said that with the recovery in the US economy, businesses that had invested in China were returning to the US market.

But others cited rising labor costs as a reason.

"We cannot ignore the fact that investment into China from developed nations, including the US, is slowing thanks to China's rising labor costs," said Zhang Yansheng, director of the Institute for International Economic Research under the National Development and Reform Commission.

US investment in China in 2010 grew by 13.31 percent year-on-year, compared to 31 percent for its total overseas investment, according to the United Nations Conference on Trade and Development.

Yuan Gangming, a researcher at the Center for China in the World Economy at Tsinghua University, said "the US is much too reliant on China" for investment to drop over the long term.

But US investors "probably have complaints, such as barriers", he said.

In a survey of its member companies released last month the US Chamber of Commerce in China cited "bureaucracy, lack of management, ambiguous laws and infringement of intellectual property rights" as major challenges facing US firms here.

But the survey also pointed out that 80 percent of the companies recorded profits in 2010 and many have expansion plans.

Robert Poole, vice-president of China Operations at the US-China Business Council, told China Daily that a number of companies plan to boost investment in China.

General Motors said it will invest $5 billion to $7 billion over the next five years, aiming to double its sales to 5 million units by 2015.

Starbucks said recently it was planning to expand its network in China to 70 cities from the current 35.

"US businesses are generally positive about China's investment environment," Yao Jian, commerce ministry spokesman, said at the news briefing on Tuesday.

China announced in April 2010 that it would try to attract more foreign investment in the high-tech, energy and service sectors, a switch in focus from low-end manufacturing.

"We expect the US to encourage more high-end investment into China, particularly in the service sector," Yao said.

China's service sector led the way in absorbing FDI from January to April, with investment growing by 31.26 percent to $18.27 billion, accounting for 47.1 percent of the total FDI.

FDI increased by 26.03 percent year-on-year to $38.8 billion during the first four months.

"China enjoys unrivaled advantages in attracting FDI," the academy's Song said.

"It is a rapidly growing economy which creates a huge market and is a perfect manufacturing base."

The April figure was down from an increase of 32.9 percent in March, and the lowest monthly figure this year.

From January to April, China's overseas direct investment (ODI) grew by 17.5 percent to $13.4 billion, with just over 31 percent, or $4.2 billion, involving mergers and acquisitions.

China's ODI in the non-financial sector rose last year by 36.3 percent to $59 billion.

Zheng Chao, commercial counselor at the Department of Outward Investment and Economic Cooperation at the Ministry of Commerce, said the US, the EU and Latin-America will be the major destinations for China's ODI.

Chen Deming, commerce minister, currently on a visit to Brazil, was quoted by Reuters as saying that China is mulling investment worth $1 billion in the country.

Li Fangfang contributed to this story.

Specials

The song dynasty

There are MORE THAN 300 types of Chinese operas but two POPULAR varieties are major standouts

Sino-US Dialogue

China and the US hold the third round of the Strategic and Economic Dialogue from May 9-10 in Washington.

Building communities

American architect John Portman and his company have developed more than 30 projects across China.