Brazilian farm exports to China expected to still rise

Updated: 2014-02-17 06:11

By XU WEI in Beijing (China Daily Latin America)

|

|||||||||

Brazilian agricultural exports to China should continue to rise in 2014 after China overtook the European Union as the region's largest destination country for agricultural products in 2013, a Brazilian official has predicted.

China became the largest destination country for Brazil's agricultural exports in 2013 with a total trade volume of $22.88 billion, up by 4.91 billion from 2012, according to the Ministry of Agriculture, Livestock and Food Supply in Brazil.

|

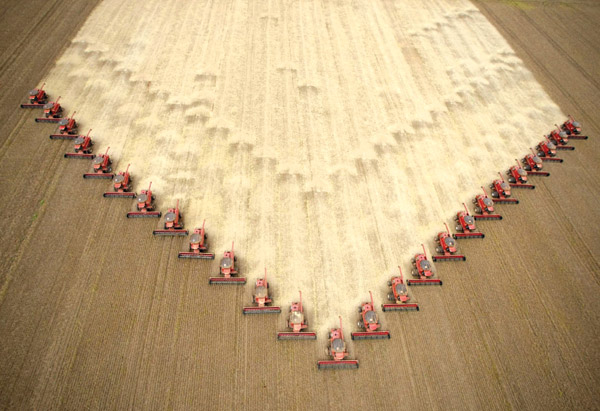

| Farmers in a farm in Mato Grosso harvest soybeans. XINHUA |

"We are expecting the export volume to continue to increase in 2014 with China's opening of the corn market and the possible resumption of beef exports," said Andrea Bertolini, agricultural attache of Brazil to China.

The largest category of Brazilian agricultural exports to China is soybeans, which totaled 32.8 million metric tons, worth $17.15 billion, in 2013, making Brazil China's top supplier of soybeans. The volume of Brazilian soybean exports to China in 2013 increased more than 38 percent from the previous year.

The country also exported 3.5 million tons of sugarcane to China last year, worth $1.4 billion, along with $440.8 million of poultry products and tobacco worth $453.3 million.

Bertolini said the country is seeking more diversified categories of agricultural exports to China. One of the future growth points is dependent on China's approval of more corn imports.

The General Administration of Quality Supervision, Inspection and Quarantine, China's quality watchdog, announced in November that China and Brazil have signed a protocol on the quarantine requirements for Brazilian corn, as a first step to fully open the country's market to the corn.

Brazil is the world's third-largest producer of GM corn, after the United States and Argentina.

Xu Xiaomiao, an analyst with SCI International, a commodity market information service organization in China, said Brazilian corn could have a price advantage over US corn.

"The price of Brazilian corn imported to China is about 1,745 yuan ($287) per ton after taxes. That is even cheaper than US corn, which stands at 1,800 yuan per ton after taxes," she said.

Xu said if the Brazilian corn passes the quarantine tests, there is a great chance it would challenge the dominant role of US corn in the Chinese market.

Another potential growth point for Brazilian exports is beef, as China banned the import of Brazilian beef in 2012 after reports that a 13-year-old cow died of a Bovine spongiform encephalopathy, or mad-cow disease.

Brazil expects China will approve its beef and has filed all the documents required to the AQSIQ, Bertolini said.

"Brazil has very good quality beef and has been cleared of risks to human beings. We hope that this year we will again restart our exports to China," she said.

"We can also export to China a bunch of products that have not been exported, including orange juice and coffee," she said.

Tobacco exports to China could also increase two or three times after a protocol was signed between the China Tobacco Association and a major Brazilian tobacco producer last year.

However, Bertolini warned there are still some policy barriers to tackle to further smooth the export procedure.

One of the issues is China's attitude towards genetically modified products.

In June, China's agricultural authorities issued biosafety certificates to three new overseas varieties of genetically modified soybeans, allowing them to be imported as raw materials for domestic processing, in a move welcomed by Brazilian agricultural authorities and farmers.

The approval could give Brazilian soybeans a price edge in the Chinese market, Bertolini said.

However, China is still to give approval to some GM corn products, especially a strain named MIR 162.

Last year, China rejected a total of 12 shipments, or 545,000 tons, of US corn after detecting the MIR 162 strain in it.

"Since China is the major grain importer, China's slow procedure on genetically modified varieties approval impacts on the introduction of new agricultural technologies in producer countries," she said.

Bertolini said many corn farmers in Brazil grow the MIR 162 strain, which could hamper their exports.

Another important aspect is to further increase the dialogue between authorities of the two countries, as well as to lower Chinese tariffs to import processed products, such as soybean oil or soybean bran.

"Currently the process of approval of new export establishments between the two countries, mainly in the sector of meat and animal products, is also very slow. So there is a need to reduce bureaucracy and improve efficiency in the dialogue between the two country's authorities," she said.

China's imports of Brazilian agricultural products, mostly soybeans, have seen steady growth since 2007, according to statistics from Agrostat, with the total volume of soybeans increasing from about 10 million metric tons in 2007 to 32.8 million tons in 2013.

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

US space telescope spots 715 more planets

Bags banned in Boston Marathon

Asiana fined $500,000 over SF crash

TPP talks in final stretch

Spotlight on Chinese publishing

Weibo faces modest growth in '14

Services top US firms' revenue

US planning full Afghan pullout

US Weekly

|

|