Dragon dance

Updated: 2012-01-20 08:52

By Andrew Moody (China Daily)

|

|||||||||

As China enters the new year, 'nimble footwork' is needed

China enters the Year of the Dragon in a stronger position to withstand economic shocks from the outside world than before the financial crisis in 2008, according to experts.

Just over three years ago, China was heavily dependent on exports and lost 30 percent of its markets in a matter of weeks.

|

||||

The economy is now more broadly balanced and less dependent on the export of inexpensive manufactured goods.

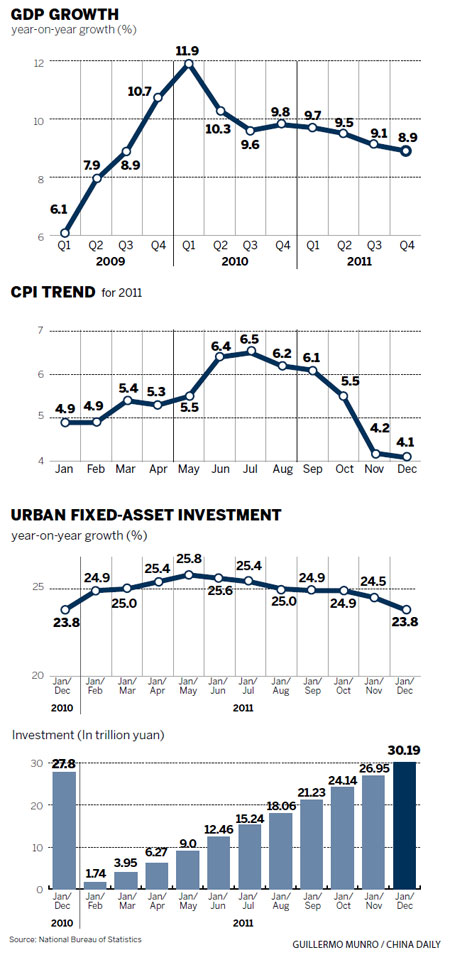

Donna Kwok, the Hong Kong-based China economist at HSBC, is confident GDP growth will hit 8.6 percent this year.

She says net exports (the difference between exports and imports) are now just between 2 and 3 percent of China's GDP, compared with 8 percent in 2007.

"We estimated that over the last year, net exports contributed next to nothing to headline GDP growth. Most of the growth has been internally generated," she says.

"Private household spending, public spending investment now make a much more significant contribution."

London-based Jonathan Fenby, director of China research at Trusted Sources, the emerging markets research service, and also author of the upcoming book Tiger Head, Snake Tails, says the China economy has moved on significantly in a short period of time.

"The trade effect on China's growth is certainly less than in the middle of the last decade going into the 2008 downturn," he says.

"If Europe goes into serious negative growth of 2 to 3 percent, it might result in China's growth slowing by just half a point to 7.5 percent. Exports contribute less to GDP growth than they did in 2007."

The situation in Europe and the prospect of a Greek default and exit from the euro was one of the factors that spooked the financial markets in China as well as the rest of the world in 2011.

The Shanghai Composite Index, China's main stock market indicator, fell 21.68 percent in the 12 months to the end of December - the third-largest drop ever in a single year but not as severe as the 65.39 percent slump in 2008 - but has rallied in the opening weeks of 2012.

Kwok at HSBC says it would be turmoil in the financial markets as a result of a euro collapse that would have the biggest impact on China, rather than anything to do with trade.

"The turbulence in global financial markets could potentially spill over into the real economy, not only in Europe and the United States but also in Asia," she says.

"I think this is where the major risk lies with the European sovereign debt crisis."

Some believe the euro crisis will become significantly more serious in 2012 and will risk dragging the world economy into recession.

The buoyant mood of the markets in the opening weeks of this year have been interrupted just once when ratings agency Standard & Poor's downgraded nine eurozone countries, even stripping France of its prized triple-A rating, on Jan 13.

Derek Han, chairman of North Square Blue Oak, a research and investment company with offices in Beijing and London, believes we are in for major drama in the first three months of the year.

"I think in the first quarter, we are going to get into a very difficult situation in Europe. It is not a question of whether there is going to be a default or a break-up but what kind. I believe the euro is unsustainable and it will come apart. It is an unthinkable mess," he says.

Han, who lives in Florida, says China will be unable to escape the ramifications of this.

"China is already seeing a slowdown of European imports of Chinese goods but they are soon going to stop dramatically. China's growth will certainly slow in the first quarter depending on what happens and how messy the default is."

The Chinese economy faced a number of key challenges in 2011 including rising prices, particularly of food which rose 9.1 percent in the year to December, and unprecedented levels of local government debt, which until the eurozone came along was one of the major international financial stories.

Inflation as measured by the consumer price index (CPI) reached a high of 6.5 percent in July but as a result of government monetary tightening measures had fallen to 4.1 percent in December, according to the National Bureau of Statistics. For the full year, it was down to 5.4 percent.

Many economists now expect further loosening of the bank's reserve requirement ratio (RRR) in the first half of the year - allowing more credit back into the banking system - and then for interest rates to start being cut in the second half of the year.

