Alibaba eyes revamp in food sector

After taking the lion's share of China's e-commerce sector, Alibaba Group Holding Ltd is looking to revamp the food sector by addressing the imbalance between supply and demand.

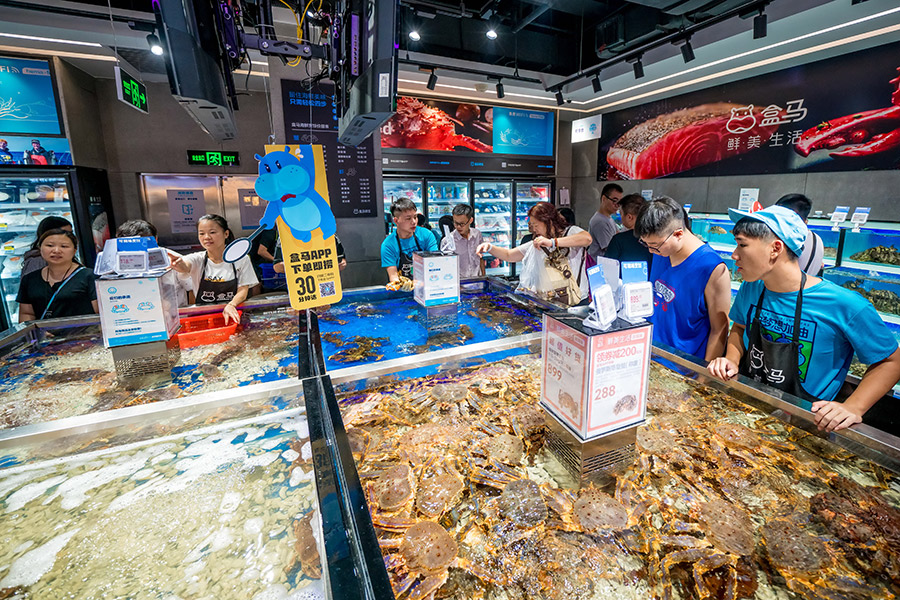

Hema Fresh, its iconic fresh food chain that employs technologies to dispatch goods and manage inventory, plans to open stores across all first and second-tier cities in China and aims to reach at least 300 million consumers.

The goal was announced at last week's vendor conference in Shanghai, where Hema forged partnerships with over 500 merchants including agriculture produce bases, and pledged not to charge any fees as prerequisites for brands to access Hema.

Chief Executive Officer Hou Yi said the company was making more efforts in product development with merchants and targeting sales of tailor-made goods to account for half of Hema's overall sales in three years.

New Zealand-based diary giant Fonterra Co-op Group Ltd was among the early adopters of such a model. For instance, the pair are shortening the shelf life of milk sold in stores down to less than 24 hours from the usual seven to 10 days. The milk is produced and collected each day at Fonterra's dairy hub in Hebei province, one of the two the company operates in China.

Such a tie-up is part of Hema's "Daily Fresh" program, which sees a host of fresh produce and meat removed from store shelves at the end of the day and replaced with fresh products the following morning.

The model is likely to be extended to a wider variety of goods, with Hema signing direct procurement contracts with agricultural produce bases in Yunnan, Hubei and Shandong provinces.

"Under the project, consumers can buy the most comprehensive and fresh local produce at the lowest possible prices," said Wang Minzheng, head of the department of agriculture of Yunnan province.

"Eliminating middlemen can effectively trim costs and boost retail efficiency," said Gu Guojian, head of Shanghai Chain-Store & Franchise Institute. "The model is especially meaningful as China moves to increase imports and enhance circulation efficiency."

"They can totally leverage big data instead of third-party market research firms to get more precise customer insights and estimates of market size, therefore deciding what and how much (of the goods) to keep stock of," said Shi Jialong, head of China internet equity research at Nomura Securities Co Ltd.

The move aims to meet the evolving preferences of Chinese consumers who shun preservatives in their quest for a healthier lifestyle. According to Hou, Hema's typical consumers are middle-to-upper income earners who are willing to experience new things and shop on a daily basis rather than weekly.

Unlike conventional supermarkets that introduce a wide range of products for shoppers to compare, Hema has adopted the buyer model, where professional procurers are responsible for sourcing and hand-picking the right goods to sell.

"This model is 'win-win' as it revolutionizes the producer end by using customer data to predict their preferences and can tailor manufacturing to meet their needs," said Lao Guoling, a professor at Shanghai University of Finance and Economics.

New Manufacturing is one of the five "New"s that Alibaba founder Jack Ma proposed two years ago to reshape commercial technologies.

Ele.me, Alibaba's newly acquired food delivery arm, has integrated its membership system with Alibaba's e-commerce sites to tap into at least 500 million active users who could order food as they shop via their mobile devices.

Koubei, its offline local services platform, has also branched out by offering breakfast pre-ordering services via smart phones in a number of café and bakery chains in Shanghai.