China-US

Dot-Com becoming Dot-Con?

Updated: 2011-06-22 07:53

By Wang Xing, Li Xiang, Chen Limin and Shen Jingting (China Daily)

|

US investors are told to be cautious when investing in Chinese companies following revelations of accounting irregularities by some of those businesses. Provided to China Daily |

Investors are beginning to shun Chinese Internet stocks, report Wang Xing, Li Xiang, Chen Limin and Shen Jingting in Beijing.

Just a couple of months ago the debate was still open as to whether there was a bubble in US-listed Chinese Internet stocks. Today, it's hard to deny that the bubble is there - unless it has already burst.

In recent weeks, investor fever for the typical Chinese growth story has quickly turned into doubt and panic, with many starting to shun the sector that used to provide such high rewards.

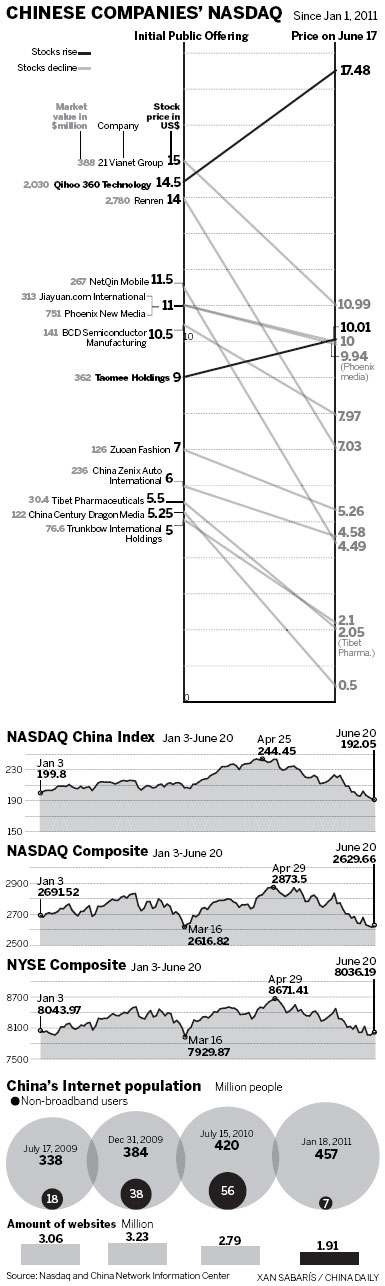

The Nasdaq China Index, which tracks major Chinese stocks trading in the US high-tech stock market, has dropped nearly 20 percent in fewer than 40 days, from $243.45 on May 2 to $196.83 on June 10. Moreover, the price of Chinese stocks, including Sino-Forest Corp and Yongye International Inc, has plunged more than 50 percent.

"You never know you are in a bubble until it's over," said Duncan Clark, president of the Beijing-based research firm BDA China. "It's part of human psychology. And it takes an event to shake people back into a sense of reality."

And for many fevered investors, the event that has shaken them back to reality is a series of alleged financial scandals involving Chinese companies.

Since March, more than two dozen China-based companies have disclosed information regarding auditor resignations or accounting problems. Last month, the hedge fund manager, Jim Chanos, president of Kynikos Associates and one of the most prominent short sellers of Chinese stocks, said that it was getting hard to find shares to short.

Over the following weeks, a number of US independent investment companies, including Muddy Waters Research, issued negative reports on some Chinese companies, claiming they had been "aggressively committing fraud".

The market panic even forced Interactive Brokers Group to ban clients from borrowing on margin to buy approximately 160 different Chinese companies. "While the vast majority of these Chinese companies may be legitimate businesses, a growing number of them are proving to have significant accounting deficiencies or are vessels of outright fraud," said Luis Aguilar, a commissioner at the US Securities and Exchange Commission (SEC), in April.

In the same month, SEC Chairman Mary Schapiro said in a letter sent to the House Committee on Oversight and Government Reform that "the SEC has moved aggressively to protect investors from the risks that may be posed by certain foreign-based companies listed on US exchanges".

Schapiro noted that while the majority of foreign-based issuers are engaged in legitimate business operations, others may be taking advantage of the remoteness of their operations to engage in fraud.

Reverse takeovers

Separated by vast geographic distances, the language barrier and differences in legal systems, many US investors find it difficult to fully evaluate the true worth of companies operating in China. That provides some dishonest Chinese companies with the opportunity to take advantage of US regulatory flaws to cash in on the capital market.

A major way to accomplish that is through reverse takeovers (RTOs), which allow companies to trade on US exchanges even though their operations are situated overseas. The listing process is quicker than a traditional initial public offering and involves less scrutiny of the credibility of a company's financial performance.