Wang Jianmao, professor of economics at the China Europe International Business School (CEIBS) in Shanghai, worries the government has not quite put the inflation genie back in the bottle and cautions about loosening monetary policy.

He believes if the government pursues a policy of relaxing the RRR, it should actually also raise interest rates as a precaution.

"I think any lowering of the Triple R and an increase in interest rates would be a very bad combination. I think the government needs to increase interest rates at the same time so we don't have a problem with inflation," he says.

Duncan Innes-Ker, senior economist for the Economist Intelligence Unit and a China analyst, also sees the danger of inflation rising at the end of 2012 but anticipates the government's anti-inflation measures to have the biggest impact in the early part of the year.

"We are expecting inflation to average around 3.5 percent in 2012, although it will probably be heading back above 4 percent year-on-year by December," he says.

Kwok at HSBC expects the government to go full steam ahead with a 0.25 percent interest rate reduction some time in the second half of the year after further reductions in the RRR.

"We will see three more Triple R cuts by the end of June and once inflation comes down below 3 percent, we shall see the first 25 basis points interest rate cut. We are only anticipating one this year."

The National Audit Office, China's leading auditor, revealed in June that municipal authorities had borrowed some 10.7 trillion yuan ($1.68 trillion, 1.33 trillion euros) in 2010, around a quarter of China's GDP.

Much of this expenditure was on infrastructure projects using the 4 trillion yuan of cash the central government had pumped into the economy in the wake of the 2008 economic crisis.

Many economists felt at the time this represented wasteful spending and could considerably slow China's juggernaut growth rate in the medium term.

Wang at CEIBs believes 2011 may prove a turning point and that this year any planned infrastructure project will come under much greater scrutiny.

"There is a need to spend money in a smart and not a stupid way. You need to look at getting a good return or else it will slow the growth of the economy," he says.

"Those government officials who have made the wrong decisions are simply bad decision makers and should be held accountable and punished so you get a more disciplined environment."

Wang says that instead of a focus on the hardware of infrastructure, the government should place more emphasis on the software of people.

"One way of doing this would be to improve the basic education in the rural areas of China and hire more higher quality teachers. You would then build more of an educated middle class in these areas which would boost consumption over the longer term," he says.

A major concern in China remains the property market, which has been subject to more than two years of tightening measures, after house prices tripled between 2005 and 2009.

According to an analysis of Chinese official figures, the prices of new homes rose by just 2.2 percent in November, the slowest rise for the whole year.

Kwok at HSBC says the risk remains of an over-correction of property prices.

"The China government has no intention of letting up on its current tightening measures being imposed on the property market until prices in tier-1 cities such as Beijing and Shanghai have fallen by 20 to 30 percent. If property price falls were to overshoot that, then growth could come in lower than expected."

Innes-Ker at the EIU says whereas in the West property price falls would be seen as bad for the economy, in China they actually provide a boost to consumption.

"When property prices are rising, people feel as though they have to save more to buy a property so when they fall they need to save less and therefore they spend more," he says.

"It is the opposite of what happens in the West when rising house prices encourage people to borrow against their houses and spend more."

Apart from the major headline economic data, some believe the Year of the Dragon could be when Chinese companies begin to assert their relatively strong financial position and begin to make acquisitions, particularly in Europe and North America.

Mike Bastin, a leading expert on Chinese brands and now a researcher at Nottingham University's School of Contemporary Chinese Studies, believes some of China's big name brand-owning companies could be involved.

"I see Chinese companies making a number of audacious takeover bids for established Western brands in 2012. I wouldn't be surprised if Lenovo, China's leading computer maker, or Haier, the household appliance maker, launch bids for American or European companies," he says.

There will be focus outside China in 2012 on whether there will be any moves toward a further internationalization of the Chinese yuan.

The yuan - the value of which is a major subject of debate in the US presidential race - reached a record level against the US dollar at the end of 2011, rising 4.86 percent over the year as a whole on top of a 3.1 percent appreciation in 2010.

"I think there will be an opening of new channels for Chinese people to invest overseas to prepare for the internationalization of the Chinese currency. It will be a gradual step-by-step process but I think it may happen much earlier than 2020, the timeline that some predict," he says.

One of the major issues of 2011 was whether the Chinese economy was heading for a hard or soft landing and while the debate still exists, many now are more confident of a soft landing.

"I think the question is now less about a hard or soft landing but more about what pattern we are going to see in growth," adds Innes-Ker at the EIU, who is forecasting 8.1 percent GDP growth for the year.

"I think what we are going to see is a very sharp downturn in the first and second quarters - mainly the lagged impact of measures to slow down the property sector - but then a sharp recovery in the second half."

Kwok at HSBC agrees: "We still feel comfortable about a soft landing because of the fact the government realizes the seriousness of the situation and will implement the loosening measures required."

(China Daily 01/20/2012 page1)

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Chinese fleet drives out Japan's boats from Diaoyu

Health new priority for quake zone

Inspired by Guan, more Chinese pick up golf

Russia criticizes US reports on human rights

China, ROK criticize visits to shrine

Sino-US shared interests emphasized

China 'aims to share its dream with world'

Chinese president appoints 5 new ambassadors

US Weekly

|

|