Trump's next bankruptcy may be US-China relationship

Updated: 2016-10-21 10:33

(China Daily USA)

|

|||||||||

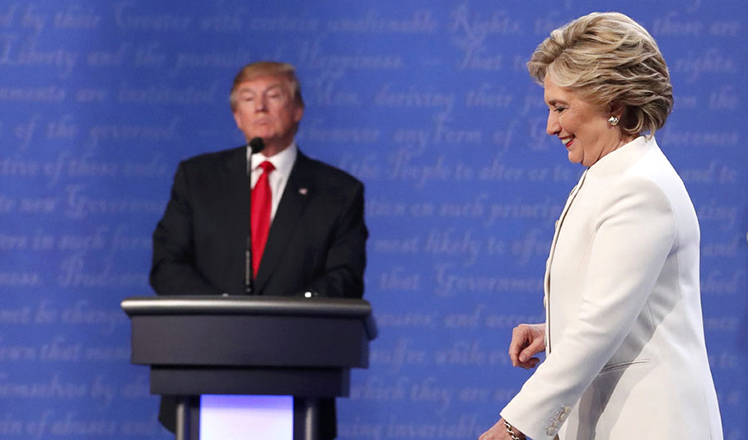

The final presidential debate went viral as Republican Donald Trump wouldn't commit to accept the election results, to which his opponent, Democrat Hillary Clinton, responded that such a statement was "horrifying" and that he was "taking down our democracy."

This does not bring out the best in America's highly valued democracy.

Candidates are often careless with facts at campaign rallies and debates, but Trump has set a record of making false statements, deceptions and even outright lies never seen before in a presidential election, especially his blistering attacks on trade agreements and China. Here is a reality check:

Trump has stated repeatedly that he would slap a 45 percent tariff on all Chinese products entering the US.

Reality: What he does not know is that there are thousands of US trade actions that already limit Chinese exports to the US. These punishing import tariffs are often applied unfairly because China is still considered a non-market economy, but ultimately they do unintended harm to US importers (who pay the tariffs), end-users, retailers and American consumers.

The Department of Commerce recently levied a 500 percent duty on Chinese cold rolled steel (metal to make appliances, cars and electronic motors), significantly higher than what Trump is advocating.

Trump also believes he could get away with such action, but he should know China will not hesitate to retaliate whenever they believe US trade laws are being applied unfairly.

This was certainly the case involving the solar panel sector. When the US applied anti-dumping duties of up to 78 percent on Chinese solar panels (prompted by lobbying on behalf of a German-owned solar panel facility based in Portland, Oregon), China quickly responded with its own 57 percent against US produces of polycrystalline silicon, the raw material for photovoltaic cells essential to making solar panels. If this continues, we most certainly will be on the path to a trade war.

Finally, if Trump took time to read the Constitution, he would see that it clearly states it is the Congress (not the president) that has the authority to regulate interstate and foreign commerce.

Trump finds it convenient to blame China and trade agreements for the huge job losses across America's heartland.

Reality: While he finds it convenient to portray China as the chief beneficiary of the Trans-Pacific Partnership (TPP) and the North American Free Trade Agreement (NAFTA) trade pacts, the truth is China is not involved in any of the US trade agreements.

Many factors contributed to the job losses, but it was mostly US corporations relocating their operations abroad adjusting to a more global economy. Trump lives in fantasyland when he boastfully claims he will bring back all those manufacturing jobs if he becomes president.

The campaign rhetoric surrounding TPP has all but guaranteed it will not be approved. While China was excluded for obvious geopolitical and economic reasons, it has much more to gain if TPP fails to be ratified, which is the opposite of what Trump claims.

More alarmingly is Trump's pre-campaign statement that "I'd love to have a trade war with China if we did no business with China, frankly we will save a lot of money."

Reality: This is typical Trump saber-rattling, threatening a trade war that would force China to make major concessions, or he genuinely believes as commander-in-chief, that America would emerge victorious.

Trade is a two-way street, so a trade war would have huge consequences on both sides.

According to the Rhodium Group, China is a top investor in America with $18 billion in the first half of 2016 and another $30 billion in the pipeline. There would be even greater investments if the US-China Bilateral Investment Treaty (BIT) were to be approved but that is unlikely given the anti-trade rhetoric this election year.

Also some of China's top corporations are locating their manufacturing operations all across America. According to a report issued by the National Committee on US-China Relations and Rhodium Group earlier last year, more than 1,900 Chinese companies have operations in the US and employ over 90,000 Americans.

Most of the nation's state governors are anxious to lead trade delegations to China to urge more investments in their states.

The reality is that China is investing heavily worldwide and if, as president, Trump were to shut the door or erect barriers, then the needed investment capital will flow to other countries. Despite his business savvy, this would be a bad deal for the United States.

There is imbalance in the trade relationship, to be sure, but China is now importing $130 billion in merchandise from the US, an amount that's increasing with China's rising middle class and the surge of online purchasing.

This election year, Trump has been ever boastful of his business achievements despite the multiple bankruptcies, as evidenced by the enormous $900 million debt he acquired building casinos in Atlantic City, New Jersey.

If Trump wins the election in November and moves from the Trump Tower to the White House, we can expect another bankruptcy, this time possibly of the US-China relationship.

The author is executive director of APCO Worldwide, a former Democratic US congressman and chairman of the House Foreign Affairs Subcommittee on Trade.

Ten photos from around China: Oct 14-20

Ten photos from around China: Oct 14-20

Veterans mark 80th anniv. of end of Red Army's Long March

Veterans mark 80th anniv. of end of Red Army's Long March

Road with 24 bends zigzags in Southwest China

Road with 24 bends zigzags in Southwest China

Trump refuses to say he will accept election results

Trump refuses to say he will accept election results

Top guns: Airshow China in past two decades

Top guns: Airshow China in past two decades

Street photographer captures hustle-bustle of Beijing

Street photographer captures hustle-bustle of Beijing

Five-time Olympic champion diver Chen Ruolin retires

Five-time Olympic champion diver Chen Ruolin retires

Glimpse into lifestyle of astronauts in space

Glimpse into lifestyle of astronauts in space

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

'Zero Hunger Run' held in Rome

Trump outlines anti-terror plan, proposing extreme vetting for immigrants

Phelps puts spotlight on cupping

US launches airstrikes against IS targets in Libya's Sirte

Ministry slams US-Korean THAAD deployment

Two police officers shot at protest in Dallas

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

US Weekly

|

|