A survey by the US Public Company Accounting Oversight Board, which monitors auditors, identified 159 Chinese companies that listed in the US through RTOs from the start of 2007 through to March 2010. That's almost three times the number of Chinese companies that launched normal IPOs in the US over the same period. A Bloomberg index also shows that Chinese RTOs more than tripled between March 2009 and January 2010.

"US investors don't understand China, because they don't use the services of the companies that they are investing in," according to Charles Zhang, chairman of Sohu.com Inc.

He said many US investors believe that most Chinese Internet companies are simply copies of established US companies, and so they often take it for granted that the companies will provide good returns because of China's continued economic prosperity and the nation's ever-expanding number of Internet users.

According to figures from the Nasdaq exchange, during the past 12 months Chinese Internet stocks put up the strongest showing on the first day of their listing with three Chinese shares among the top five highfliers.

"People want to simplify things and have something that's easier to understand and to relate to," said BDA's Duncan. He said there is a tendency for Chinese companies to try to position themselves as "the X of China". "That may be useful in terms of raising capital. But if you live by cloning, maybe you die by cloning," he added.

China story

In fact, US-listed Chinese companies, particularly those with high growth potential, have already proved attractive investments. A good example is Baidu Inc, which is a consistent holding for many American hedge and mutual fund managers, and it has also performed exceptionally well - up nine times over the past two years, compared with Apple Inc's three.

"In the US, the Chinese growth story continues to be a very popular investment theme, and investors are eager to find new ways of accessing China investment themes," said Isaac Souede, chairman and chief executive officer of Permal Group, one of the oldest and largest alternative asset managers in the US.

According to figures from the China Internet Network Information Center (CNNIC), the number of Internet users in China had reached 456 million by the end of last year, a year-on-year increase of 73.3 million from 2009. The same year saw the number of mobile Internet users hit 303 million, a year-on-year increase of 69.3 million.

These figures, together with China's rising global economic clout and the increasing level of consumer spending, provide an alluring growth story for US investors.

"The story of China's growth and Internet has a secular and cyclical component," said Richard Lacaille, chief investment officer of State Street Global Advisors.

He said that many investors are watching carefully to see how the Chinese economy develops as the government attempts to control inflation and the high level of credit expansion.

Bubble burst?

In fact, the current plunge in the share price of Chinese stocks listed in the US reminded many observers of the rupturing of the "dot-com" bubble in the late 1990s and early 2000s, which wreaked havoc on the US economy and high-tech industry. However, some industry analysts say that this is not the end for US-listed Chinese stocks.

"The market itself is, in a sense, a risky gamble. The more you want the rewards, the higher the risk," said Michael Ruan, co-president and chief operating officer of the Chinese research firm iResearch Consulting Group. However, he added that the market now is not comparable with what happened after the original "dot-com" bubble.

"Internet companies in 2000 didn't have any clear business models that could sustain their huge spending. But now, most companies have at least foreseeable models that can support their high valuations," he said, adding that China's continued growth in the number of Internet users will provide a fundamental source of growth for the nation's Internet companies in the future.

"This is a very different scenario from the 1990s, but you must still be circumspect," said Permal's Isaac Souede. He said there is excitement in the market, but there is also significant pressure on the companies to deliver, which was rarely the case in the late 1990s.

"Short-term, the likes of Youku and Renren may create waves, but like all other investments, the longer-term fundamentals will be the only meaningful factor. Those Internet companies that fail to meet expectations will find their share price suffering," he said.

Li Guoqing, the co-founder of Dangdang.com, one of China's biggest e-commerce websites, said in his micro blog earlier this month that the price declines of Chinese Internet companies were mainly driven by the overall outside environment.

He said a series of events, such as the financial frauds, the poor delivery of growth targets, and Alibaba's recent transfer of its online payment business to a domestic subsidiary without the consent of its foreign investors, have combined to contribute to people's distrust of Chinese Internet companies.

"I believe that performance is still the most vital factor that affects share prices, but it may need more time to be recognized," he said.

In fact, many Chinese Internet companies have already taken some steps to launch stricter self-regulation. For example, before its first day of public trading, Taomee Holdings Limited, a Chinese company operating a website for children that listed on June 9, said that its auditors had found major gaps in its internal controls. It said it lacked sufficient accounting resources and the necessary expertise to comply with US accounting standards.

"History tells us that, with hindsight, there have been substantial under-valuations as well as substantial over-valuations of technology companies. This is because the potential growth rates are in a much wider range than companies with more traditional businesses," said Richard Lacaille.

He said long-term growth and the sheer size of China is an enticing prospect for investors who may gain from the shift to a more consumer-oriented and sustainable economic balance.

Specials

My China story

Foreign readers are invited to share your China stories.

Pret-a-design

Though Elisabeth Koch did not attend the Aprilweddingof Prince William and Kate Middleton in London, her tailor-made hats might have.

Mom’s the word

Italian expat struggles with learning English and experiences the joys of motherhood again.