US banking platform banks on global good

Updated: 2015-04-17 12:04

By CELIA CHEN in Hong Kong(China Daily USA)

|

|||||||||

You may never expect to spend more on banking services than food, but that is the sad reality for many underprivileged US citizens.

"The tremendous spending (involved) deprives poor people of access to banking services and it is a serious problem," Jerry Ross, chairman of US-based tech firm GlobeOne, told China Daily in Hong Kong.

To figure out a solution to the problem, the financial technology service provider created a dedicated mobile banking platform to help people earn an income stream while availing of banking services.

Founded in 2013 by socially conscious entrepreneurs and industry leaders, California-headquartered GlobeOne brings together members and a global network of member banks with the aim of fulfilling the genuine needs of the community on a global scale. Its revolutionary financial services platform combines mobile banking with GlobeOne's two innovative initiatives - SocialBoost and GoMoney.

Capitalizing on the explosion of access to mobile-based devices and the development of new technologies, GlobeOne has created a community of people and banks from around the world to create a global social banking community, said Ross in echoing the message on the company website.

The membership fee GlobeOne is $9.95 in the US. But Ross said they would adjust the fee level according to the the purchasing power parity in each market. For example, the fee they charge in Mexico is $5.95.

Sending money to GlobeOne members via GoMoney, no matter where they are in the world, incurs no additional charge domestically and never more than a 2 percent foreign exchange charge internationally, which is much lower than the current level of about 7.9 percent charged by banks for overseas remittances, Ross said.

Additionally, members may establish a no-minimum demand checking account with debit card, and create a security or savings account with line of credit.

And how does SocialBoost work? The company said if you invite friends and family to join, as a part of your personal community, they enjoy the benefits of membership and, as they use the services, GlobeOne member banks give back 50 percent of all the interest charged, with 25 percent going to you and 25 percent to the GlobeOne Community.

To better explain the SocialBoost working mode, the company gave a specific example. "If you invite 10 members and the GlobeOne Community is 100 members, you receive a tenth of the community funds."

The firm's stated mission is to create financial inclusion and financial opportunity for the growing number of dissatisfied and underserved, by improving and enhancing their financial health and well-being.

Ross said his goal is to have 50 million members in 30 countries by 2020 through a network of partners. Nevertheless, he admits the primary hurdle to building the global community is carrying out localized research for different communities.

He expects to launch services on the Chinese mainland by the end of this year but is aware of likely stiff competition posed by homegrown technology giants such as Tencent and Alibaba. "They have many strengths that traditional banks currently lack," said Ross. "They have great customers, tons of money and cutting-edge technology."

The most important fact is that technology companies have the trust of younger generations, he stressed.

"The younger generation is growing up on social media channels, which are supported by technologies," said Ross. "They developed a relationship with social media almost on faith of that and that is the reason why we connected finance and technology."

However, it will take considerable time for these technology giants to conduct banking business on a global scale as a foreign banking license is not easy to obtain.

"All governments are not going to say ‘Come in' and open banks overnight," explained Ross. "What we are doing is to join with banks that have a license already."

Ross said he would be more than happy if GlobeOne has the chance to cooperate with Chinese technology firms to achieve mutual benefits.

Luo Weiteng contributed to the story.

celia@chinadailyhk.com

Top 10 foreign holders of US Treasuries

Top 10 foreign holders of US Treasuries

Denmark's Queen Margrethe 75th birthday celebrated

Denmark's Queen Margrethe 75th birthday celebrated

Lost in sandstorms

Lost in sandstorms

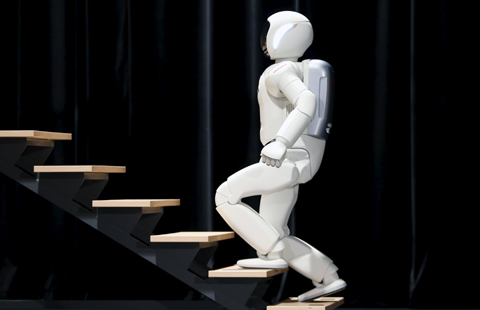

New roles for technology: Rise of robots

New roles for technology: Rise of robots

Strange but true: Getting ahead of the rest

Strange but true: Getting ahead of the rest

Top 10 industries with most job-hoppers

Top 10 industries with most job-hoppers

Russia honors Chinese veterans from WWII

Russia honors Chinese veterans from WWII

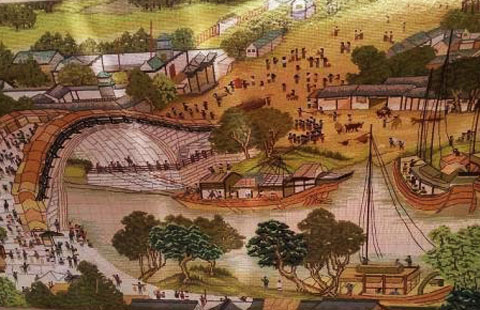

Woman embroiders giant painting

Woman embroiders giant painting

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

World Bank, IMF: will work with AIIB

Ex-PM says US, China can be allies

Hainan Air links San Jose, Beijing

Carrying on a Chinese food legacy

America, Europe told to work with BRICS

Beijing film festival draws top moviemakers, Oscar winners

Chinese teachers mark progress

US-listed Chinese tech stocks not bubbly: analysts

US Weekly

|

|