Seattle real estate even hotter after BC tax

Updated: 2016-10-05 11:52

By Linda Deng in Seattle(China Daily USA)

|

|||||||||

Seattle, a popular destination for wealthy Chinese real estate investors, is heating up even more as a new tax across the border in Vancouver is sending more buyers to the Puget Sound.

"The tax (15 percent on foreign buyers) in Vancouver is increasing the number of people looking in Seattle," said Anna Fortune Riley, premier properties director at Windermere Real Estate.

"In fact, some Vancouver agents are accompanying their clients down to Seattle and helping them look here," she said. "The most popular price range is $2 million to $3 million, but international buyers have also purchased some of our most prized and expensive real estate, including waterfront as high as $9 million.

"During the past two years, about 50 percent of my listings have been purchased by international Chinese buyers, and currently about 65 percent of our showings are to Chinese buyers living in China or Vancouver," Riley said.

Dean Jones, principal and owner of Realogics Sotheby's International Realty | Realogics Inc in Seattle, told China Daily that since the August tax increase in the Canadian city, he's seen several significant sales, all to Chinese.

"We know that in the luxury segment above $2 million on the Eastside, Chinese buyers are now between 30 to 50 percent of the consumers."

Metro Vancouver home sales totaled 2,253 in September, a drop of 32.6 per cent from the 3,345 sales recorded in the prior year, and a decline of 9.5 per cent compared to August, when 2,489 homes were sold, according to figures released by the Real Estate Board of Greater Vancouver on Tuesday. Last month's sales also were nearly 10 percent below the 10-year sales average for the month.

Juwai.com, a website in China that connects investors with international home-sellers, shows inquiries for property in Vancouver from the Chinese mainland fell 81 percent in August after the tax was implemented. But inquiries for Seattle homes surged by 143 percent in August compared with August 2015.

The US National Association of Realtors said Chinese buyers bought $1.6 billion worth of real estate in Washington state in 2015, out of $27 billion spent across the country that year.

Andy Yip, an international real estate adviser at Realogic Sotheby's International Realty, offered other reasons why Seattle is desirable.

"The livability of Seattle is very high to start with, combined with the increasing business opportunities; it is just being discovered in recent years," he said. "As the hot money in Silicon Valley cools, Seattle is taking in a lot of residents from California every year from the field of IT. After all, Seattle home prices are about 60 percent of San Francisco's.

"The US dollar will experience an extended period of appreciation against the RMB," he said. "Those with the means to transfer wealth from China to the United States see real estate purchase in the US as a primary wealth management strategy."

"Especially in the last three years, we see tremendous growth of Chinese investments," said Holly Yang, Head of the Kidder Mathews Seattle China Services Group.

"Our cities have initiated many events to attract more investors. For example, the mayor of Seattle, Ed Murray, invited the mayor of Shenzhen, China, to visit."

Overall, the US real estate market has become a favorite destination for Chinese investors, reaching an estimated $10 billion in investment, with approximately $4.4 billion being invested in commercial properties in 2015, according to KPMG's China Inbound Investing in US Real Estate-2016 Semi-Annual Update report.

"Chinese investors continue to show a strong appetite for US development assets in gateway cities and increasingly in other markets with strong real estate fundamentals such as Dallas and Seattle," said Roger Power, leader for KPMG's US-China Real Estate Initiative.

The Chinese Insurance Regulatory Commission encouraged Chinese insurance companies to increase overseas investments by permitting investment of up to 15 percent of their assets overseas.

Create World International Inc, a conglomerate founded in Hong Kong Special Administrative Region in 1997, has worked with Kidder Mathews in 2015 on a land deal for a multifamily high-rise development in Bellevue, Washington, now under construction. Create World also invested in another project in the Seattle Metro market - a 26-story, 242-unit apartment building.

The Seattle venture will be the first high-rise residential development in the South Lake Union technology hub. It is close to Amazon.com Inc offices, the Bill & Melinda Gates Foundation and the University of Washington Medical School.

lindadeng@chinadailyusa.com

- World's longest sightseeing escalator awaits you in China

- More than 20 buried under collapsed buildings in Wenzhou

- Li arrives in Macao to boost ties with Portuguese-speaking countries

- Scenic spots ranked for their holiday services

- Illness raises risk of vanishing

- Jack Ma and Spielberg work together to tell Chinese stories

- Russia-US relations change fundamentally

- Trump assails Bill Clinton, vows to jail Hillary Clinton if he wins

- US Navy ship targeted in failed attack from Yemen

- Panel tackles Fox News skit on Chinatown

- Chinese tourists forced to sleep at airport for 5 days

- Saudi-led coalition denies striking funeral in Yemen's capital

The world in photos: Sept 26 - Oct 9

The world in photos: Sept 26 - Oct 9

Classic cars glitter at Berlin motor show

Classic cars glitter at Berlin motor show

Autumn colors in China

Autumn colors in China

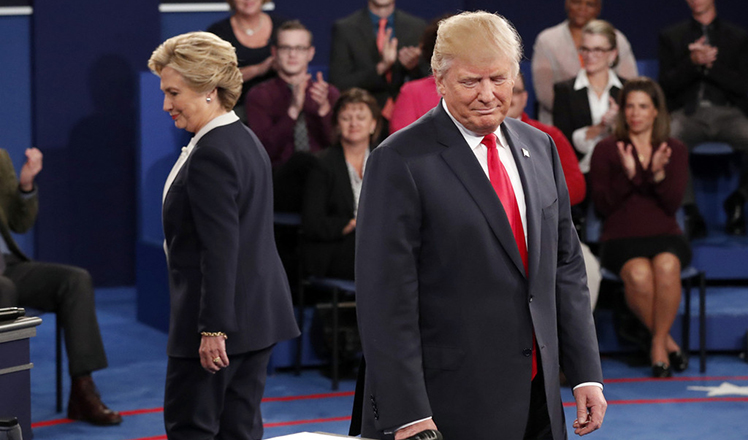

US second presidential debate begins

US second presidential debate begins

Egrets Seen in East China's Jiangsu

Egrets Seen in East China's Jiangsu

Highlights of Barcelona Games World Fair

Highlights of Barcelona Games World Fair

Coats, jackets are out as cold wave sweeps in

Coats, jackets are out as cold wave sweeps in

6 things you may not know about Double Ninth Festival

6 things you may not know about Double Ninth Festival

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Trump outlines anti-terror plan, proposing extreme vetting for immigrants

Phelps puts spotlight on cupping

US launches airstrikes against IS targets in Libya's Sirte

Ministry slams US-Korean THAAD deployment

Two police officers shot at protest in Dallas

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

Effects of supply-side reform take time to be seen

US Weekly

|

|